Question: With the given information, solve for (e). Current Attempt in Progress A review of the ledger of Sheffield Corporation at its year end, July 31,

With the given information, solve for (e).

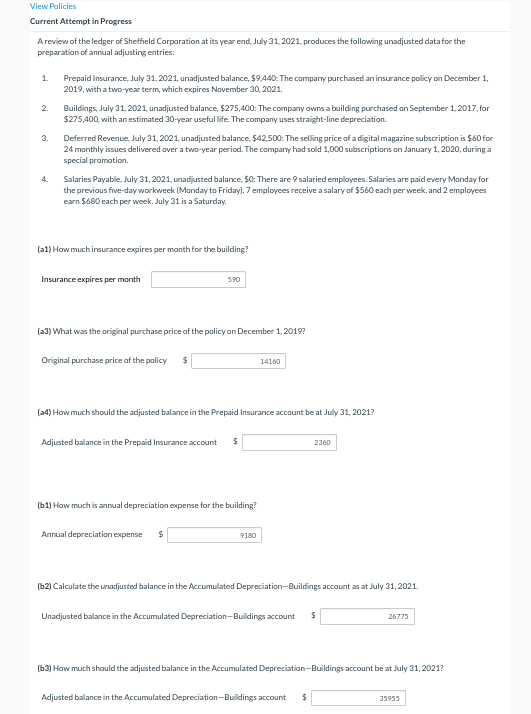

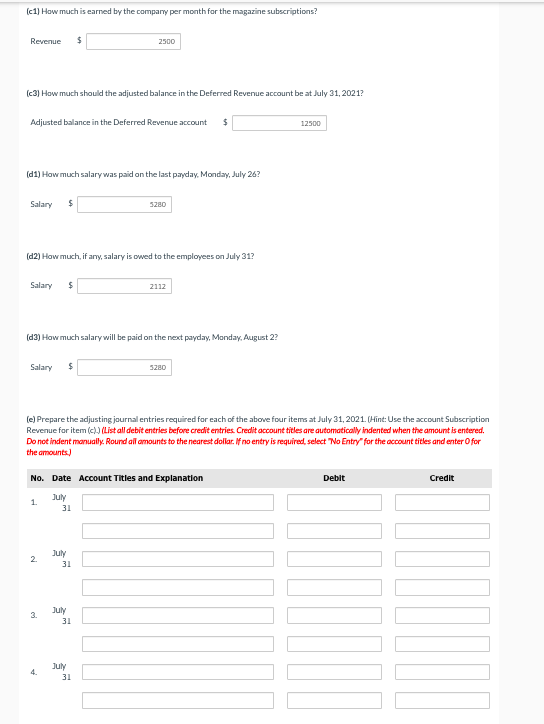

Current Attempt in Progress A review of the ledger of Sheffield Corporation at its year end, July 31, 2021, produces the following unadjusted data for the preparation of annual adjusting entries: 1. Prepaid Insurance, July 31, 2021, unadjusted balance, $9,440 : The compary purchased an insurance policy ca December 1 , 2019 , with a two-year term, which expires Navember 30,2021. 2. Puildings, July 31, 2021, unadjusted balance, $275,400 : The compary owna a building purchased an 5 eptember 1 , 2017 , for $275,400, with an estimated 30 -year useful life. The company uses straight-line depreciation. 3. Deferred Revenue, July 31, 2021, unadjusted balance, $42,500 : The sel Ting price af a digital magazine subscription is $40 for 24 manthly issues delivered aver a twa-year period. The camparyy had sold 1,000 subscriptians an January 1,2020 , during a special promoticn. 4. Salaries Payable, July 31,2021 , unad;usted balance, $0 : There are 9 salaried employees. Salaries are paid every Manday for the previous five-day workweek [Manday to Friday]. 7 employees receive a salary of $560 each per week, and 2 employees earn $6BD each per week. July 31 is a Saturday. (a1) How much insurance expires per month for the building? Insurance expires per manth (a3) What was the ariginal purchase price of the palicy on December 1, 2019? Original purchase price of the palicy $ (a4) How much should the adjusted balance in the Prepaid Insurance account be at July 31, 2021? Adjusted balance in the Prepaid Inaurance account $ (b1) How much is annual depreciation expense for the building? Annual depreciatian expense $ (b2) Calculate the unadjusted balance in the Accumulated Depreciatian-Buildings account as at July 31,2021. Unadjusted balance in the Accumulated Depreciation-Builings account $ (b3) How much should the adjusted balance in the Accumulated Depreciation-Buildings account be at July 31,2021 ? Adjusted balance in the Accumulated Depreciation-Buildings account $ [c3] Haw much should the adjusted balance in the Deferred Revenue account be at July 31,2021 ? Adjusted balance in the Deferred Revenue account \$ (d1) How much salary was paid on the last payday, Monday, July 26? Salary $ (d2) How much, if arry, salary is owed ta the employees on July 31? Salary $ (d3) How much salary will be paid on the next payday, Manday, August 2? Salary $ (e) Prepare the adjusting jaurnal entries required for each of the above four items at July 31,2021 . (Hint: Use the account Subscription Revenue far item (c)) (List all debit entries before credit entrier Credit account tites are automatically indented when the amount is entered. Do not indent monuaily. Round ail omounts to the nearest dollar. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts