Question: wk.6 thank you. pls need help with this problem. Sign in eBook Show Me How Activity-Based Costing: Selling and Administrative Expenses Jungle Junior Company manufactures

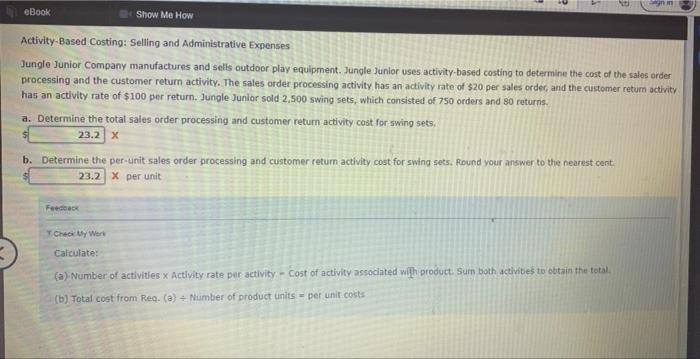

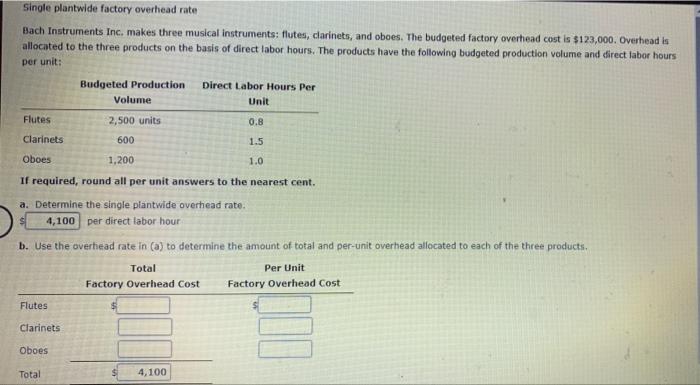

Sign in eBook Show Me How Activity-Based Costing: Selling and Administrative Expenses Jungle Junior Company manufactures and sells outdoor play equipment. Jungle Junior uses activity-based costing to determine the cost of the sales order processing and the customer return activity. The sales order processing activity has an activity rate of $20 per sales order, and the customer return activity has an activity rate of $100 per return. Jungle Junior sold 2,500 swing sets, which consisted of 750 orders and 80 returns. a. Determine the total sales order processing and customer return activity cost for swing sets. $1 23.2 X b. Determine the per-unit sales order processing and customer return activity cost for swing sets. Round your answer to the nearest cent. 23.2 X per unit Feedback T. Check My Work Calculate: (a) Number of activities x Activity rate per activity - Cost of activity associated with product. Sum both activities to obtain the total. (b) Total cost from Req. (a) + Number of product units per unit costs = Single plantwide factory overhead rate Bach Instruments Inc. makes three musical instruments: flutes, clarinets, and oboes. The budgeted factory overhead cost is $123,000. Overhead is allocated to the three products on the basis of direct labor hours. The products have the following budgeted production volume and direct labor hours per unit: Budgeted Production. Direct Labor Hours Per Volume Unit Flutes 2,500 units 0.8 Clarinets 600 1.5 Oboes 1,200 1.0 If required, round all per unit answers to the nearest cent. a. Determine the single plantwide overhead rate. 4,100 per direct labor hour b. Use the overhead rate in (a) to determine the amount of total and per-unit overhead allocated to each of the three products. Total Per Unit Factory Overhead Cost Factory Overhead Cost Flutes Clarinets Oboes Total 4,100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts