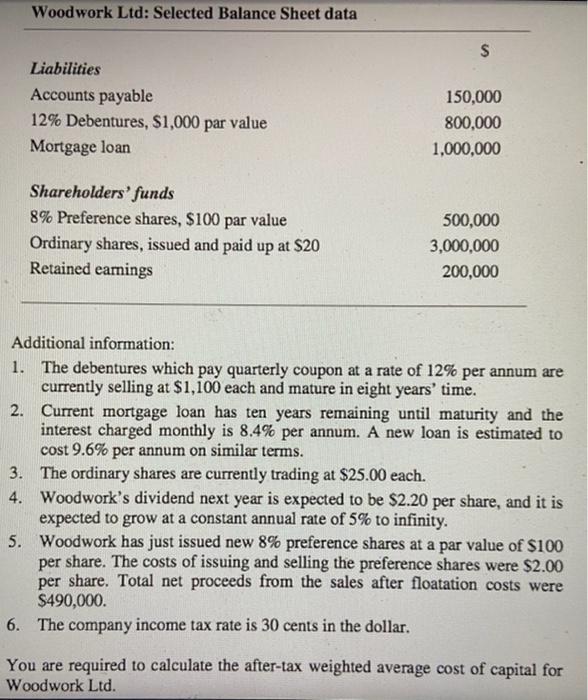

Question: Woodwork Ltd: Selected Balance Sheet data $ Liabilities Accounts payable 12% Debentures, $1,000 par value Mortgage loan 150,000 800,000 1,000,000 Shareholders' funds 8% Preference shares,

Woodwork Ltd: Selected Balance Sheet data $ Liabilities Accounts payable 12% Debentures, $1,000 par value Mortgage loan 150,000 800,000 1,000,000 Shareholders' funds 8% Preference shares, $100 par value Ordinary shares, issued and paid up at $20 Retained earnings 500,000 3,000,000 200,000 Additional information: 1. The debentures which pay quarterly coupon at a rate of 12% per annum are currently selling at $1,100 each and mature in eight years' time. 2. Current mortgage loan has ten years remaining until maturity and the interest charged monthly is 8.4% per annum. A new loan is estimated to cost 9.6% per annum on similar terms. 3. The ordinary shares are currently trading at $25.00 each. 4. Woodwork's dividend next year is expected to be $2.20 per share, and it is expected to grow at a constant annual rate of 5% to infinity. 5. Woodwork has just issued new 8% preference shares at a par value of $100 per share. The costs of issuing and selling the preference shares were $2.00 per share. Total net proceeds from the sales after floatation costs were $490,000 6. The company income tax rate is 30 cents in the dollar. You are required to calculate the after-tax weighted average cost of capital for Woodwork Ltd

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts