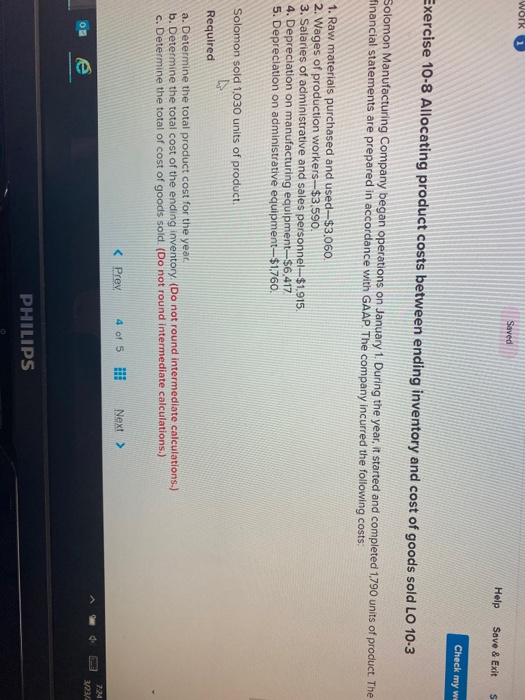

Question: Work 1 Help Save & Exits Check my we Exercise 10-8 Allocating product costs between ending inventory and cost of goods sold LO 10-3 Solomon

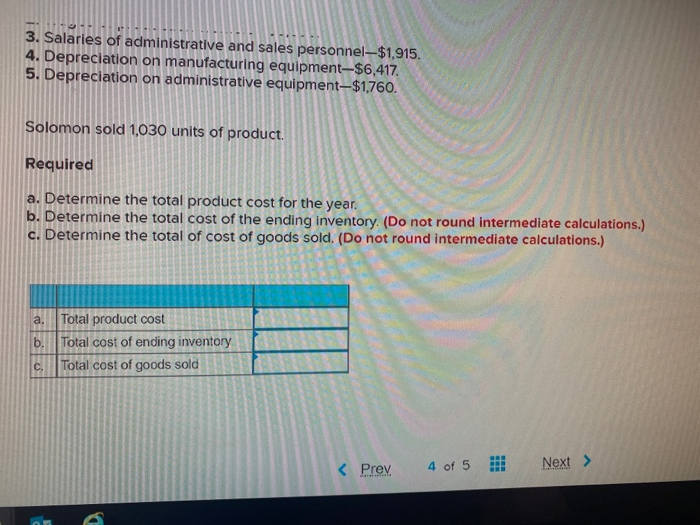

Work 1 Help Save & Exits Check my we Exercise 10-8 Allocating product costs between ending inventory and cost of goods sold LO 10-3 Solomon Manufacturing Company began operations on January 1. During the year, it started and completed 1790 units of product. The financial statements are prepared in accordance with GAAP. The company incurred the following costs: 1. Raw materials purchased and used-$3,060. 2. Wages of production workers-$3,590. 3. Salaries of administrative and sales personnel-$1.915. 4. Depreciation on manufacturing equipment-$6.417 5. Depreciation on administrative equipment-$1.760. Solomon sold 1,030 units of product Required a. Determine the total product cost for the year. b. Determine the total cost of the ending inventory. (Do not round intermediate calculations.) c. Determine the total of cost of goods sold. (Do not round intermediate calculations.) A 3 23/ PHILIPS 3. Salaries of administrative and sales personnel--$1,915. 4. Depreciation on manufacturing equipment-$6,417. 5. Depreciation on administrative equipment-$1,760. 60. Solomon sold 1,030 units of product. Required a. Determine the total product cost for the year. b. Determine the total cost of the ending inventory. (Do not round intermediate calculations.) c. Determine the total of cost of goods sold. (Do not round intermediate calculations.) / a. Total product cost Total cost of ending inventory Total cost of goods sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts