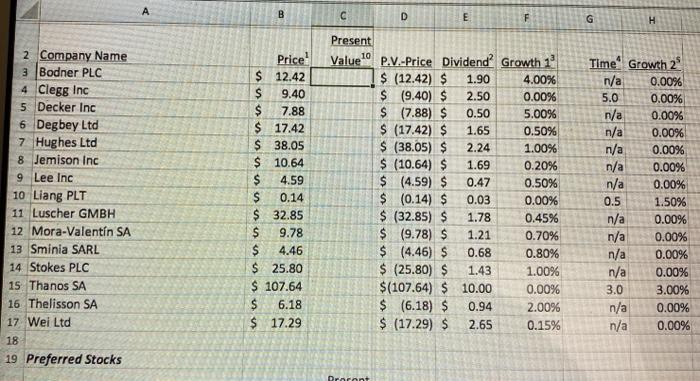

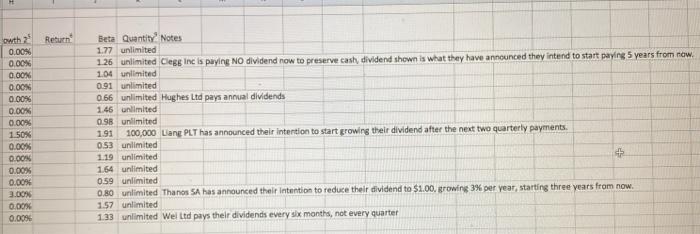

Question: wondering what the Present value is and what the return would be. Equations would also be helpful if possible. I believe that is the price

B D E F G H n/a 2 Company Name 3 Bodner PLC 4 Clegg Inc 5 Decker Inc 6 Degbey Ltd 7 Hughes Ltd 8 Jemison Inc 9 Lee Inc 10 Liang PLT 11 Luscher GMBH 12 Mora-Valentn SA 13 Sminia SARL 14 Stokes PLC 15 Thanos SA 16 Thelisson SA 17 Wei Ltd 18 19 Preferred Stocks Price? $ 12.42 $ 9.40 $ 7.88 $ 17.42 $ 38.05 $ 10.64 $ 4.59 $ 0.14 $ 32.85 $ 9.78 $ 4.46 $ 25.80 $ 107.64 $ 6.18 $ 17.29 Present Value 10 P.V.-Price Dividend? Growth 1 $ (12.42) $ 1.90 4.00% $ (9.40) $ 2.50 0.00% $ (7.88) $ 0.50 5.00% $ (17.42) $ 1.65 0.50% $ (38.05) $ 2.24 1.00% $ (10.64) $ 1.69 0.20% $ (4.59) $ 0.47 0.50% $ (0.14) $ 0.03 0.00% $ (32.85) $ 1.78 0.45% $ (9.78) $ 1.21 0.70% $ (4.46) $ 0.68 0.80% $ (25.80) $ 1.43 1.00% $(107.64) $ 10.00 0.00% $ (6.18) $ 0.94 2.00% $ (17.29) $ 2.65 0.15% Time Growth 2 n/a 0.00% 5.0 0.00% n/a 0.00% 0.00% n/a 0.00% n/a 0.00% n/a 0.00% 0.5 1.50% n/a 0.00% n/a 0.00% 0.00% n/a 0.00% 3.0 3.00% n/a 0.00% n/a 0.00% n/a Dracant Return owth 0.00% 0.00% 0.00% 0.00N 0.0096 0.00% 0.00% 150 0.00% 0.00% 0.00% 0.009 3.00 0.00% 0.005 Beta Quantity Notes 1.77 unlimited 1.26 unlimited Clegg Inc is paying NO dividend now to preserve cash dividend shown is what they have announced they intend to start paying 5 years from now. 104 unlimited 0.91 unlimited 0.66 unlimited Hughes Ltd pays annual dividends 1.46 unlimited 0.98 unlimited 1.91 100,000 Lang PLT has announced their intention to start growing their dividend after the next two quarterly payments. 0.53 unlimited 1.19 unlimited + 164 unlimited 0.59 unlimited 0.80 unlimited Thanos SA has announced their intention to reduce their dividend to $1.00, growing 3% per year, starting three years from now. 1.57 unlimited 133 unlimited Wel Ltd pays their dividends every six months, not every quarter B D E F G H n/a 2 Company Name 3 Bodner PLC 4 Clegg Inc 5 Decker Inc 6 Degbey Ltd 7 Hughes Ltd 8 Jemison Inc 9 Lee Inc 10 Liang PLT 11 Luscher GMBH 12 Mora-Valentn SA 13 Sminia SARL 14 Stokes PLC 15 Thanos SA 16 Thelisson SA 17 Wei Ltd 18 19 Preferred Stocks Price? $ 12.42 $ 9.40 $ 7.88 $ 17.42 $ 38.05 $ 10.64 $ 4.59 $ 0.14 $ 32.85 $ 9.78 $ 4.46 $ 25.80 $ 107.64 $ 6.18 $ 17.29 Present Value 10 P.V.-Price Dividend? Growth 1 $ (12.42) $ 1.90 4.00% $ (9.40) $ 2.50 0.00% $ (7.88) $ 0.50 5.00% $ (17.42) $ 1.65 0.50% $ (38.05) $ 2.24 1.00% $ (10.64) $ 1.69 0.20% $ (4.59) $ 0.47 0.50% $ (0.14) $ 0.03 0.00% $ (32.85) $ 1.78 0.45% $ (9.78) $ 1.21 0.70% $ (4.46) $ 0.68 0.80% $ (25.80) $ 1.43 1.00% $(107.64) $ 10.00 0.00% $ (6.18) $ 0.94 2.00% $ (17.29) $ 2.65 0.15% Time Growth 2 n/a 0.00% 5.0 0.00% n/a 0.00% 0.00% n/a 0.00% n/a 0.00% n/a 0.00% 0.5 1.50% n/a 0.00% n/a 0.00% 0.00% n/a 0.00% 3.0 3.00% n/a 0.00% n/a 0.00% n/a Dracant Return owth 0.00% 0.00% 0.00% 0.00N 0.0096 0.00% 0.00% 150 0.00% 0.00% 0.00% 0.009 3.00 0.00% 0.005 Beta Quantity Notes 1.77 unlimited 1.26 unlimited Clegg Inc is paying NO dividend now to preserve cash dividend shown is what they have announced they intend to start paying 5 years from now. 104 unlimited 0.91 unlimited 0.66 unlimited Hughes Ltd pays annual dividends 1.46 unlimited 0.98 unlimited 1.91 100,000 Lang PLT has announced their intention to start growing their dividend after the next two quarterly payments. 0.53 unlimited 1.19 unlimited + 164 unlimited 0.59 unlimited 0.80 unlimited Thanos SA has announced their intention to reduce their dividend to $1.00, growing 3% per year, starting three years from now. 1.57 unlimited 133 unlimited Wel Ltd pays their dividends every six months, not every quarter

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts