Question: With solutions pleasee Payroll Problem: Your auditing company was engaged by DO-GAS CORPORATION operating as a business processing outsourcing (BPO) for the annual period ending

With solutions pleasee

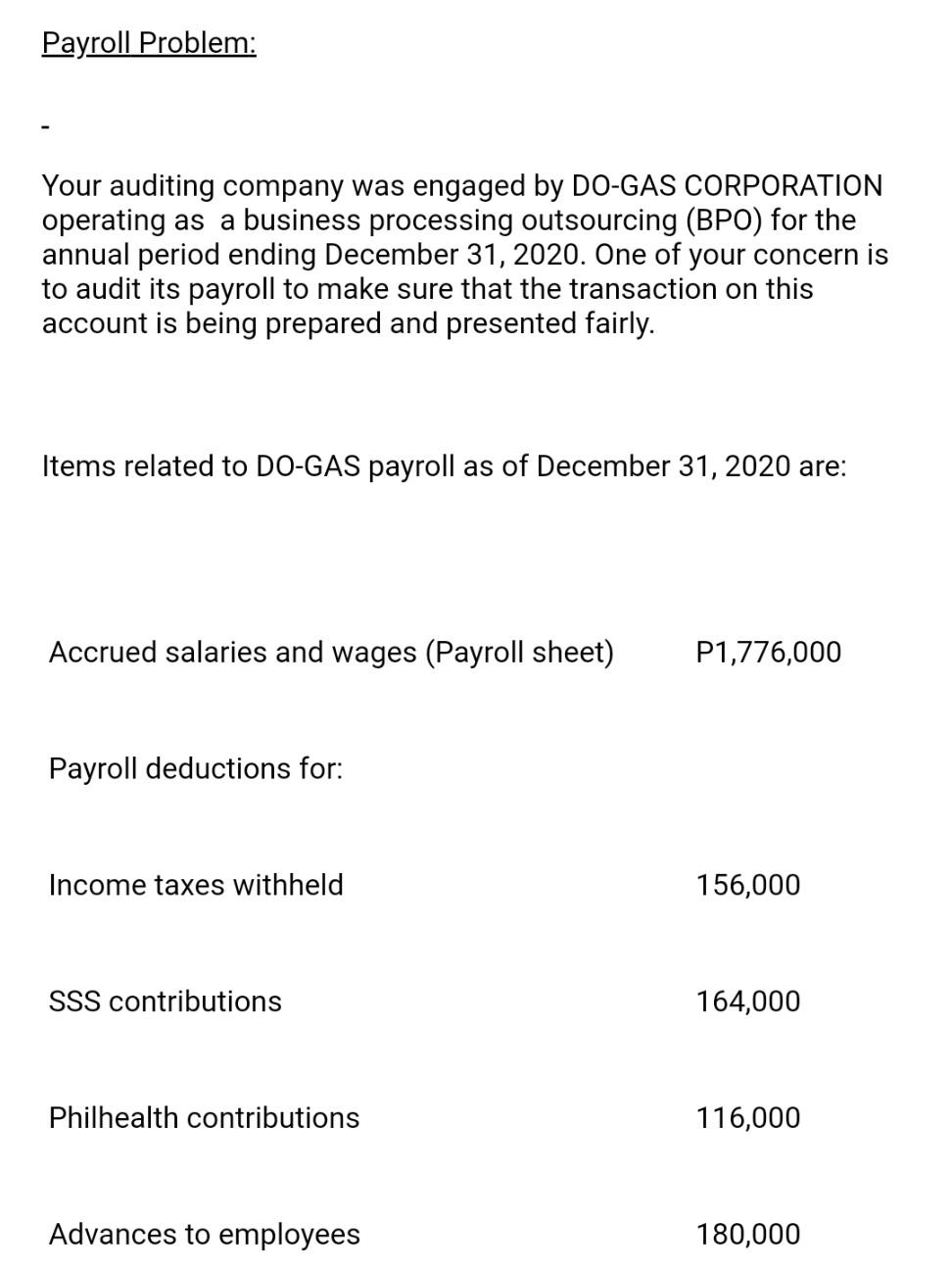

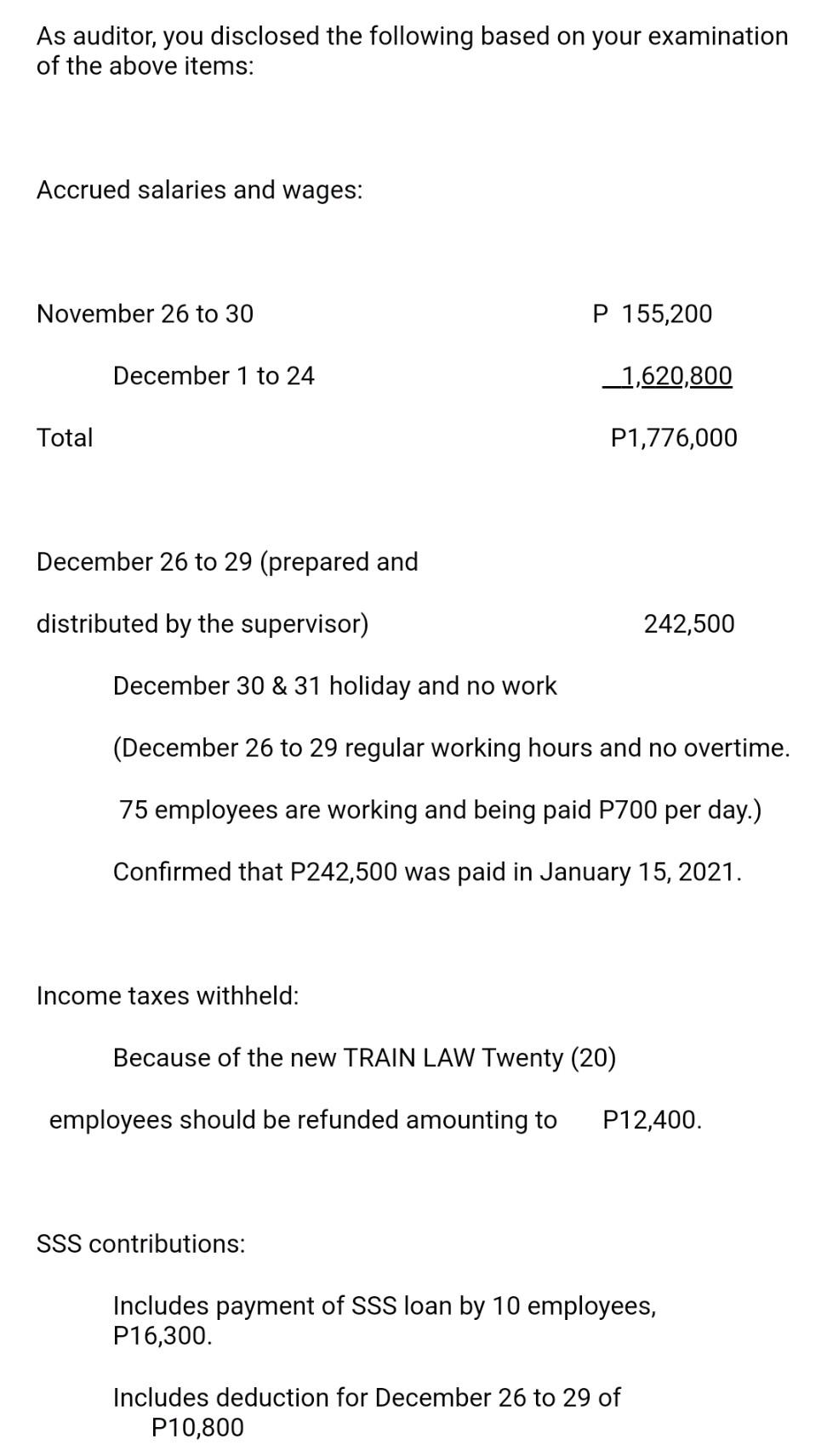

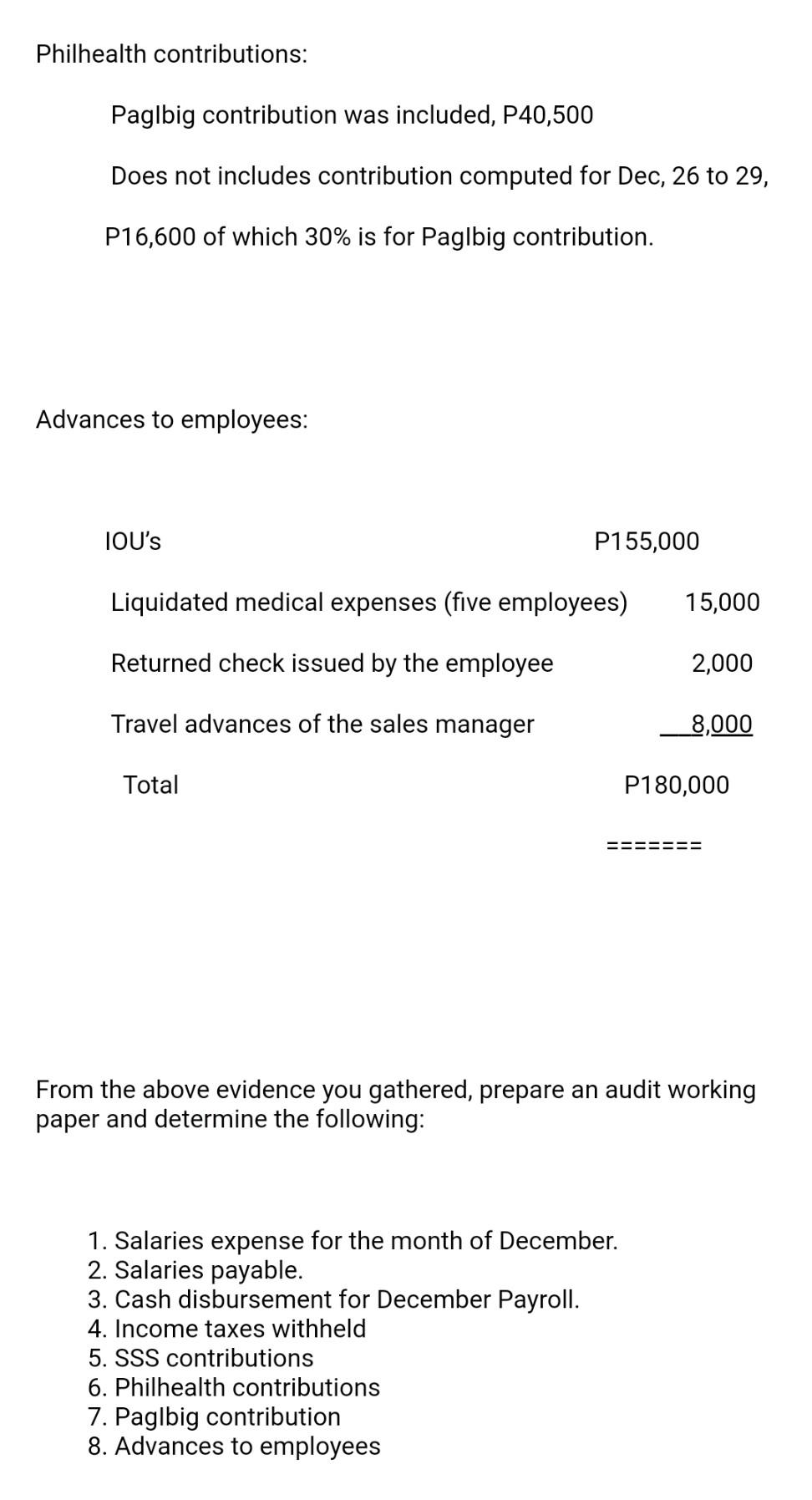

Payroll Problem: Your auditing company was engaged by DO-GAS CORPORATION operating as a business processing outsourcing (BPO) for the annual period ending December 31, 2020. One of your concern is to audit its payroll to make sure that the transaction on this account is being prepared and presented fairly. Items related to DO-GAS payroll as of December 31, 2020 are: Accrued salaries and wages (Payroll sheet) P1,776,000 Payroll deductions for: Income taxes withheld 156,000 SSS contributions 164,000 Philhealth contributions 116,000 Advances to employees 180,000 Philhealth contributions: Paglbig contribution was included, P40,500 Does not includes contribution computed for Dec, 26 to 29, P16,600 of which 30% is for Paglbig contribution. Advances to employees: JOU's P155,000 Liquidated medical expenses (five employees) 15,000 Returned check issued by the employee 2,000 Travel advances of the sales manager 8,000 Total P180,000 %%%%%%%3D From the above evidence you gathered, prepare an audit working paper and determine the following: 1. Salaries expense for the month of December. 2. Salaries payable. 3. Cash disbursement for December Payroll. 4. Income taxes withheld 5. SSS contributions 6. Philhealth contributions 7. Paglbig contribution 8. Advances to employees

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts