Question: without using excel Only mathematical formulas Question Consider a 25-year regular premium endowment assurance policy with a sum assured of 75,000 payable on maturity (or

without using excel

without using excel

Only mathematical formulas

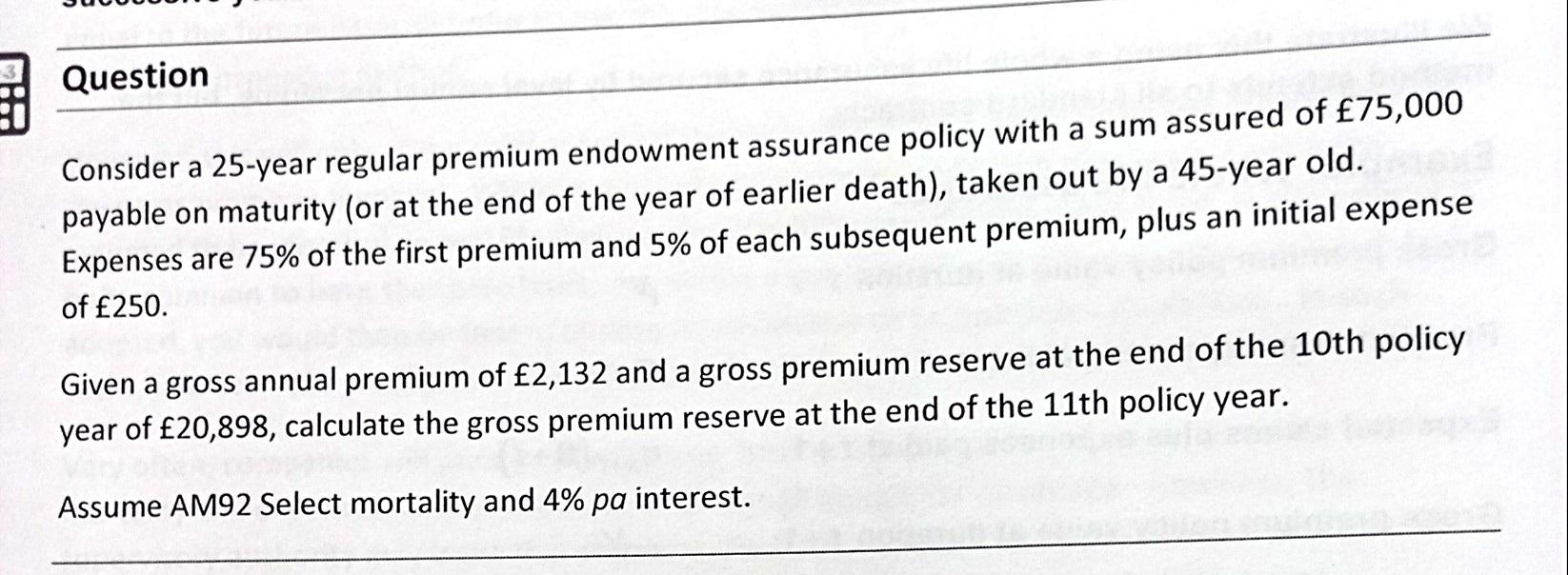

Question Consider a 25-year regular premium endowment assurance policy with a sum assured of 75,000 payable on maturity (or at the end of the year of earlier death), taken out by a 45-year old. Expenses are 75% of the first premium and 5% of each subsequent premium, plus an initial expense of 250. Given a gross annual premium of 2,132 and a gross premium reserve at the end of the 10th policy year of 20,898, calculate the gross premium reserve at the end of the 11th policy year. Assume AM92 Select mortality and 4% pa interest. Question Consider a 25-year regular premium endowment assurance policy with a sum assured of 75,000 payable on maturity (or at the end of the year of earlier death), taken out by a 45-year old. Expenses are 75% of the first premium and 5% of each subsequent premium, plus an initial expense of 250. Given a gross annual premium of 2,132 and a gross premium reserve at the end of the 10th policy year of 20,898, calculate the gross premium reserve at the end of the 11th policy year. Assume AM92 Select mortality and 4% pa interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts