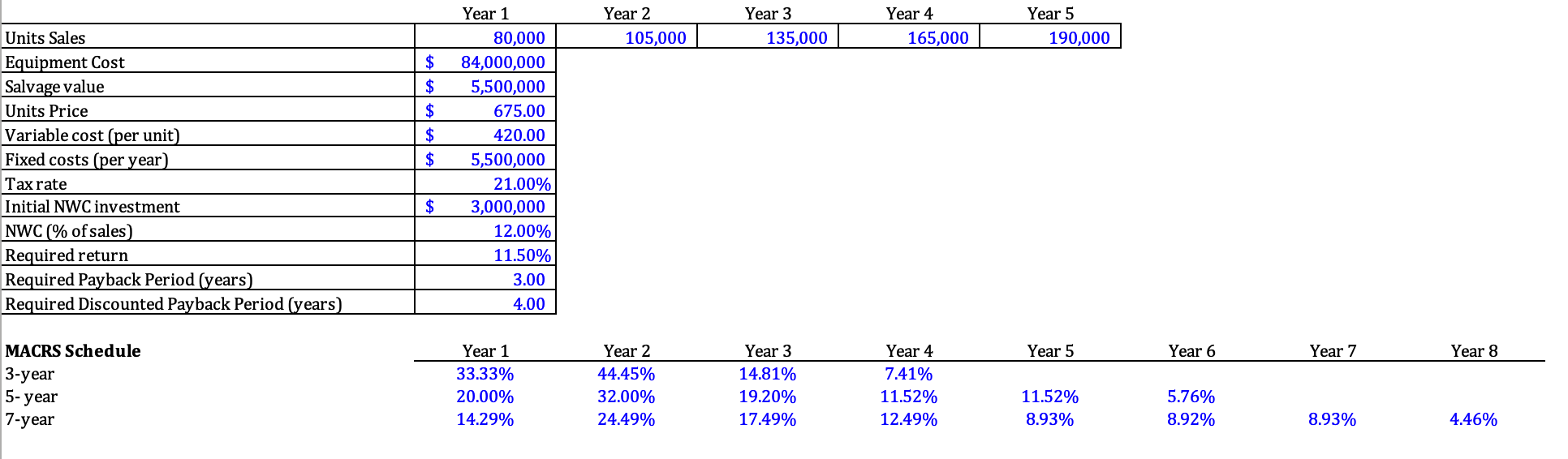

Question: With the information above fill out the excel sheet below with work: MACRS Schedule 3-year 5- year begin{tabular}{rrcccccc} Year 1 & Year 2 & Year

With the information above fill out the excel sheet below with work:

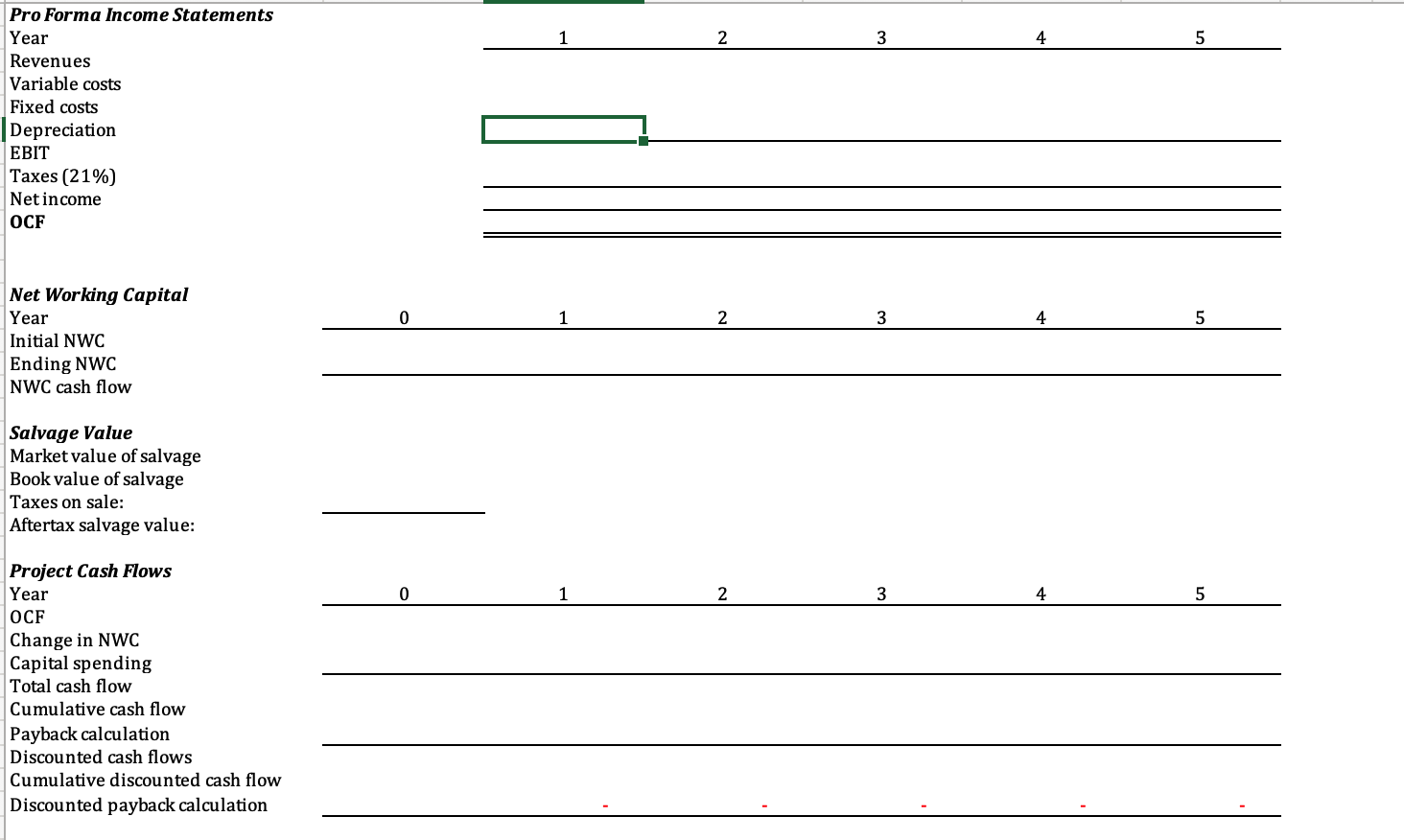

MACRS Schedule 3-year 5- year \begin{tabular}{rrcccccc} Year 1 & Year 2 & Year 3 & Year 4 & Year 5 & Year 6 & Year 7 & Year 8 \\ \hline 33.33% & 44.45% & 14.81% & 7.41% & & & \\ 20.00% & 32.00% & 19.20% & 11.52% & 11.52% & 5.76% & \\ 14.29% & 24.49% & 17.49% & 12.49% & 8.93% & 8.92% & 8.93% & 4.46% \end{tabular} Pro Forma Income Statements Year \begin{tabular}{lllll} 1 & 2 & 4 & 5 \\ \hline \end{tabular} Revenues Variable costs Fixed costs Depreciation EBIT Taxes(21%) Net income OCF Net Working Capital Year 0 01 2 3 Initial NWC Ending NWC NWC cash flow Salvage Value Market value of salvage Book value of salvage Taxes on sale: Aftertax salvage value: Project Cash Flows Year OCF Change in NWC Capital spending Total cash flow Cumulative cash flow Payback calculation Discounted cash flows Cumulative discounted cash flow Discounted payback calculation MACRS Schedule 3-year 5- year \begin{tabular}{rrcccccc} Year 1 & Year 2 & Year 3 & Year 4 & Year 5 & Year 6 & Year 7 & Year 8 \\ \hline 33.33% & 44.45% & 14.81% & 7.41% & & & \\ 20.00% & 32.00% & 19.20% & 11.52% & 11.52% & 5.76% & \\ 14.29% & 24.49% & 17.49% & 12.49% & 8.93% & 8.92% & 8.93% & 4.46% \end{tabular} Pro Forma Income Statements Year \begin{tabular}{lllll} 1 & 2 & 4 & 5 \\ \hline \end{tabular} Revenues Variable costs Fixed costs Depreciation EBIT Taxes(21%) Net income OCF Net Working Capital Year 0 01 2 3 Initial NWC Ending NWC NWC cash flow Salvage Value Market value of salvage Book value of salvage Taxes on sale: Aftertax salvage value: Project Cash Flows Year OCF Change in NWC Capital spending Total cash flow Cumulative cash flow Payback calculation Discounted cash flows Cumulative discounted cash flow Discounted payback calculation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts