Question: Work Assignment 6 Intermediate Corporation earmed $ 4 6 , 2 4 0 , 2 5 0 in calendar ( and fiscal ) year 2

Work Assignment

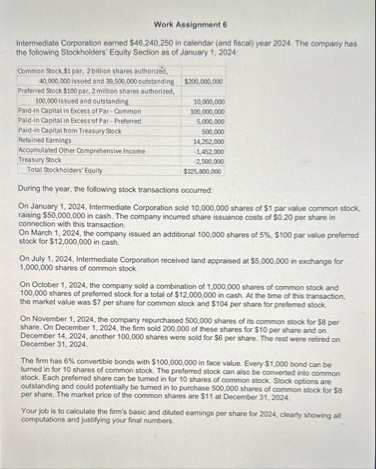

Intermediate Corporation earmed $ in calendar and fiscal year The company has the following Stockholders' Equity Section as of January :

tableComman Sack $ par, billien shares authorited, issoed and outstanding,$Preferred Sack $pat,mminsh shares authorized, is sued and outstanding,Paidin Capital in Excess of Par Common,Paldin Capital in Excestu of Par Preferred,Paidin Capital from TreasorySask,Aetained Earnings,Acoumulated Other Comprehensive lincsme,Treasury Sapck,Total Seockheldess' Equity,$

During the year, the following stock transactions occurred:

On January Intermediate Corporation sold shares of $ par value common stock, raising $ in cash. The company incurred share issuance costs of $ per share in connection with this transaction.

On March the company issued an additional shares of $ par value preferred stock for $ in cash.

On July Intermediate Comporation received land appraised at $ in exchange for shares of common stock.

On October the company sold a combination of shares of common stock and shares of preferred stock for a total of $ in cash. At the time of this transaction, the market value was $ per share for common stock and $ per share for preferned stock.

On November the company reputchased shares of is common stock for $ per share. On December the firm sold of these shares for $ per share and on December another shares were sold for $ per share. The rest were retired on December

The firm has convertble bonds with $ in face value. Every $ bond can be turned in for shares of common stock. The preferred stock can also be converted into common stock. Each preferred share can be turned in for shares of common stock. Stock options are outstanding and could potentially be turned in to purchase shares of common stock for $ per share. The market price of the common shares are $ at December

Your job is to calculate the firm's basic and diuted eamings per share for clearly showing alt computations and justrifing your final numbers.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock