Question: Work in Process Account Data for Two Months; Cost of Production Reports Hearty Soup Co. uses a process cost system to record the costs of

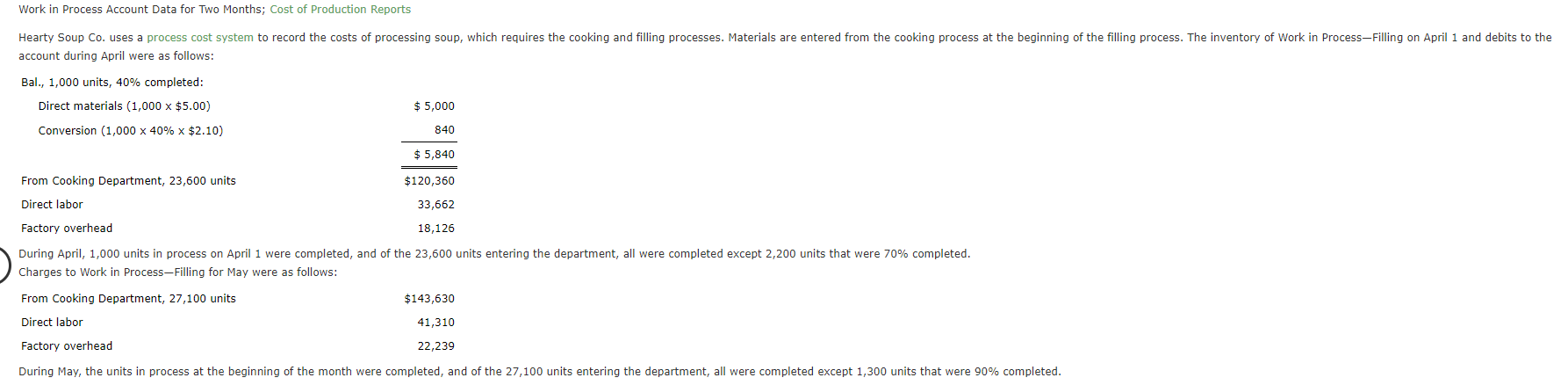

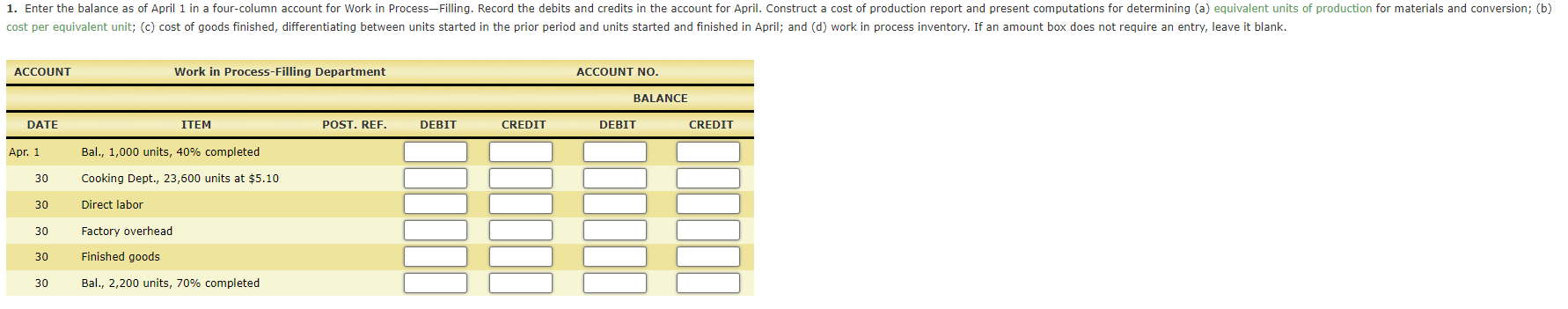

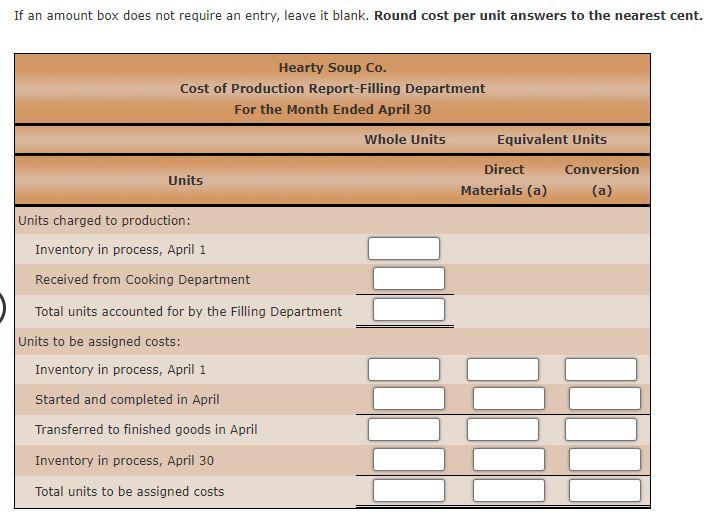

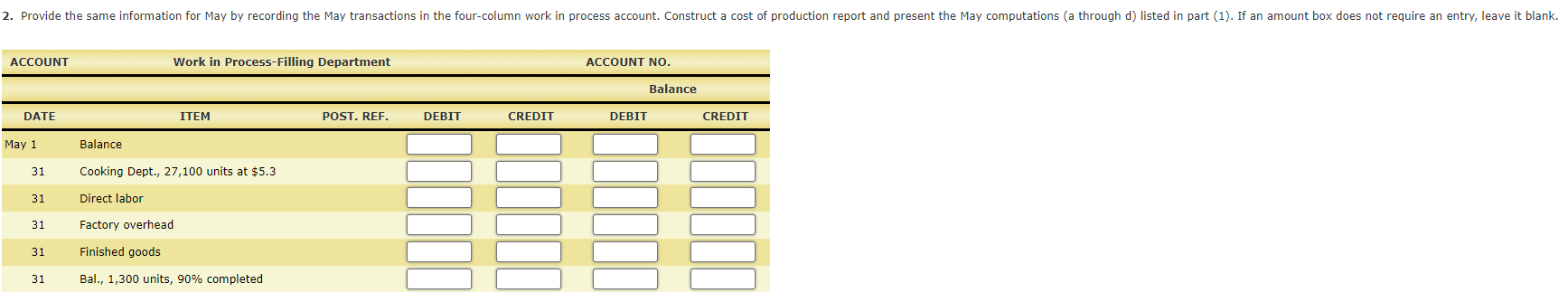

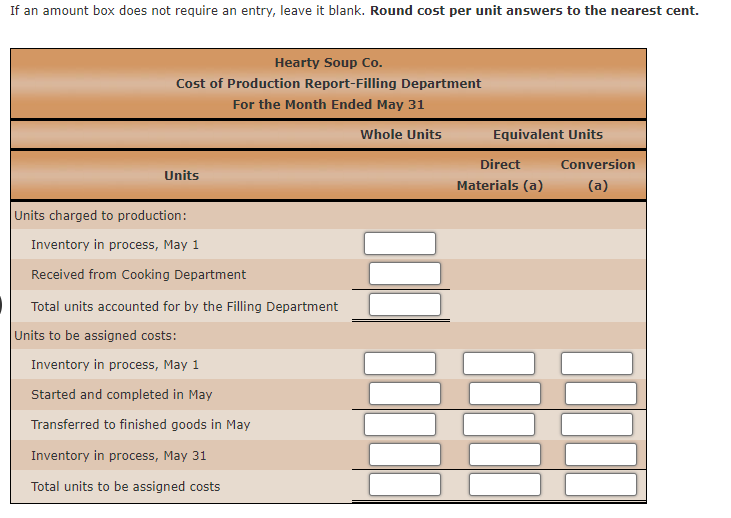

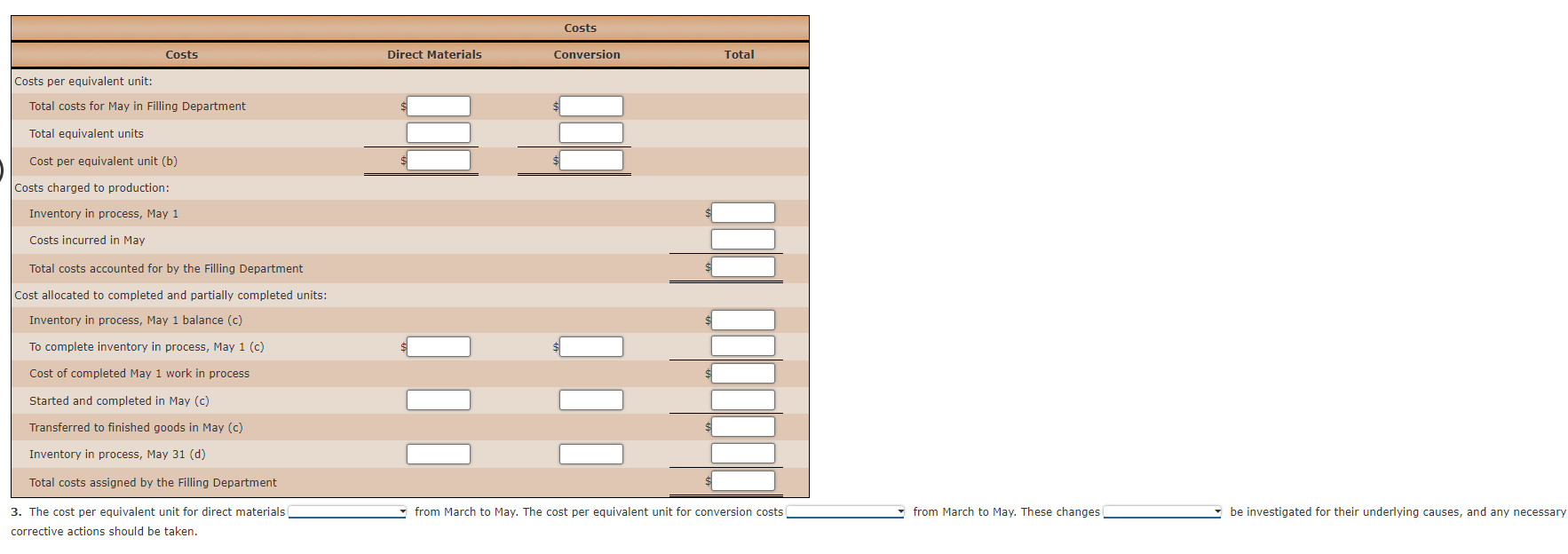

Work in Process Account Data for Two Months; Cost of Production Reports Hearty Soup Co. uses a process cost system to record the costs of processing soup, which requires the cooking and filling processes. Materials are entered from the cooking process at the beginning of the filling process. The inventory of Work in Process-Filling on April 1 and debits to the account during April were as follows: Bal., 1,000 units, 40% completed: Direct materials (1,000 x $5.00) $ 5,000 Conversion (1,000 x 40% x $2.10) 840 $ 5,840 $120,360 From Cooking Department, 23,600 units Direct labor 33,662 Factory overhead 18,126 During April, 1,000 units in process on April 1 were completed, and of the 23,600 units entering the department, all were completed except 2,200 units that were 70% completed. Charges to Work in Process-Filling for May were as follows: From Cooking Department, 27,100 units $143,630 Direct labor 41,310 Factory overhead 22,239 During May, the units in process at the beginning of the month were completed, and of the 27,100 units entering the department, all were completed except 1,300 units that were 90% completed. 1. Enter the balance as of April 1 in a four-column account for Work in Process-Filling. Record the debits and credits in the account for April. Construct a cost of production report and present computations for determining (a) equivalent units of production for materials and conversion; (b) cost per equivalent unit; (c) cost of goods finished, differentiating between units started in the prior period and units started and finished in April; and (d) work in process inventory. If an amount box does not require an entry, leave it blank. ACCOUNT Work in Process-Filling Department ACCOUNT NO. BALANCE DATE ITEM POST. REF. DEBIT CREDIT DEBIT CREDIT Apr. 1 Bal., 1,000 units, 40% completed 30 Cooking Dept., 23,600 units at $5.10 30 Direct labor 30 Factory overhead 30 Finished goods 30 Bal., 2,200 units, 70% completed If an amount box does not require an entry, leave it blank. Round cost per unit answers to the nearest cent. Hearty Soup Co. Cost of Production Report-Filling Department For the Month Ended April 30 Whole Units Equivalent Units Units Direct Materials (a) Conversion (a) Units charged to production: Inventory in process, April 1 Received from Cooking Department Total units accounted for by the Filling Department Units to be assigned costs: Inventory in process, April 1 Started and completed in April Transferred to finished goods in April Inventory in process, April 30 Total units to be assigned costs Costs Costs Direct Materials Conversion Total Costs per equivalent unit: Total costs for April in Filling Department Total equivalent units Cost per equivalent unit (b) Costs charged to production: Inventory in process, April 1 Costs incurred in April III Total costs accounted for by the Filling Department Cost allocated to completed and partially completed units: Inventory in process, April 1 balance (c) To complete inventory in process, April 1 (c) Cost of completed April 1 work in process Started and completed in April (C) Transferred to finished goods in April (c) Inventory in process, April 30 (d) Total costs assigned by the Filling Department 2. Provide the same information for May by recording the May transactions in the four-column work in process account. Construct a cost of production report and present the May computations (a through d) listed in part (1). If an amount box does not require an entry, leave it blank. ACCOUNT Work in Process-Filling Department ACCOUNT NO. Balance DATE ITEM POST. REF. DEBIT CREDIT DEBIT CREDIT May 1 Balance 31 Cooking Dept., 27,100 units at $5.3 31 Direct labor 31 Factory overhead 31 Finished goods 31 Bal., 1,300 units, 90% completed If an amount box does not require an entry, leave it blank. Round cost per unit answers to the nearest cent. Hearty Soup Co. Cost of Production Report-Filling Department For the Month Ended May 31 Whole Units Equivalent Units Units Direct Materials (a) Conversion (a) Units charged to production: Inventory in process, May 1 Received from Cooking Department Total units accounted for by the Filling Department Units to be assigned costs: Inventory in process, May 1 Started and completed in May Transferred to finished goods in May Inventory in process, May 31 Total units to be assigned costs Costs Costs Direct Materials Conversion Total Costs per equivalent unit: Total costs for May in Filling Department Total equivalent units Cost per equivalent unit (b) Costs charged to production: Inventory in process, May 1 Costs incurred in May Total costs accounted for by the Filling Department Cost allocated to completed and partially completed units: Inventory in process, May 1 balance (c) To complete inventory in process, May 1 (c) Cost of completed May 1 work in process Started and completed in May (c) Transferred to finished goods in May (c) Inventory in process, May 31 (d) Total costs assigned by the Filling Department from March to May. The cost per equivalent unit for conversion costs from March to May. These changes be investigated for their underlying causes, and any necessary 3. The cost per equivalent unit for direct materials corrective actions should be taken

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts