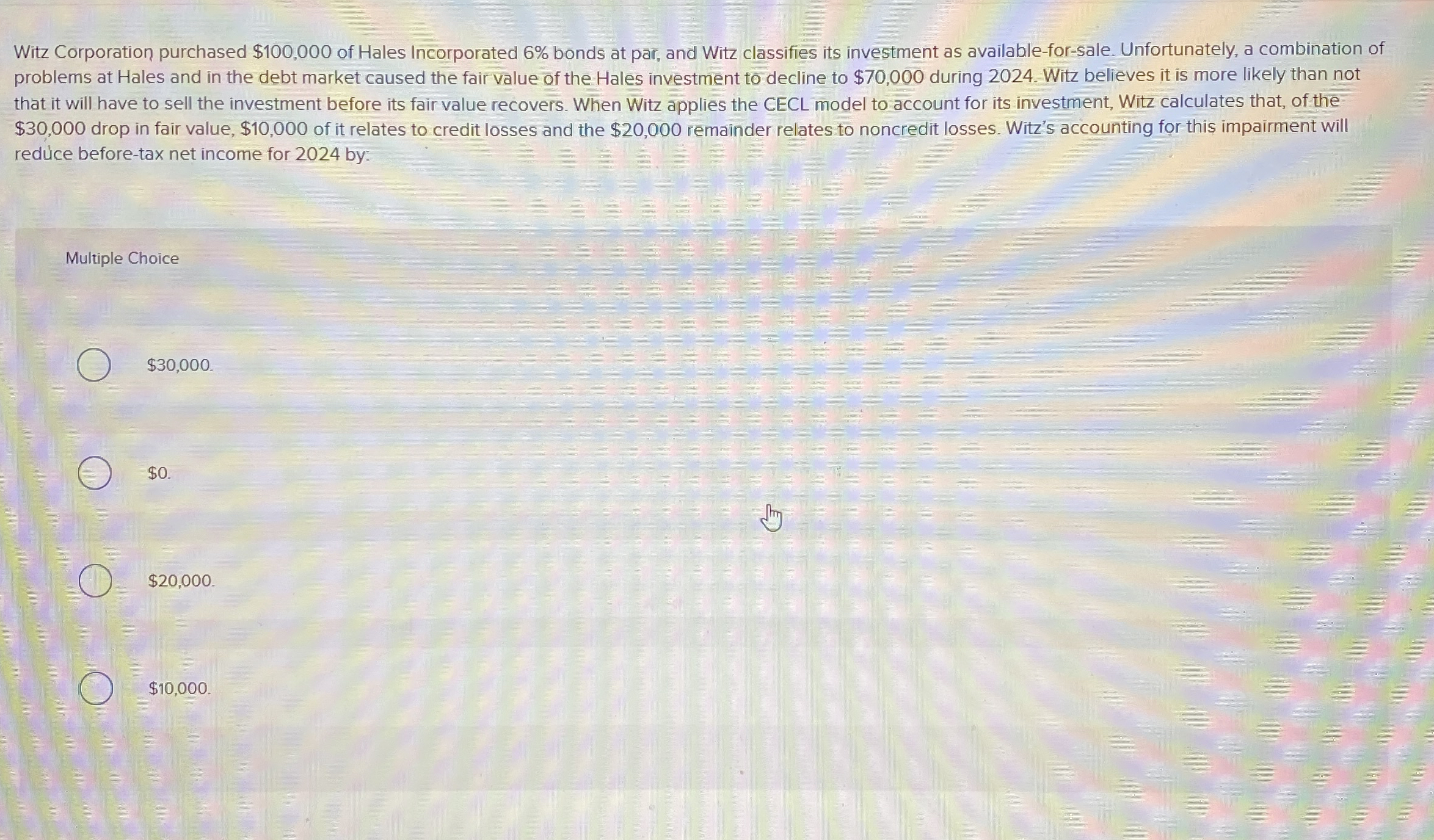

Question: Witz Corporation purchased $ 1 0 0 , 0 0 0 of Hales Incorporated 6 % bonds at par, and Witz classifies its investment as

Witz Corporation purchased $ of Hales Incorporated bonds at par, and Witz classifies its investment as availableforsale. Unfortunately, a combination of problems at Hales and in the debt market caused the fair value of the Hales investment to decline to $ during Witz believes it is more likely than not that it will have to sell the investment before its fair value recovers. When Witz applies the CECL model to account for its investment, Witz calculates that, of the $ drop in fair value, $ of it relates to credit losses and the $ remainder relates to noncredit losses. Witz's accounting for this impairment will reduce beforetax net income for by:

Multiple Choice

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock