Question: With the following information, Please answer questions 1-3 down below. Thanks. THERE ARE 9,450 SHARES OUTSTANDING. Book Value BSG Year 10 151,750 163,241 Book/Market Multiple-

With the following information, Please answer questions 1-3 down below. Thanks.

THERE ARE 9,450 SHARES OUTSTANDING.

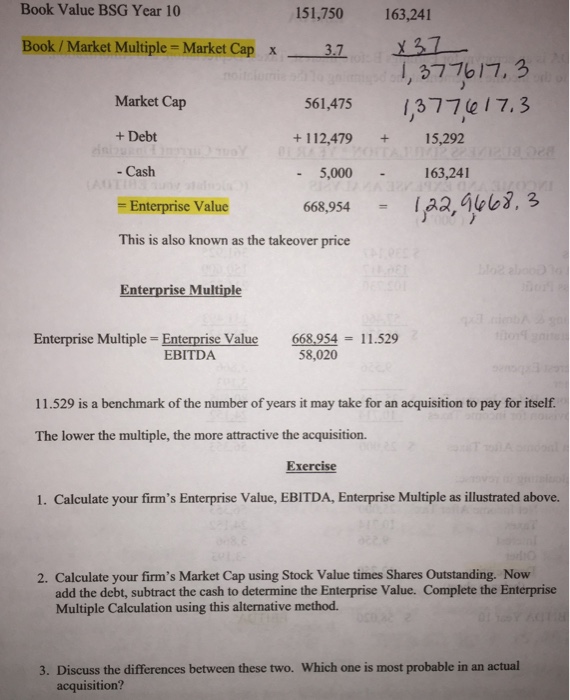

Book Value BSG Year 10 151,750 163,241 Book/Market Multiple- Market Cap x31 1, 377617, 3 Market Cap + Debt - Cash = Enterprise Value This is also known as the takeover price 561,475 1,377017.3 +112,479+15,292 - 5,000 163,241 68.9542, gelb?, 3 Enterprise Multiple Enterprise Multiple Enterprise Value 668.954-11.529 EBITDA 58,020 11.529 is a benchmark of the number of years it may take for an acquisition to pay for itself. The lower the multiple, the more attractive the acquisition. Exercise 1. Calculate your firm's Enterprise Value, EBITDA, Enterprise Multiple as illustrated above. 2. Calculate your firm's Market Cap using Stock Value times Shares Outstanding. Now add the debt, subtract the cash to determine the Enterprise Value. Complete the Enterprise Multiple Calculation using this alternative method. 3. Discuss the differences between these two. Which one is most probable in an actual acquisition? Book Value BSG Year 10 151,750 163,241 Book/Market Multiple- Market Cap x31 1, 377617, 3 Market Cap + Debt - Cash = Enterprise Value This is also known as the takeover price 561,475 1,377017.3 +112,479+15,292 - 5,000 163,241 68.9542, gelb?, 3 Enterprise Multiple Enterprise Multiple Enterprise Value 668.954-11.529 EBITDA 58,020 11.529 is a benchmark of the number of years it may take for an acquisition to pay for itself. The lower the multiple, the more attractive the acquisition. Exercise 1. Calculate your firm's Enterprise Value, EBITDA, Enterprise Multiple as illustrated above. 2. Calculate your firm's Market Cap using Stock Value times Shares Outstanding. Now add the debt, subtract the cash to determine the Enterprise Value. Complete the Enterprise Multiple Calculation using this alternative method. 3. Discuss the differences between these two. Which one is most probable in an actual acquisition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts