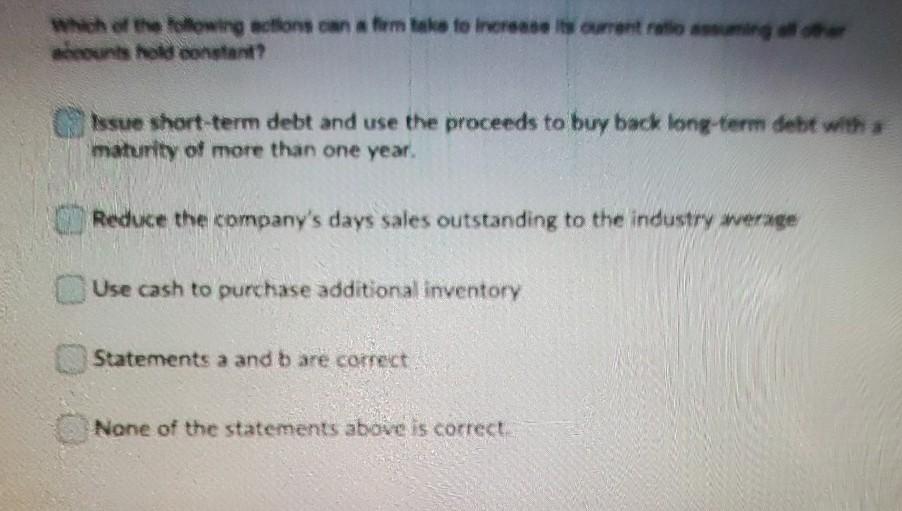

Question: with the owing actions can atom take to increase is current room counts hold constant? issue short-term debt and use the proceeds to buy back

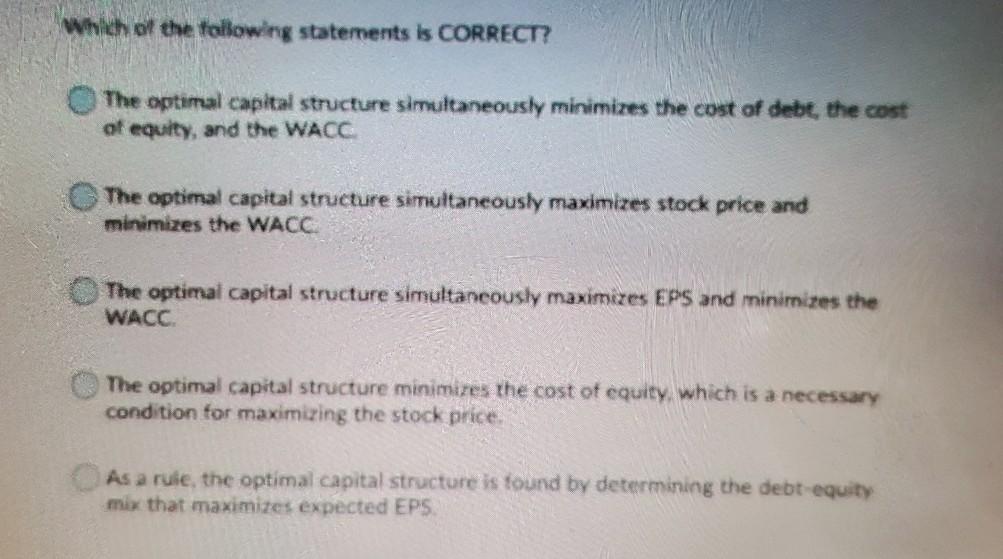

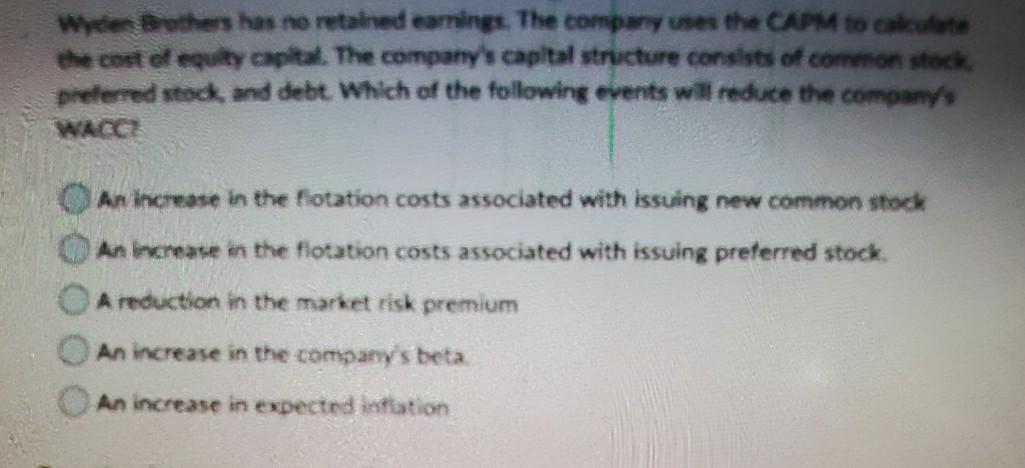

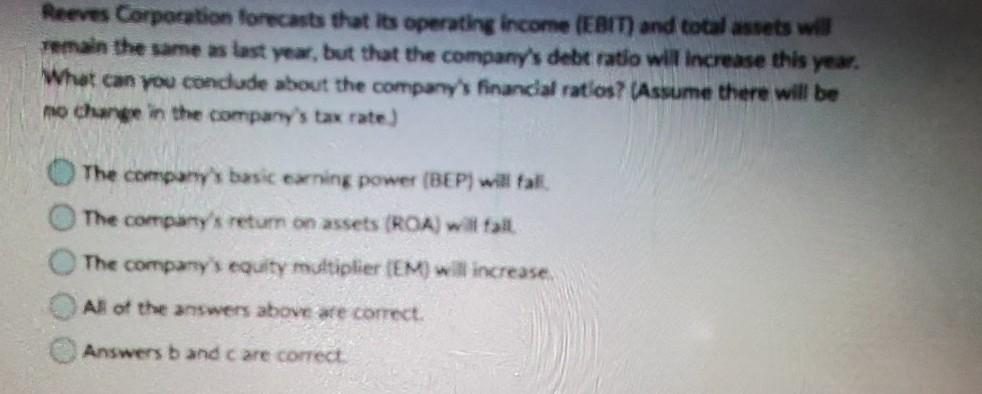

with the owing actions can atom take to increase is current room counts hold constant? issue short-term debt and use the proceeds to buy back long term debt with maturity of more than one year. Reduce the company's days sales outstanding to the industry wenge Use cash to purchase additional inventory Statements a and b are correct None of the statements above is correct Which of the following statements is CORRECT? The optimal capital structure simultaneously minimizes the cost of debt, the cost of equity, and the WACC The optimal capital structure simultaneously maximizes stock price and minimizes the WACC The optimal capital structure simultaneously maximizes EPs and minimizes the WACC. The optimal capital structure minimizes the cost of equity, which is a necessary condition for maximizing the stock price. As a rule, the optimal capital structure is found by determining the debt equity mix that maximizes expected EPS Wydrothers has no retained earnings. The company uses the CAPM to calculate the cost equity capital. The company's capital structure consists of common stock preferred stock and debt. Which of the following events will reduce the company's WACC An increase in the flotation costs associated with issuing new common stock An increase in the fiotation costs associated with issuing preferred stock A reduction in the market risk premium An increase in the company's beta. An increase in expected tion Reeves Corporation forecasts that ib operating income (EBIT) and total assets will remain the same as last year, but that the company's debt ratio will increase this year. What can you condude about the company's financial ratios? (Assume there will be mo change in the company's tax rate) The company's basic cxning power (BEP) will fal The company's return on assets (ROA) with The company's equity multiplier (EM) will increase Al of the answers above are correct. o Answers band care correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts