Question: Within this module, we explored the numerous risks financial institutions face . For the discussion this week, evaluate the risks that would be faced in

Within this module, we explored the numerous risks financial institutions face. For the discussion this week, evaluate the risks that would be faced in each of the scenarios described below. Explain in detail why you would be concerned with the chosen risks. Then, discuss if your answers differ for the scenarios and the reasons why they may.

You are the CEO of a large commercial bank such as Wells Fargo Bank. So, what are some risks Wells face and are they positive or negative and why? Explain your concerns with them in detail.

You are a bank manager of a small town state bank. So, what are some risks a small town bank face and are they positive or negative and why? Explain your concerns with them in detail. (Please keep in mind that the small bank faces different risks from the Large Banks)

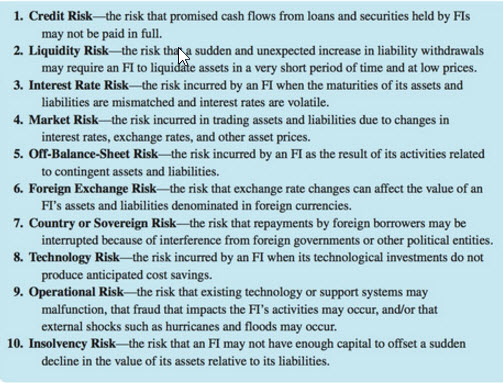

i. Credit Risk-the risk that promised cash flows from loans and securities held by FIs may not be paid in full. 2. Liquidity Risk-the risk tha a sudden and unexpected increase in liability withdrawals may require an FI to liquidate assets in a very short period of time and at low prices. 3. Interest Rate Risk-the risk incurred by an FI when the maturities of its assets and liabilities are mismatched and interest rates are volatile. 4. Market Risk the risk incurred in trading assets and liabilities due to changes in interest rates, exchange rates, and other asset prices. 5. Off Balance-Sheet Risk-the risk incurred by an FI as the result of its activities related to contingent assets and liabilities 6. Foreign Exchange Risk-the risk that exchange rate changes can affect the value of an FI's assets and liabilities denominated in foreign currencies. 7. Country or Sovereign Risk-the risk that repayments by foreign borrowers may be interrupted because of interference from foreign governments or other political entities. 8. Technology Risk-the risk incurred by an FI when its technological investments do not produce anticipated cost savings. 9. Operational Risk the risk that existing technology or support systems may malfunction, that fraud that impacts the FI's activities may occur, and/or that external shocks such as hurricanes and floods may occur. 10. Insolvency Risk-the risk that an FI may not have enough capital to offset a sudden decline in the value ofits assets relative to its liabilities. i. Credit Risk-the risk that promised cash flows from loans and securities held by FIs may not be paid in full. 2. Liquidity Risk-the risk tha a sudden and unexpected increase in liability withdrawals may require an FI to liquidate assets in a very short period of time and at low prices. 3. Interest Rate Risk-the risk incurred by an FI when the maturities of its assets and liabilities are mismatched and interest rates are volatile. 4. Market Risk the risk incurred in trading assets and liabilities due to changes in interest rates, exchange rates, and other asset prices. 5. Off Balance-Sheet Risk-the risk incurred by an FI as the result of its activities related to contingent assets and liabilities 6. Foreign Exchange Risk-the risk that exchange rate changes can affect the value of an FI's assets and liabilities denominated in foreign currencies. 7. Country or Sovereign Risk-the risk that repayments by foreign borrowers may be interrupted because of interference from foreign governments or other political entities. 8. Technology Risk-the risk incurred by an FI when its technological investments do not produce anticipated cost savings. 9. Operational Risk the risk that existing technology or support systems may malfunction, that fraud that impacts the FI's activities may occur, and/or that external shocks such as hurricanes and floods may occur. 10. Insolvency Risk-the risk that an FI may not have enough capital to offset a sudden decline in the value ofits assets relative to its liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts