Question: WITH THE TABLE USING MACRS Modified Accelerted Cost Recovery System Gebeng engineering Sdn Bhd, in the 25% income tax bracket, is considering the purchased of

WITH THE TABLE USING MACRS Modified Accelerted Cost Recovery System

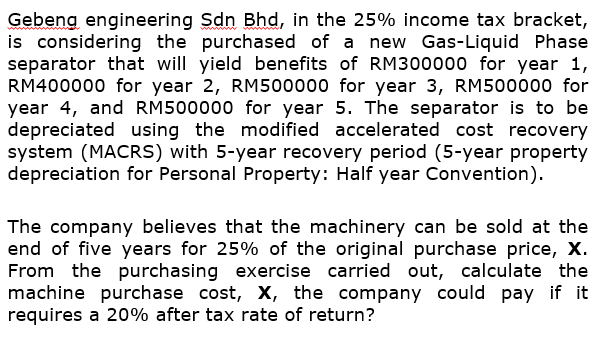

Gebeng engineering Sdn Bhd, in the 25% income tax bracket, is considering the purchased of a new Gas-Liquid Phase separator that will yield benefits of RM300000 for year 1, RM400000 for year 2, RM500000 for year 3, RM500000 for year 4, and RM500000 for year 5. The separator is to be depreciated using the modified accelerated cost recovery system (MACRS) with 5-year recovery period (5-year property depreciation for Personal Property: Half year Convention). The company believes that the machinery can be sold at the end of five years for 25% of the original purchase price, X. From the purchasing exercise carried out, calculate the machine purchase cost, X, the company could pay if it requires a 20% after tax rate of return? Gebeng engineering Sdn Bhd, in the 25% income tax bracket, is considering the purchased of a new Gas-Liquid Phase separator that will yield benefits of RM300000 for year 1, RM400000 for year 2, RM500000 for year 3, RM500000 for year 4, and RM500000 for year 5. The separator is to be depreciated using the modified accelerated cost recovery system (MACRS) with 5-year recovery period (5-year property depreciation for Personal Property: Half year Convention). The company believes that the machinery can be sold at the end of five years for 25% of the original purchase price, X. From the purchasing exercise carried out, calculate the machine purchase cost, X, the company could pay if it requires a 20% after tax rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts