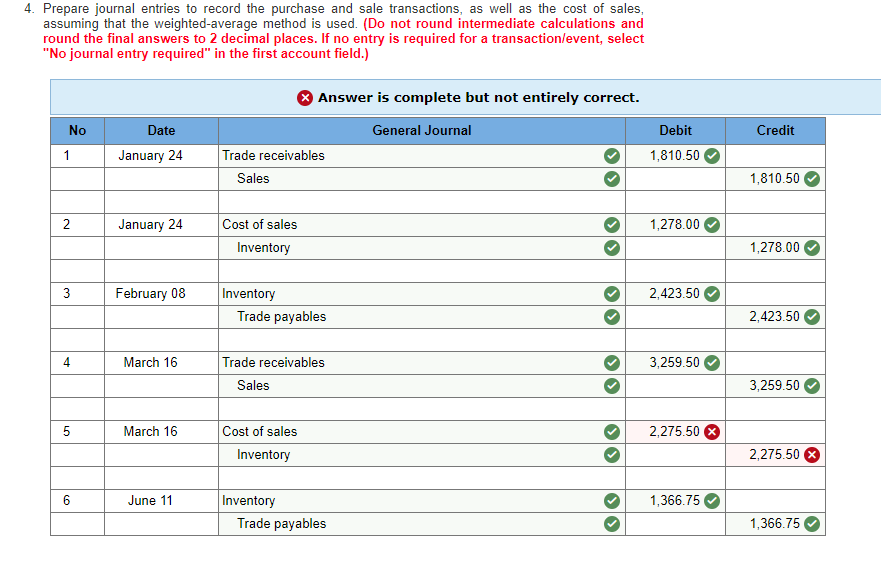

Question: With this information, what would the correct 5th journal entry be? A previous expert gave me the value above and was wrong and hasn't bothered

With this information, what would the correct 5th journal entry be? A previous expert gave me the value above and was wrong and hasn't bothered to reply back to me, so the help is greatly appreciated.

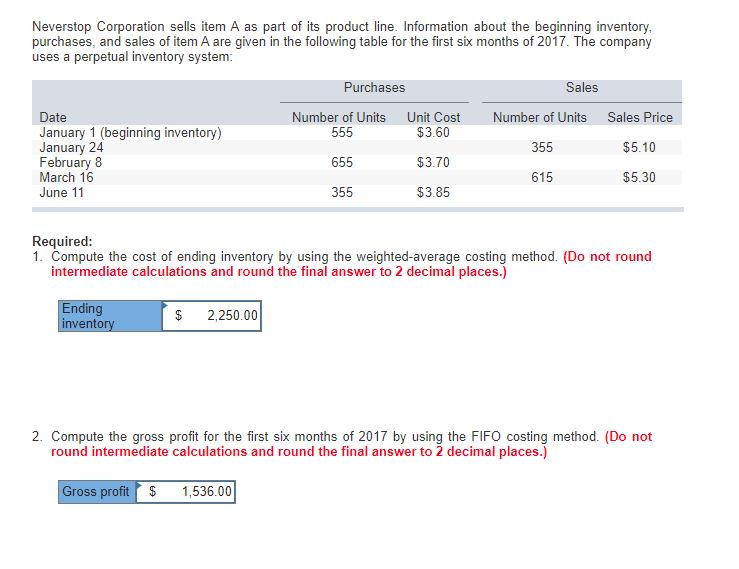

Neverstop Corporation sells item A as part of its product line. Information about the beginning inventory, purchases, and sales of item A are given in the following table for the first six months of 2017. The company uses a perpetual inventory system: Purchases Sales Date Number of Units Unit Cost Number of Units Sales Price January 1 (beginning inventory) 555 $3.60 January 24 355 $5.10 February 8 655 $3.70 March 16 615 $5.30 June 11 355 $3.85 Required: 1. Compute the cost of ending inventory by using the weighted average costing method. (Do not round intermediate calculations and round the final answer to 2 decimal places.) Ending inventory $ 2,250.00 2. Compute the gross profit for the first six months of 2017 by using the FIFO costing method. (Do not round intermediate calculations and round the final answer to 2 decimal places.) Gross profit $ 1,536.00 4. Prepare journal entries to record the purchase and sale transactions, as well as the cost of sales, assuming that the weighted average method is used. (Do not round intermediate calculations and round the final answers to 2 decimal places. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is complete but not entirely correct. No General Journal Credit Date January 24 Debit 1,810.50 Trade receivables Sales 1,810.50 2 January 24 1,278.00 Cost of sales Inventory 1,278.00 February 08 2,423.50 Inventory Trade payables 2,423.50 4 March 16 3,259.50 Trade receivables Sales 3,259.50 5 March 16 2,275.50 X Cost of sales Inventory 2,275.50 6 June 11 1,366.75 Inventory Trade payables 1,366.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts