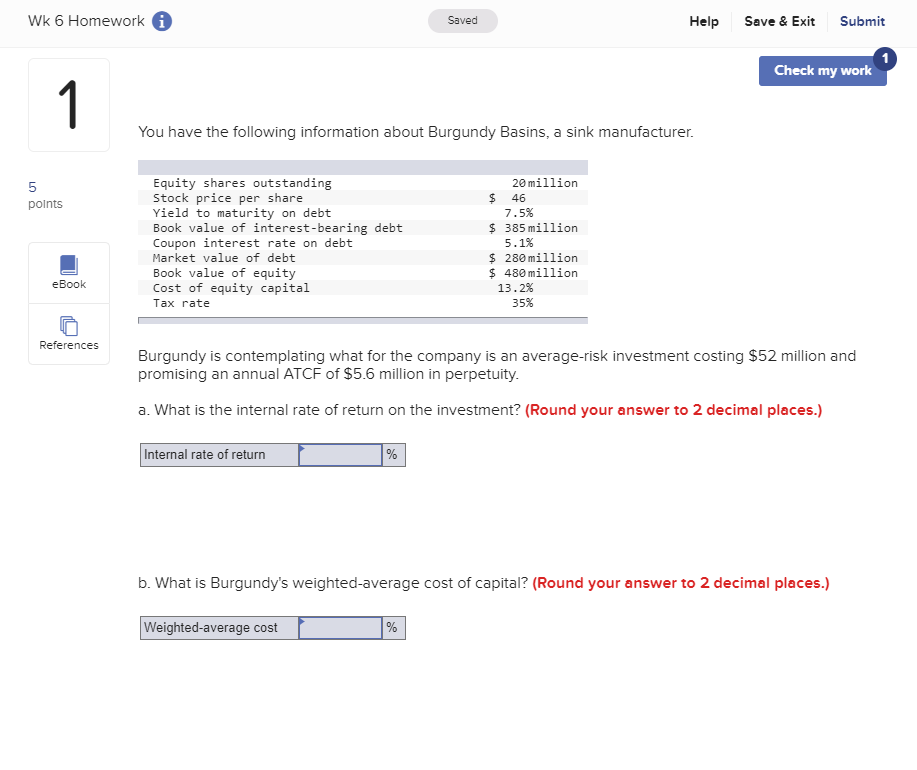

Question: Wk 6 Homework A Saved Help Save & Exit Submit Check my work You have the following information about Burgundy Basins, a sink manufacturer points

Wk 6 Homework A Saved Help Save & Exit Submit Check my work You have the following information about Burgundy Basins, a sink manufacturer points Equity shares outstanding Stock price per share Yield to maturity on debt Book value of interest-bearing debt Coupon interest rate on debt Market value of debt Book value of equity Cost of equity capital Tax rate 20 million $ 46 7.5% $ 385 million 5.1% $ 280 million $ 480 million 13.2% 35% eBook References Burgundy is contemplating what for the company is an average-risk investment costing $52 million and promising an annual ATCF of $5.6 million in perpetuity. a. What is the internal rate of return on the investment? (Round your answer to 2 decimal places.) Internal rate of return % b. What is Burgundy's weighted average cost of capital? (Round your answer to 2 decimal places.) Weighted average cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts