Question: Wk 2 - Practice: Connect Knowledge Check [due Day 5] i Saved Help Save & Exit Submit Check my work 5 Exercise 2-9 Recording effects

![Wk 2 - Practice: Connect Knowledge Check [due Day 5] i](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/11/6736146e08cae_4216736146ddad1b.jpg)

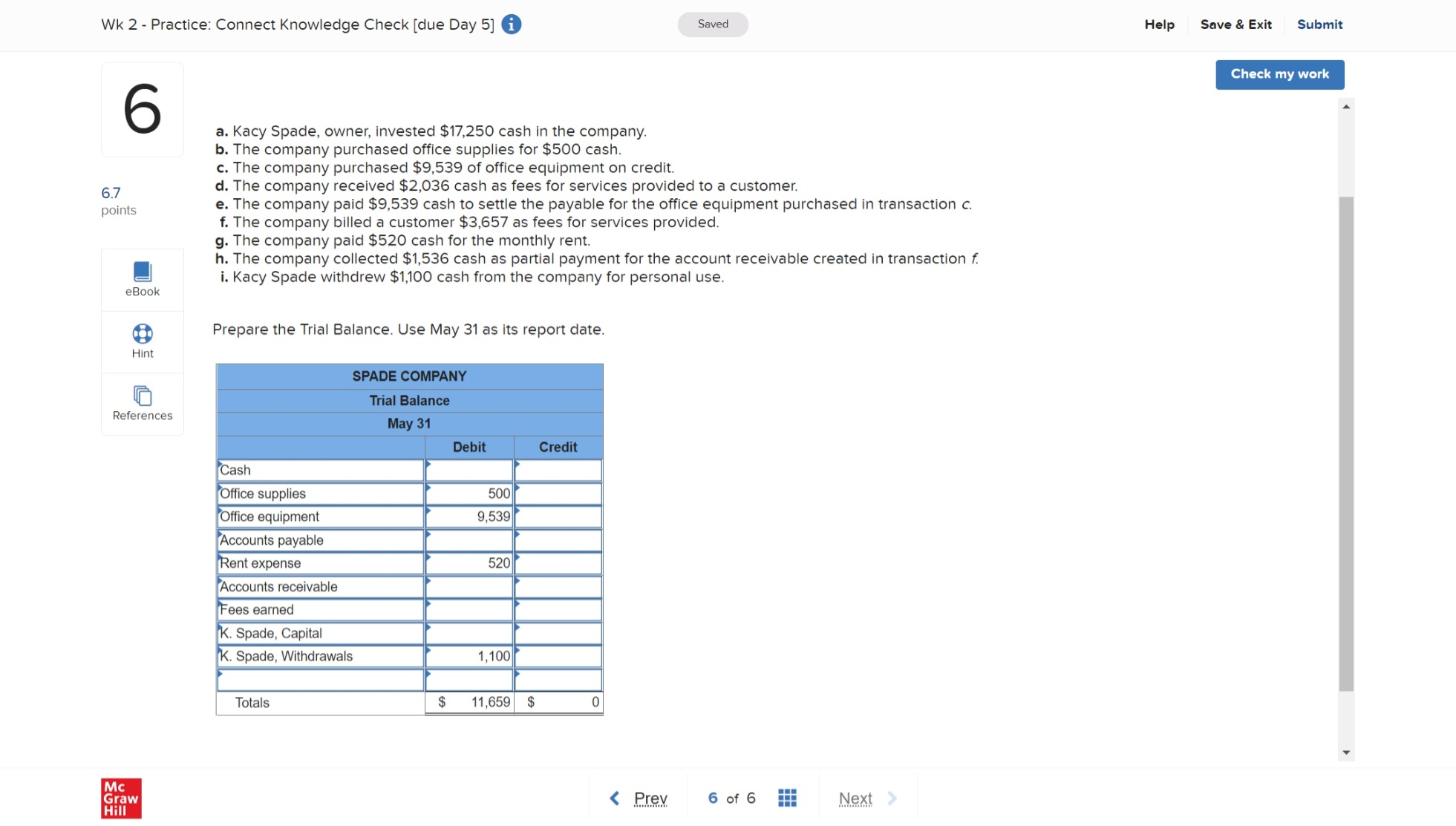

Wk 2 - Practice: Connect Knowledge Check [due Day 5] i Saved Help Save & Exit Submit Check my work 5 Exercise 2-9 Recording effects of transactions in T-accounts LO A1 6.66 The transactions of Spade Company appear below. points a. Kacy Spade, owner, invested $13,750 cash in the company. b. The company purchased office supplies for $399 cash. c. The company purchased $7,604 of office equipment on credit. eBook d. The company received $1,622 cash as fees for services provided to a customer. e. The company paid $7,604 cash to settle the payable for the office equipment purchased in transaction c. f. The company billed a customer $2,915 as fees for services provided. Hint g. The company paid $510 cash for the monthly rent. h. The company collected $1,224 cash as partial payment for the account receivable created in transaction f. i. Kacy Spade withdrew $800 cash from the company for personal use. References Required: 1. Prepare general journal entries to record the transactions above for Spade Company by using the following accounts: Cash; Accounts Receivable; Office Supplies; Office Equipment; Accounts Payable; K. Spade, Capital; K. Spade, Withdrawals; Fees Earned; and Rent Expense. Use the letters beside each transaction to identify entries. 2. Post the above journal entries to T-accounts, which serve as the general ledger for this assignment. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Post the above journal entries to T-accounts, which serves as the general ledger for this assignment. Cash Accounts Receivable a. 13,750 2,915 d 1,622 Mc Graw HillWk 2 - Practice: Connect Knowledge Check [due Day 5] i Saved Help Save & Exit Submit Check my work 6 a. Kacy Spade, owner, invested $17,250 cash in the company. b. The company purchased office supplies for $500 cash. c. The company purchased $9,539 of office equipment on credit. 6.7 d. The company received $2,036 cash as fees for services provided to a customer. points e. The company paid $9,539 cash to settle the payable for the office equipment purchased in transaction c. f. The company billed a customer $3,657 as fees for services provided. g. The company paid $520 cash for the monthly rent. h. The company collected $1,536 cash as partial payment for the account receivable created in transaction f. i. Kacy Spade withdrew $1,100 cash from the company for personal use. eBook Prepare the Trial Balance. Use May 31 as its report date. Hint SPADE COMPANY Trial Balance References May 31 Debit Credit Cash Office supplies 500 Office equipment 9,539 Accounts payable Rent expense 520 Accounts receivable Fees earned K. Spade, Capital K. Spade, Withdrawals 1,100 Totals $ 11,659 $ 0 Mc Graw Hill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts