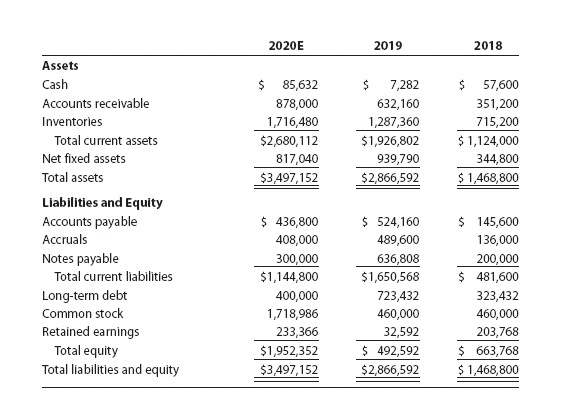

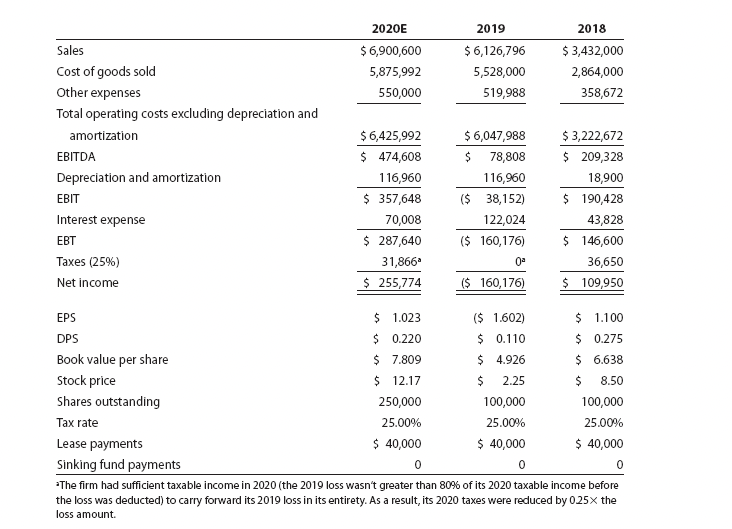

Question: With the information provided create an MDA calculate the Net sales and operation income and cash dividend per share loss amount. Assume that all cash

With the information provided create an MDA

calculate the Net sales and operation income

and cash dividend per share

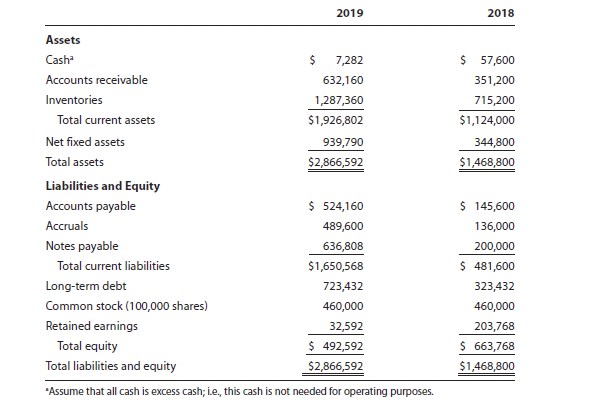

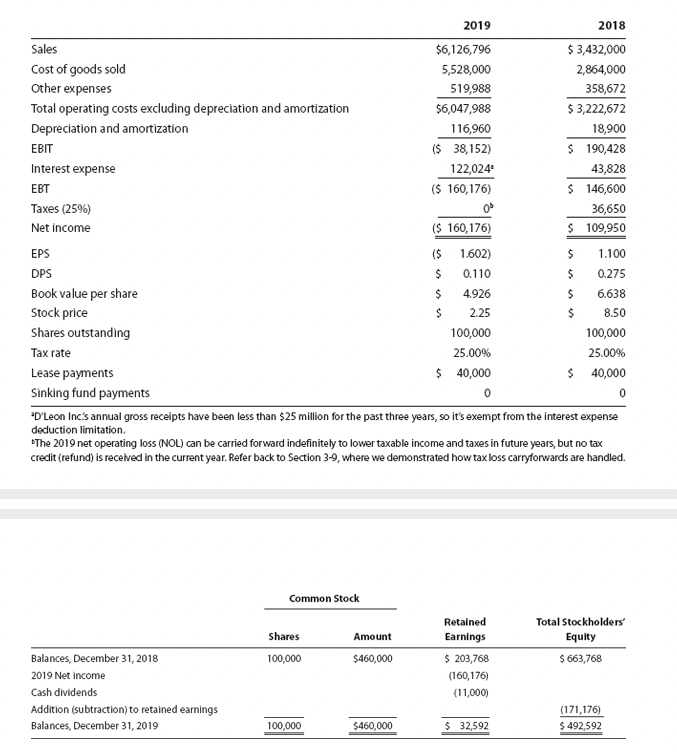

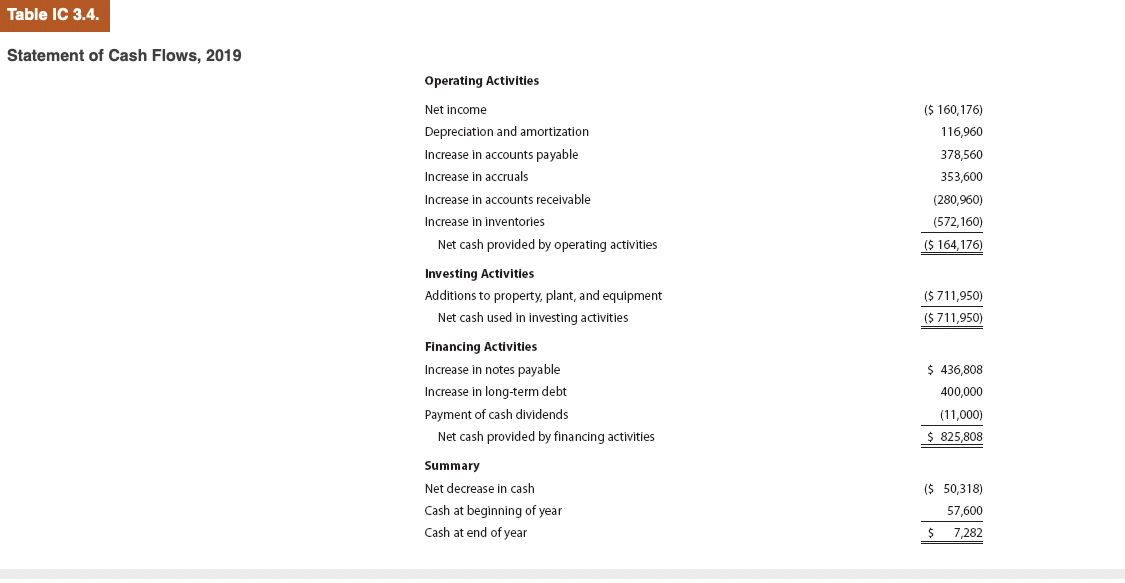

loss amount. "Assume that all cash is excess cash; i.e., this cash is not needed for operating purposes. "ULeon Incis annual gross receipts nave Deen less than $2s millon ror the past three years, so its exempt rom the Interest expense deduction limitation. 'The 2019 net operating loss (NOL) can be carried forward indefinitely to lower taxable income and taxes in future years, but no tax credit (refund) is received in the current year. Refer back to Section 39, where we demonstrated how tax loss carryforwards are handled. Statement of Cash Flows, 2019 loss amount. "Assume that all cash is excess cash; i.e., this cash is not needed for operating purposes. "ULeon Incis annual gross receipts nave Deen less than $2s millon ror the past three years, so its exempt rom the Interest expense deduction limitation. 'The 2019 net operating loss (NOL) can be carried forward indefinitely to lower taxable income and taxes in future years, but no tax credit (refund) is received in the current year. Refer back to Section 39, where we demonstrated how tax loss carryforwards are handled. Statement of Cash Flows, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts