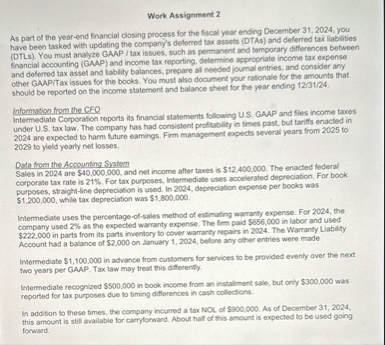

Question: Work Assignment 2 As part of the year - end financial closing process for the fiscal yoar ending December 3 1 , 2 0 2

Work Assignment

As part of the yearend financial closing process for the fiscal yoar ending December you have been tasked with updating the company's delerred tax assets DTAs and deferred tax liablities DTLs You must analyze GAAP tax issues, such as permanent and temporary differences between tinanclat accounting GAAP and income tax reporting. determine appropriate income tax expense and delerred tax asset and liablity balances, prepare al needed joumal entries, and consider any other GAAPTax issues for the books. You must also document your rationale for the amounts that should be reported on the income statement and balanoe sheet for the year ending

Information from the CFO

Intemediate Corporation reports its financial statements following US GAAP and Fles income taves under US tax law. The company has had consistent profiability in limes past, but tariffs enacted in are expected to harm future earnings. Firm management expects several years from to to yield yearly net losses.

Duta from the Accounting System

Sales in are $ and net income after taxes is $ The enacted federal corporate tax rate is For tax purposes, Intermediate uses accelerated depreciation. For book purposes, straightline depreciation is used. In depreciation expense per books was $ while tax depreciation was $

Intermediate uses the percentageolsales method of estimating warranty expense. For the company used as the expected warranty expense. The fim paid in labor and used $ in parts from its parts inventory to cover warranty repars in The Warranty Liablity Account had a balance of $ on January before any other entries were made

Intermediate $ in advance from customers for services to be provided evenly over the neat two years per GAMP. Tax law may treat this dfferently.

Imtermediate recognized $ in book income from an installment sale, but only $ was reported for tax purposes due to timing differences in cash collections.

In addition to these times, the company incurred a tax NOL of $ As of December this amount is still available for carrylonwand. About half of this amount is expected to be used going forward.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock