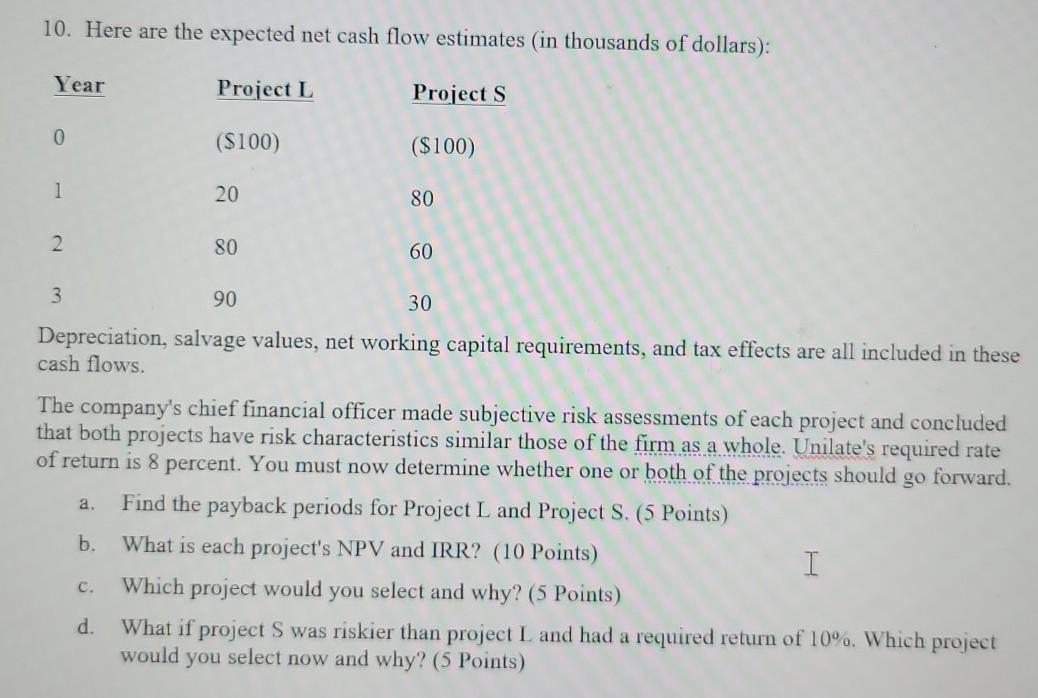

Question: without excel, if possible. 10. Here are the expected net cash flow estimates (in thousands of dollars): Year Project L Projects 0 ($100) ($100) 1

without excel, if possible.

10. Here are the expected net cash flow estimates (in thousands of dollars): Year Project L Projects 0 ($100) ($100) 1 20 80 2. 80 60 3 90 30 Depreciation, salvage values, net working capital requirements, and tax effects are all included in these cash flows. a. The company's chief financial officer made subjective risk assessments of each project and concluded that both projects have risk characteristics similar those of the firm as a whole. Unilate's required rate of return is 8 percent. You must now determine whether one or both of the projects should go forward Find the payback periods for Project L and Project S. (5 Points) b. What is each project's NPV and IRR? (10 Points) I Which project would you select and why? (5 Points) d. What if project S was riskier than project L and had a required return of 10%. Which project would you select now and why? (5 Points) C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts