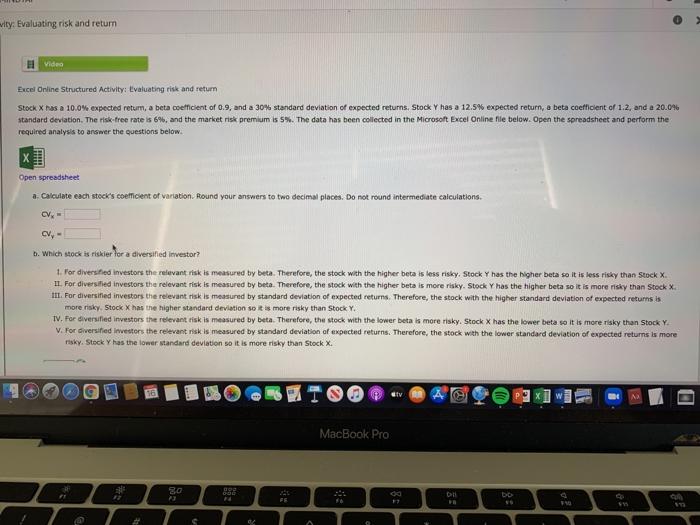

Question: wity: Evaluating risk and return Video Excel Online Structured Activity: Evaluating risk and return Stock X has a 10.0% expected retum, a beta coefficient of

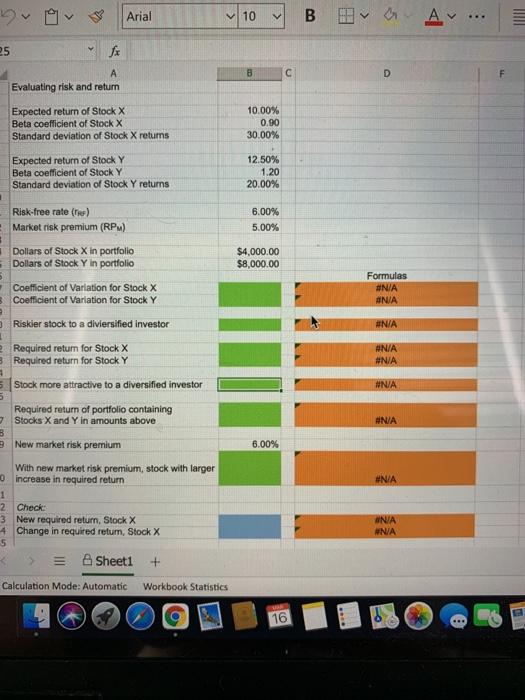

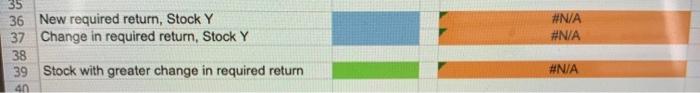

wity: Evaluating risk and return Video Excel Online Structured Activity: Evaluating risk and return Stock X has a 10.0% expected retum, a beta coefficient of 0.9, and a 30% standard deviation of expected returns, Stock Y has a 12.5% expected return, a beta coefficient of 1.2, and a 20.0% standard deviation. The risk-free rate is 6%, and the market risk premium is 5%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet a. Calculate each stock's coefficient of variation. Round your answers to two decimal places. Do not round intermediate calculations CV - CV- b. Which stock is riskier for a diversified investor? 1. For diversified investors the relevant risk is measured by beta. Therefore, the stock with the higher beta is less risky. Stock Y has the higher beta so it is less risky than Stock X 11. For diversified investors the relevant risk is measured by beta. Therefore, the stock with the higher beta is more risky. Stock Y has the higher beta so it is more risky than Stock X III. For diversified investors the relevant risk is measured by standard deviation of expected returns. Therefore, the stock with the higher standard deviation of expected returns is more risky Stock X has the higher standard deviation so is more risky than Stock Y. IV. For diversified investors the relevant risk is measured by beta. Therefore, the stock with the lower beta is more risky. Stock X has the lower beta so it is more risky than Stock Y. V. For diversified investors the relevant risk is measured by standard deviation of expected returns. Therefore, the stock with the lower standard deviation of expected returns is more risky. Stock y has the lower standard deviation so it is it is more risky than Stock MacBook Pro 20 00 FS 02 A Arial v 10 B HA... MINI 25 fx D Evaluating risk and return Expected return of Stock X Beta coefficient of Stock X Standard deviation of Stock X returns 10.00% 0.90 30.00% Expected return of Stock Y Beta coefficient of Stock Y Standard deviation of Stock Y returns 12.50% 1.20 20.00% Risk-free rate() Market risk premium (RPM) 6.00% 5.00% Dollars of Stock X in portfolio Dollars of Stock Y in portfolio $4,000.00 $8,000.00 Coefficient of Variation for Stock X Coefficient of Variation for Stock Y Formulas #N/A ONIA #N/A #N/A #N/A #N/A #N/A Riskier stock to a diversified investor 2 Required retum for Stock X Required return for Stock Y 5 Stock more attractive to a diversified investor 5 Required return of portfolio containing Stocks X and Y in amounts above B New market risk premium With new market risk premium, stock with larger increase in required return 1 2 Check 3 New required return, Stock X 4 Change in required retum, Stock X 5 = Sheet1 + 6.00% #N/A #NA #N/A Calculation Mode: Automatic Workbook Statistics 16 #N/A #N/A 35 36 New required return, Stock Y 37 Change in required return, Stock Y 38 39 Stock with greater change in required return an #N/A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts