Question: WORK IN EXCEL WOULD BE MUCH APPRECIATED, WILL THUMBS UP Consider the following two bonds: Bond A Term to maturity: 30 years from today Face

WORK IN EXCEL WOULD BE MUCH APPRECIATED, WILL THUMBS UP

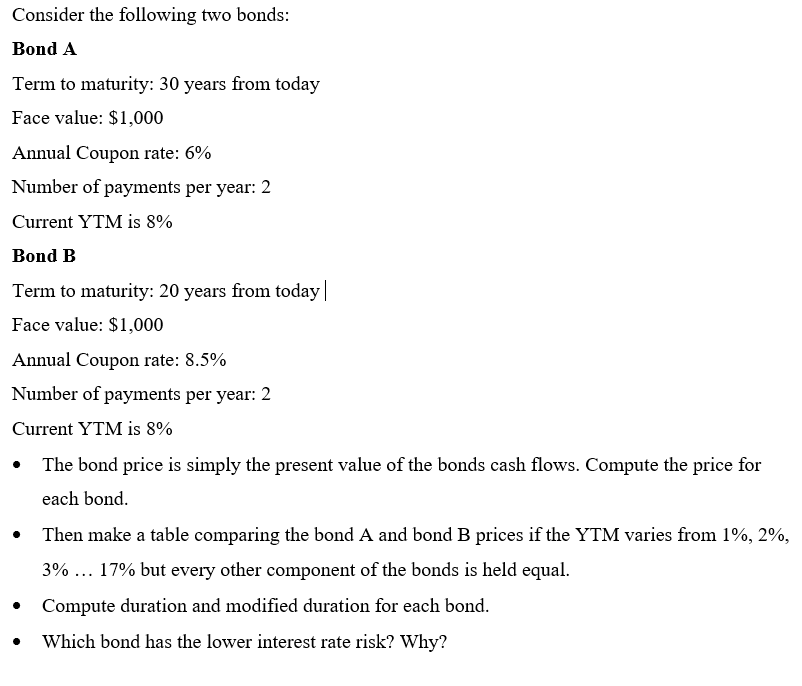

Consider the following two bonds: Bond A Term to maturity: 30 years from today Face value: $1,000 Annual Coupon rate: 6% Number of payments per year: 2 Current YTM is 8% Bond B Term to maturity: 20 years from today Face value: $1,000 Annual Coupon rate: 8.5% Number of payments per year: 2 Current YTM is 8% - The bond price is simply the present value of the bonds cash flows. Compute the price for each bond. - Then make a table comparing the bond A and bond B prices if the YTM varies from 1%,2%, 3%17% but every other component of the bonds is held equal. - Compute duration and modified duration for each bond. - Which bond has the lower interest rate risk? Why? Consider the following two bonds: Bond A Term to maturity: 30 years from today Face value: $1,000 Annual Coupon rate: 6% Number of payments per year: 2 Current YTM is 8% Bond B Term to maturity: 20 years from today Face value: $1,000 Annual Coupon rate: 8.5% Number of payments per year: 2 Current YTM is 8% - The bond price is simply the present value of the bonds cash flows. Compute the price for each bond. - Then make a table comparing the bond A and bond B prices if the YTM varies from 1%,2%, 3%17% but every other component of the bonds is held equal. - Compute duration and modified duration for each bond. - Which bond has the lower interest rate risk? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts