Question: with this info please help me fill out the two tables. here are the tables that need to be filled out. AND Emily Company uses

with this info please help me fill out the two tables. here are the tables that need to be filled out.

here are the tables that need to be filled out.

AND

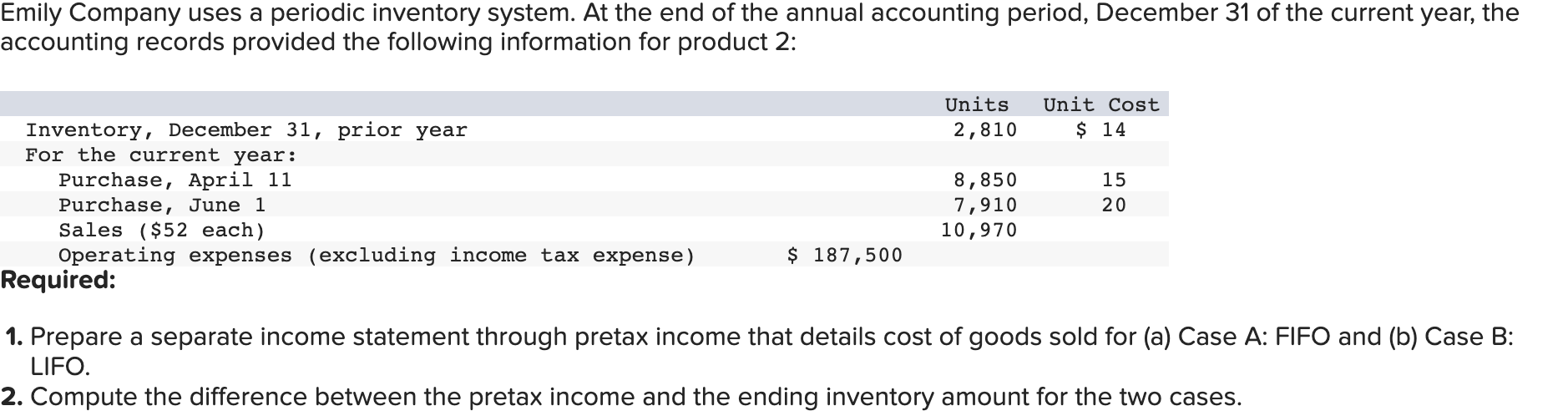

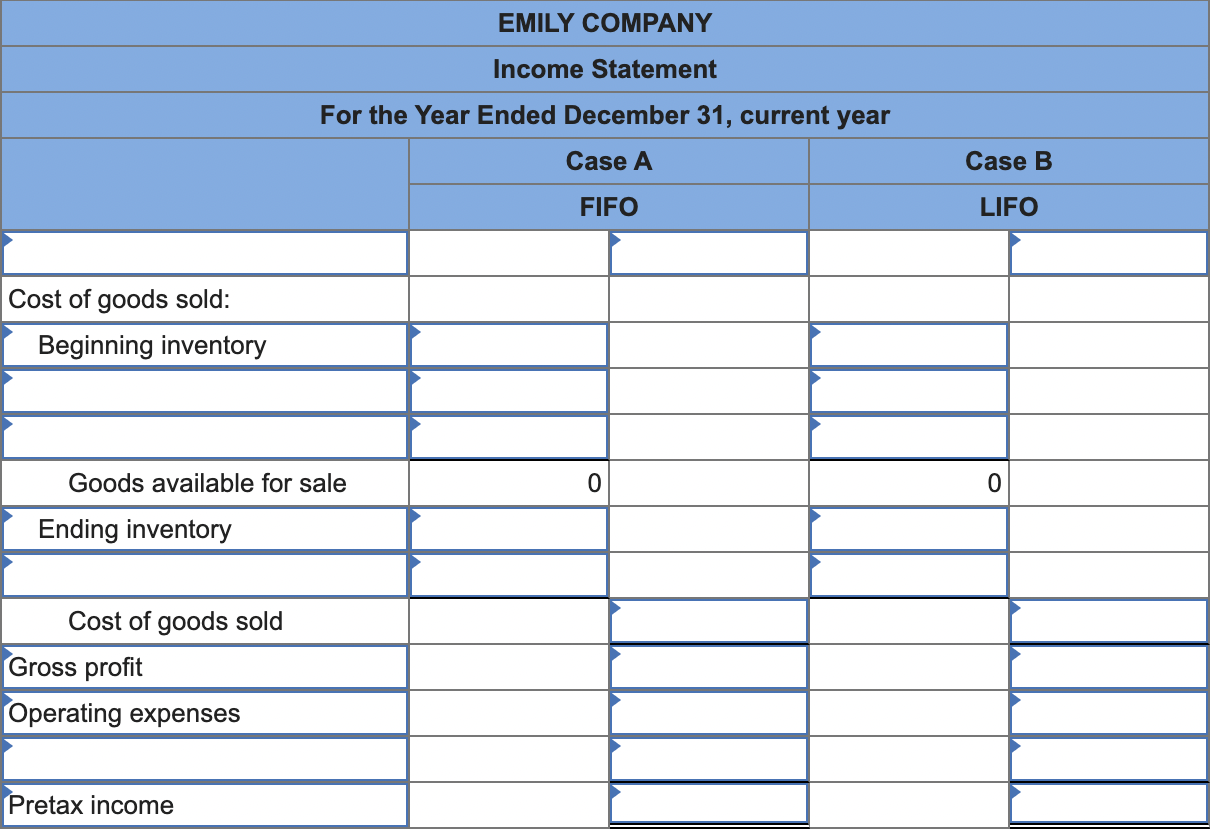

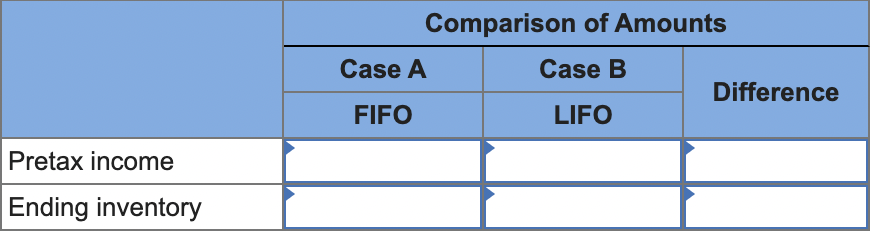

Emily Company uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the iccounting records provided the following information for product 2 : 1. Prepare a separate income statement through pretax income that details cost of goods sold for (a) Case A: FIFO and (b) Case B: LIFO. 2. Compute the difference between the pretax income and the ending inventory amount for the two cases. EMILY COMPANY Income Statement For the Year Ended December 31, current year \begin{tabular}{|l|c|c|c|} \multirow{2}{*}{} & \multicolumn{3}{c}{ Comparison of Amounts } \\ \cline { 2 - 3 } & Case A & Case B & \multirow{2}{*}{ Difference } \\ \cline { 2 - 3 } & FIFO & LIFO & \\ \hline Pretax income & & & \\ \hline Ending inventory & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts