Question: without looking up the answers , someone knowledgeble please let me know if im correct or wrong ! will give thumbs up B 1.The current

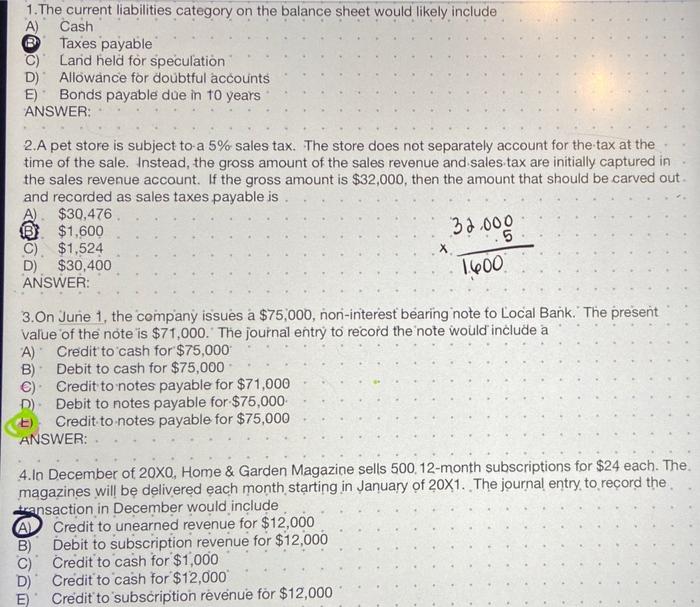

B 1.The current liabilities category on the balance sheet would likely include A) Cash Taxes payable Land held for speculation D) Allowance for doubtful accounts E) Bonds payable due in 10 years ANSWER: 32.000 X 5 1.600 2.A pet store is subject to a 5% sales tax. The store does not separately account for the tax at the time of the sale. Instead, the gross amount of the sales revenue and sales tax are initially captured in the sales revenue account. If the gross amount is $32,000, then the amount that should be carved out and recorded as sales taxes payable is. $30,476 $ $1,600 C) $1,524 D) $30,400 ANSWER: 3.On June 1, the company issues a $75,000, non-interest bearing note to Local Bank. The present value of the note is $71,000. The journal entry to record the note would include a A) Credit to cash for $75,000 B) Debit to cash for $75,000 ) Credit to notes payable for $71,000 D) Debit to notes payable for $75,000 Credit to notes payable for $75,000 ANSWER: 4.In December of 20x0, Home & Garden Magazine sells 500 12-month subscriptions for $24 each. The. magazines will be delivered each month starting in January of 20X1. The journal entry to record the transaction in December would include A Credit to unearned revenue for $12,000 B) Debit to subscription revenue for $12,000 C) Credit to cash for $1,000 D) Credit to cash for $12,000 Credit to subscription revenue for $12,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts