Question: with the information provided can you help with question 2.1 please Your firm is financed with debt and common equity. Debt is comprised of a

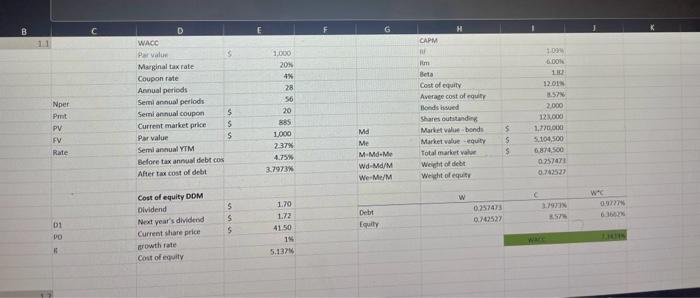

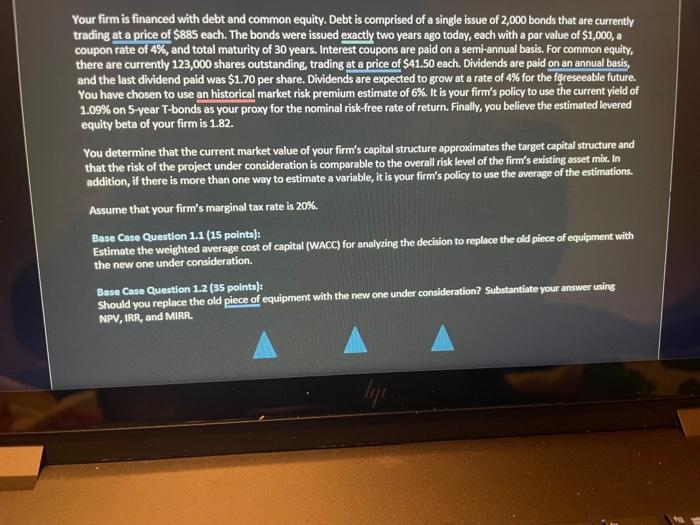

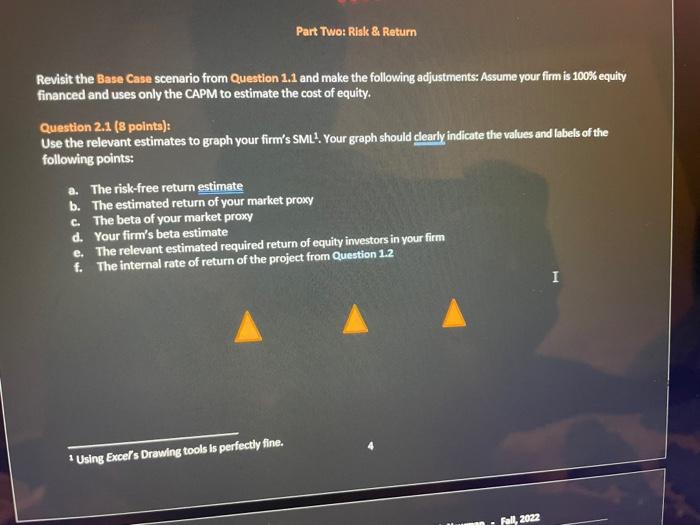

Your firm is financed with debt and common equity. Debt is comprised of a single issue of 2,000 bonds that are currently trading at a price of $885 each. The bonds were issued exactly two years ago today, each with a par value of $1,000, a coupon rate of 4%, and total maturity of 30 years. Interest coupons are paid on a semi-annual basis. For common equity, there are currently 123,000 shares outstanding, trading at a price of $41.50 each. Dividends are paid on an annual basis, and the last dividend paid was $1.70 per share. Dividends are expected to grow at a rate of 4% for the forreseeable future. You have chosen to use an historical market risk premium estimate of 6%. It is your firm's policy to use the current yield of 1.09\% on 5-year T-bonds as your proxy for the nominal risk-free rate of return. Finally, you believe the estimated levered equity beta of your firm is 1.82. You determine that the current market value of your firm's capital structure approximates the target capital structure and that the risk of the project under consideration is comparable to the overall risk level of the firm's existing asset mix. In addition, if there is more than one way to estimate a variable, it is your firm's policy to use the average of the estimations. Assume that your firm's marginal tax rate is 20%. Base Case Question 1.1 (15 pointe): Estimate the weighted average cost of capital (WACC) for analyzing the decision to replace the old piece of equipment with the new one under consideration. Base Case Question 1.2 ( 35 points): Should you replace the old piece of equipment with the new one under consideration? Substantiate your answer using NPV, IRR, and MIRR. financed and uses only the CAPM to estimate the cost of equity. Question 2.1. (8 points): Use the relevant estimates to graph your firm's SML2. Your graph should clearly indicate the values and labels of the following points: a. The risk-free return estimate b. The estimated return of your market proxy c. The beta of your market proxy d. Your firm's beta estimate e. The relevant estimated required return of equity investors in your firm f. The internal rate of return of the project from Question 1.2 I Your firm is financed with debt and common equity. Debt is comprised of a single issue of 2,000 bonds that are currently trading at a price of $885 each. The bonds were issued exactly two years ago today, each with a par value of $1,000, a coupon rate of 4%, and total maturity of 30 years. Interest coupons are paid on a semi-annual basis. For common equity, there are currently 123,000 shares outstanding, trading at a price of $41.50 each. Dividends are paid on an annual basis, and the last dividend paid was $1.70 per share. Dividends are expected to grow at a rate of 4% for the forreseeable future. You have chosen to use an historical market risk premium estimate of 6%. It is your firm's policy to use the current yield of 1.09\% on 5-year T-bonds as your proxy for the nominal risk-free rate of return. Finally, you believe the estimated levered equity beta of your firm is 1.82. You determine that the current market value of your firm's capital structure approximates the target capital structure and that the risk of the project under consideration is comparable to the overall risk level of the firm's existing asset mix. In addition, if there is more than one way to estimate a variable, it is your firm's policy to use the average of the estimations. Assume that your firm's marginal tax rate is 20%. Base Case Question 1.1 (15 pointe): Estimate the weighted average cost of capital (WACC) for analyzing the decision to replace the old piece of equipment with the new one under consideration. Base Case Question 1.2 ( 35 points): Should you replace the old piece of equipment with the new one under consideration? Substantiate your answer using NPV, IRR, and MIRR. financed and uses only the CAPM to estimate the cost of equity. Question 2.1. (8 points): Use the relevant estimates to graph your firm's SML2. Your graph should clearly indicate the values and labels of the following points: a. The risk-free return estimate b. The estimated return of your market proxy c. The beta of your market proxy d. Your firm's beta estimate e. The relevant estimated required return of equity investors in your firm f. The internal rate of return of the project from Question 1.2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts