Question: With the given case, how would you summarize it? Walmart's Failures in Entering Three Developed Markets Walmart, the largest retailer in the world, has been

With the given case, how would you summarize it?

Walmart's Failures in Entering Three Developed Markets

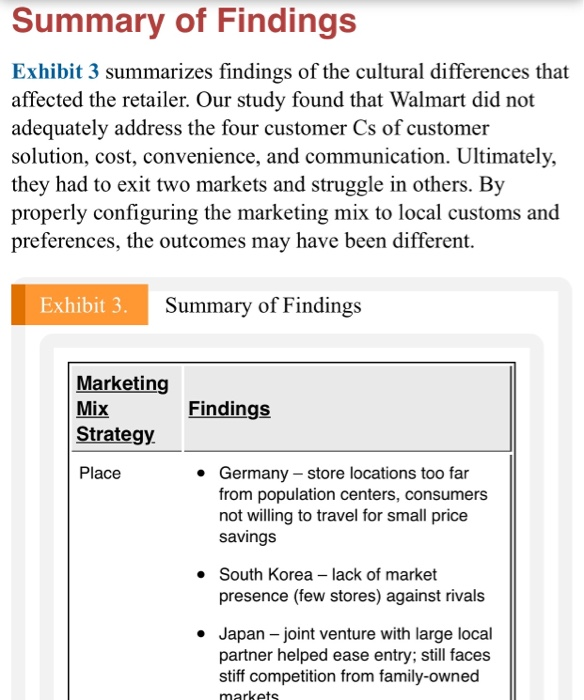

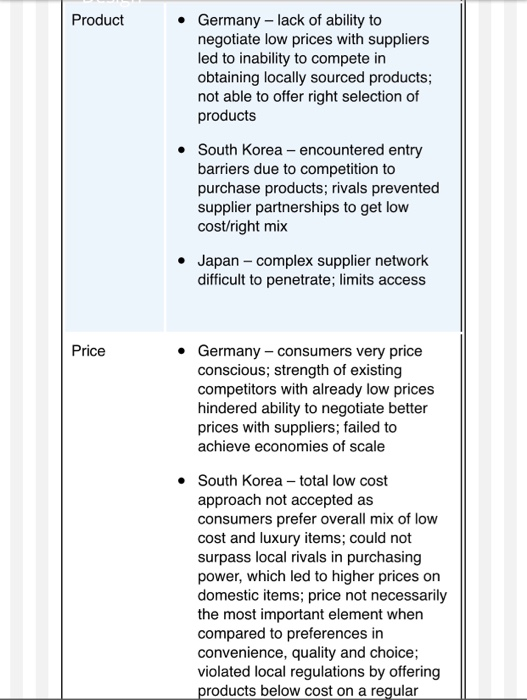

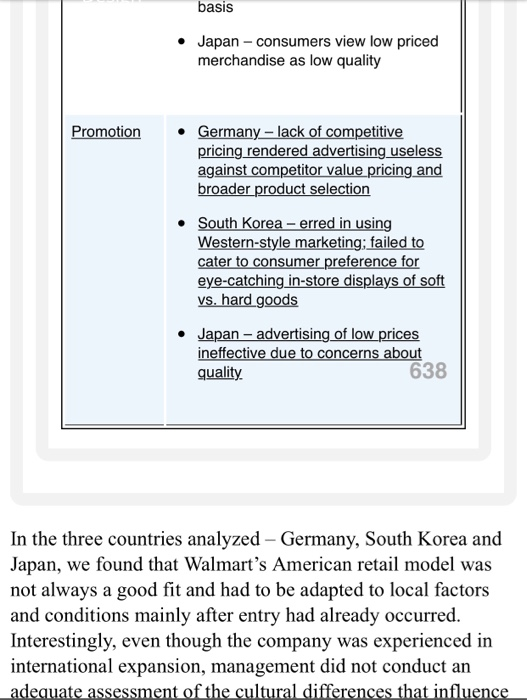

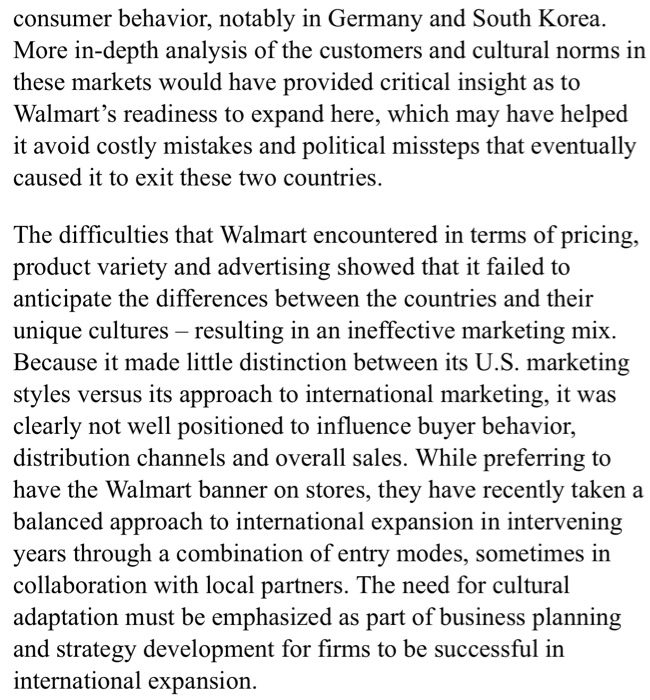

Walmart, the largest retailer in the world, has been pursuing international markets for nearly 30 years as its domestic markets reached saturation. Three market entry fiascos from Walmart's aggressive international expansion are analyzed in this case. Interestingly, these failures took place in developed market countries; Germany, South Korea, and Japan. They represent enormous levels of financial loss, as well as stunning setbacks to global expansion for the firm. Although international operations have been lucrative for Walmart, the firm has faced certain obstacles along the way. They had hoped to duplicate their dynamic business model seamlessly in other high-potential markets by building robust supplier networks due to their gargantuan size and proven ability to influence pricing, particularly through zealous inventory management via elaborate supply chain systems. Starting with Mexico in 1991, they have steadily entered new markets and by the end of 2018 foreign operations consisted of 11,718 stores in 30 countries. Fifty-five percent of Walmart' stores are now outside the United States. Exhibit 1 outlines this data. They do not officially disclose international sales figures by country, except to say that they receive 28 percent of their total revenue from outside the US. Walmart's growth has, however, been tainted by an inability to adapt in some markets to local consumer customs, culture and tastes. As a multinational enterprise, Walmart's initial 1991 penetration into foreign markets continues to be highly successful. However, when Walmart entered Germany and South Korea in the late 1990s through acquisitions, it found itself saddled with undesirable locations and was unprepared for the cultural challenges. Expansion into the Japanese market in 2002 was one of its most ambitious joint ventures as it sought to leverage the familiarity of a large, well-known domestic chain Seiyu, in which they purchased a minority interest. Ultimately Walmart suspended operations in Germany and South Korea in 2006 and was able to continue operations in Japan under the Seiyu brand. Exhibit 2 provides a summary of international expansion activities. Germany Germany was Walmart's first European entry. They started in December 1997 by acquiring Wertkauf stores with 21 locations in the southern area of the country. Within months, Walmart acquired Interspar with over 70 stores in the northern region. They believed, as do many American companies, that expansion into Europe by way of Germany makes sense due to similarities in culture, language, and legal environment. Executives assumed that acquiring the two German retailers and then changing them to the Walmart name was a solid entry strategy, but they quickly learned of the operational differences between the two chains and that their locations and appearance were far below the average American standard. Other problems were related to Walmart's lack of Germans in management roles. The company never disclosed the full amounts of its operating losses in Germany. Analysts estimate annual losses at $200 to 300 million per year during Walmart's time in the country. South Korea It could be concluded that Walmart sought entry into South Korea due to the country's rank among the top 15 economies in the world and dense population. In July 1998, Walmart acquired South Korean retailer Makro, which owned four stores and six undeveloped sites and employed over 800 people. Even though Walmart studied the market for four years and saw other multinational corporations fail (Nestl, Nokia), it nevertheless proceeded into the South Korean market, unprepared for the local conditions that they experienced. After losses increased to $150 million in 2005, Walmart sold its 16 stores to its main South Korean competitor E-mart, which already had 86 stores and 30 percent of the South Korean discount market. Japan Walmart entered Japan in May 2002 through a joint venture by purchasing a six percent stake in Seiyu Ltd., Japan's fifth largest supermarket chain with over 400 stores. They retained the Seiyu name on the storefronts but stocked through Walmart's supply chain, gradually increasing ownership share. In 2008, Walmart acquired full 100 percent interest in Seiyu. By entering Japan with a local partner, Walmart hoped to better navigate the entrenched operations of manufacturers and middlemen in a country whose historically high cost structures have made an unfriendly environment for foreign discount retailers. Japanese customers are known to be extremely finicky and the Seiyu joint venture was a way to gain advantage by aligning with a recognizable brand name to penetrate the heavily populated market. However, at the time of entry, Japan's economy was experiencing lackluster retail sales and intense competition, all factors that continue to exist. Walmart's disappointing Japanese operations continue to this day to be far underperforming their potential. Summary of Findings Exhibit 3 summarizes findings of the cultural differences that affected the retailer. Our study found that Walmart did not adequately address the four customer Cs of customer solution, cost, convenience, and communication. Ultimately, they had to exit two markets and struggle in others. By properly configuring the marketing mix to local customs and preferences, the outcomes may have been different. Exhibit 3. Summary of Findings Marketing Mix Strategy Findings Place Germany - store locations too far from population centers, consumers not willing to travel for small price savings South Korea - lack of market presence (few stores) against rivals Japan - joint venture with large local partner helped ease entry; still faces stiff competition from family-owned markets Product Germany - lack of ability to negotiate low prices with suppliers led to inability to compete in obtaining locally sourced products; not able to offer right selection of products South Korea - encountered entry barriers due to competition to purchase products; rivals prevented supplier partnerships to get low cost/right mix Japan - complex supplier network difficult to penetrate; limits access Price Germany - consumers very price conscious; strength of existing competitors with already low prices hindered ability to negotiate better prices with suppliers; failed to achieve economies of scale South Korea - total low cost approach not accepted as consumers prefer overall mix of low cost and luxury items; could not surpass local rivals in purchasing power, which led to higher prices on domestic items; price not necessarily the most important element when compared to preferences in convenience, quality and choice; violated local regulations by offering products below cost on a regular basis Japan - consumers view low priced merchandise as low quality Promotion Germany - lack of competitive pricing rendered advertising useless against competitor value pricing and broader product selection South Korea - erred in using Western-style marketing; failed to cater to consumer preference for eye-catching in-store displays of soft vs. hard goods Japan advertising of low prices ineffective due to concerns about quality 638 In the three countries analyzed - Germany, South Korea and Japan, we found that Walmart's American retail model was not always a good fit and had to be adapted to local factors and conditions mainly after entry had already occurred. Interestingly, even though the company was experienced in international expansion, management did not conduct an adequate assessment of the cultural differences that influence consumer behavior, notably in Germany and South Korea. More in-depth analysis of the customers and cultural norms in these markets would have provided critical insight as to Walmart's readiness to expand here, which may have helped it avoid costly mistakes and political missteps that eventually caused it to exit these two countries. The difficulties that Walmart encountered in terms of pricing, product variety and advertising showed that it failed to anticipate the differences between the countries and their unique cultures resulting in an ineffective marketing mix. Because it made little distinction between its U.S. marketing styles versus its approach to international marketing, it was clearly not well positioned to influence buyer behavior, distribution channels and overall sales. While preferring to have the Walmart banner on stores, they have recently taken a balanced approach to international expansion in intervening years through a combination of entry modes, sometimes in collaboration with local partners. The need for cultural adaptation must be emphasized as part of business planning and strategy development for firms to be successful in international expansion