Question: Within the relevant range: A) variable cost per unit decreases as production decreases. B) fixed cost pet unit increases as production decreases. c) fixed cost

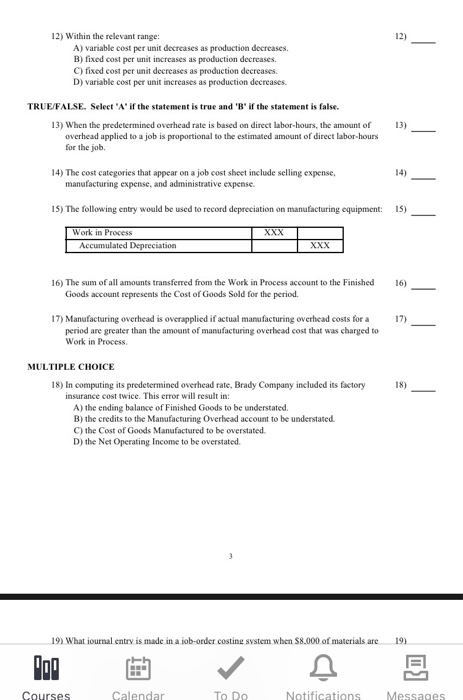

Within the relevant range: A) variable cost per unit decreases as production decreases. B) fixed cost pet unit increases as production decreases. c) fixed cost per unit decreases as production decreases. D) variable cost per unit increases as production decreases. When the predetermined overhead rate is bated on direct labor-hours, the amount of overhead applied to a job is proportional to the estimated amount of direct labor-hours for the job. The cost categories that appear on a job cost sheet include selling expense, manufacturing expense, and administrative expense. The following entry would be used to record depreciation on manufacturing equipment: The sum of all amounts transferred from the Work in Process account to the Finished Goods account represents the Cost of Goods Sold for the period. Manufacturing overhead is over applied if actual manufacturing overhead costs for a period are greater than the amount of manufacturing overhead cost that was charged to Work in Process. In computing its predetermined overhead rate. Brady Company included its factory insurance cost twice. This error will result in: A) the ending balance of Finished Goods to be understated. B) the credits to the Manufacturing Overhead account to be understated. C) the Cost of Goods Manufactured to be overstated. D) the Net Operating Income to be overstated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts