Question: work Chapter 21 Soved Help Save & Exit Check 7 You are attempting to value a put option with an exercise price of $180 and

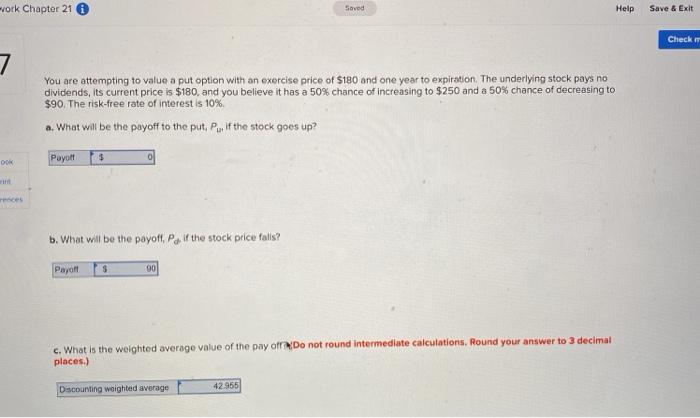

work Chapter 21 Soved Help Save & Exit Check 7 You are attempting to value a put option with an exercise price of $180 and one year to expiration. The underlying stock pays no dividends, its current price is $180, and you believe it has a 50% chance of increasing to $250 and a 50% chance of decreasing to $90. The risk-free rate of interest is 10% a. What will be the payoff to the put. Por if the stock goes up? Payott b. What will be the payoff, Paif the stock price falls? Payoff S 90 c. What is the weighted average value of the pay of Do not round Intermediate calculations. Round your answer to 3 decimal places.) 42 955 Discounting weighted average

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts