Question: with step and explaination pls 2. CMT Inc., is considering an expansion project that requires an initial fixed asset investment of $3.6 million. The fixed

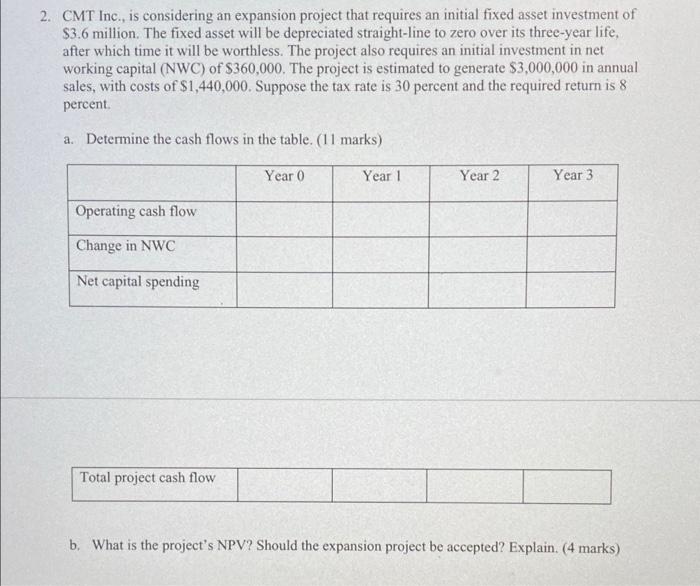

2. CMT Inc., is considering an expansion project that requires an initial fixed asset investment of $3.6 million. The fixed asset will be depreciated straight-line to zero over its three-year life, after which time it will be worthless. The project also requires an initial investment in net working capital (NWC) of $360,000. The project is estimated to generate $3,000,000 in annual sales, with costs of $1,440,000. Suppose the tax rate is 30 percent and the required return is 8 percent a. Determine the cash flows in the table. (11 marks) Year 0 Year 1 Year 2 Year 3 Operating cash flow Change in NWC Net capital spending Total project cash flow b. What is the project's NPV? Should the expansion project be accepted? Explain. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts