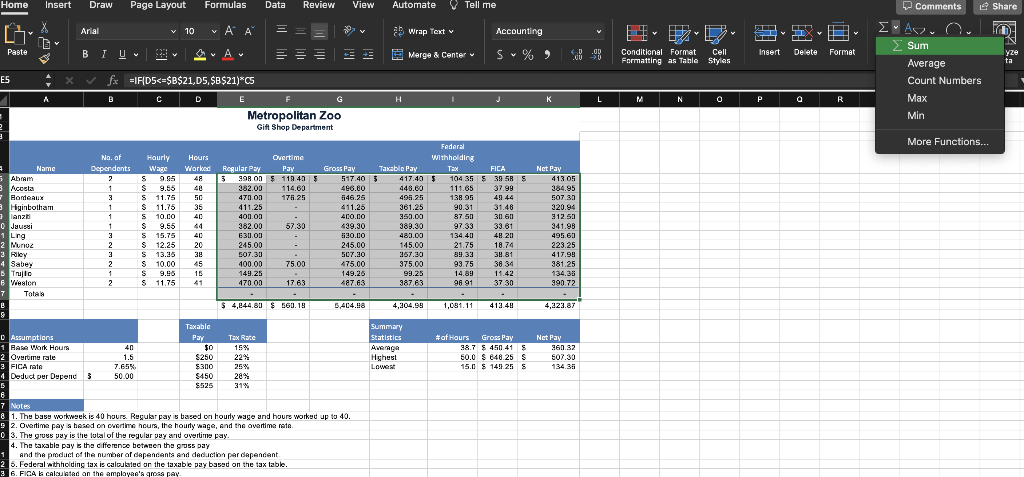

Question: With the range E5:K16 selected, use Quick Analysis tools to calculate the total regular pay, overtime pay, gross pay, taxable pay, withholding tax, FICA, and

| With the range E5:K16 selected, use Quick Analysis tools to calculate the total regular pay, overtime pay, gross pay, taxable pay, withholding tax, FICA, and net pay on row 17. Note, Mac users, with the range selected, on the Home tab, in the Editing group, click AutoSum. |

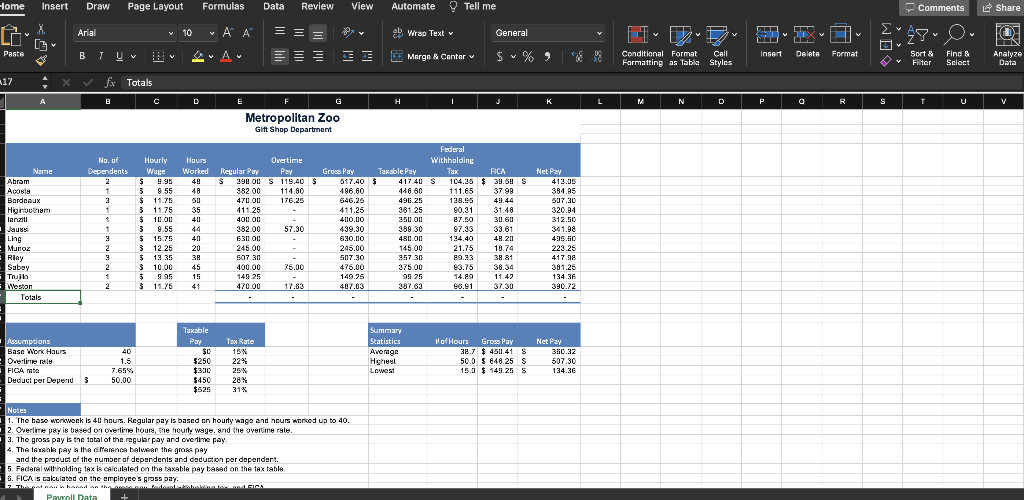

When I do this, it calculates the totals below the total row. How do I do it so it calculates in in the right spot??

Metropolitan Zoo Glft Shop Department Notes 1. The base wcriveck is 4U hnura. Regular pay is based nn hourty wage and hour wariod up bo 40. 2. Ohertire pey is based on duetine hours, the hourty wage. arid the avertime rate. 3. The gross pay ts the tatal of the regular pay and cretime pay. 4. The tarakla pay ia tha is Pranenca batusan the grake pay and the produnt of the number of dependents and dadurton per dapendart. 5. Federal wilhholding tex is calculated on the taxable pey based an the tax table. 8.. FICh is nakulabed on the amplayees gross pay. Metropolitan Zoo Gift Shop Department Notes 1. The base workweek is 40 hours. Regular pay is based on hourly wane and haurs worked up to 40. 2. Overtime pay a beaed on owertme houra, the hourty wage, and the ovartime nate. 3. The gruss pay is the futal of the redular pay and overtime pay. 4. The taxable pay is the cifference betanen the gres oay and the paduct of the number af dapentents and dedluction par dapentent. 5. Federal wthholding tax is caloulated on the taxable pay basad on the tax table. 6. FIGA be calculatad an the amplayan's groas pay Metropolitan Zoo Glft Shop Department Notes 1. The base wcriveck is 4U hnura. Regular pay is based nn hourty wage and hour wariod up bo 40. 2. Ohertire pey is based on duetine hours, the hourty wage. arid the avertime rate. 3. The gross pay ts the tatal of the regular pay and cretime pay. 4. The tarakla pay ia tha is Pranenca batusan the grake pay and the produnt of the number of dependents and dadurton per dapendart. 5. Federal wilhholding tex is calculated on the taxable pey based an the tax table. 8.. FICh is nakulabed on the amplayees gross pay. Metropolitan Zoo Gift Shop Department Notes 1. The base workweek is 40 hours. Regular pay is based on hourly wane and haurs worked up to 40. 2. Overtime pay a beaed on owertme houra, the hourty wage, and the ovartime nate. 3. The gruss pay is the futal of the redular pay and overtime pay. 4. The taxable pay is the cifference betanen the gres oay and the paduct of the number af dapentents and dedluction par dapentent. 5. Federal wthholding tax is caloulated on the taxable pay basad on the tax table. 6. FIGA be calculatad an the amplayan's groas pay

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts