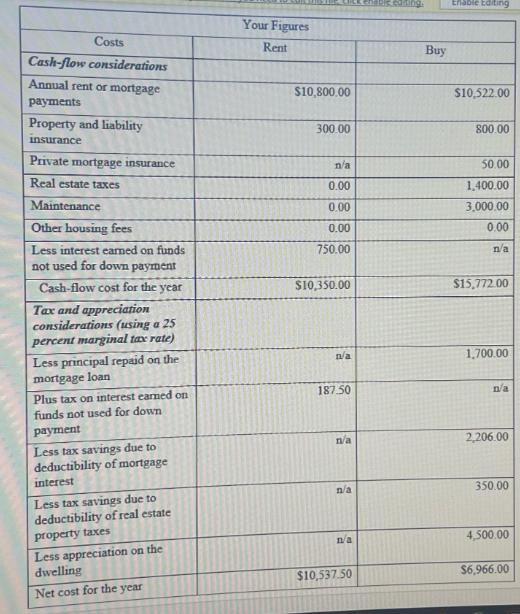

Question: With the information below, would this person be better off renting or buying? Explain. Costs Cash-flow considerations Annual rent or mortgage payments Property and liability

Costs Cash-flow considerations Annual rent or mortgage payments Property and liability insurance Private mortgage insurance Real estate taxes Maintenance Other housing fees Less interest earned on funds not used for down payment Cash-flow cost for the year Tax and appreciation considerations (using a 25 percent marginal tax rate) Less principal repaid on the mortgage loan Plus tax on interest earned on funds not used for down payment Less tax savings due to deductibility of mortgage interest Less tax savings due to deductibility of real estate property taxes Less appreciation on the dwelling Net cost for the year Your Figures Rent $10,800.00 300.00 n/a 0.00 0.00 0.00 750.00 $10,350.00 n/a 187.50 n/a n/a n/a $10,537.50 Buy Enable Editing $10,522.00 800.00 50.00 1,400.00 3,000.00 0.00 n/a $15,772.00 1,700.00 na 206.00 350.00 4,500.00 $6,966.00

Step by Step Solution

There are 3 Steps involved in it

To determine whether this person would be better off renting or buying we need to consider the finan... View full answer

Get step-by-step solutions from verified subject matter experts