Question: With the fixed continuously compounded rate r, the Black-Scholes stock price S, at time t follows a lognormal distribution given by In S~ N(In

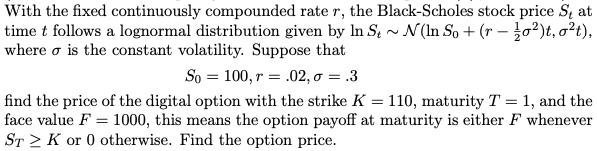

With the fixed continuously compounded rate r, the Black-Scholes stock price S, at time t follows a lognormal distribution given by In S~ N(In So + (r-)t, ot), where o is the constant volatility. Suppose that So = 100, r = .02, = .3 find the price of the digital option with the strike K = 110, maturity T = 1, and the face value F = 1000, this means the option payoff at maturity is either F whenever STK or 0 otherwise. Find the option price.

Step by Step Solution

There are 3 Steps involved in it

To find the price of the digital option we can use the BlackScholes formula for a European call option The formula is as follows C F er T Nd2 Where C is the option price F is the face value r is the c... View full answer

Get step-by-step solutions from verified subject matter experts