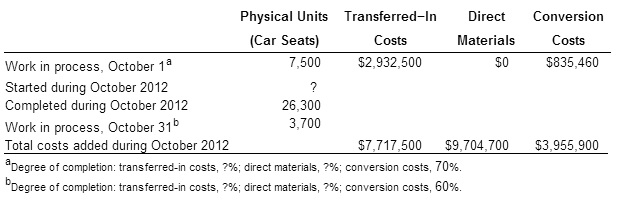

Question: Work in process, October 1 Started during October 2012 Completed during October 2012 Work in process, October 31b Physical Units Transferred-In Direct Conversion (Car

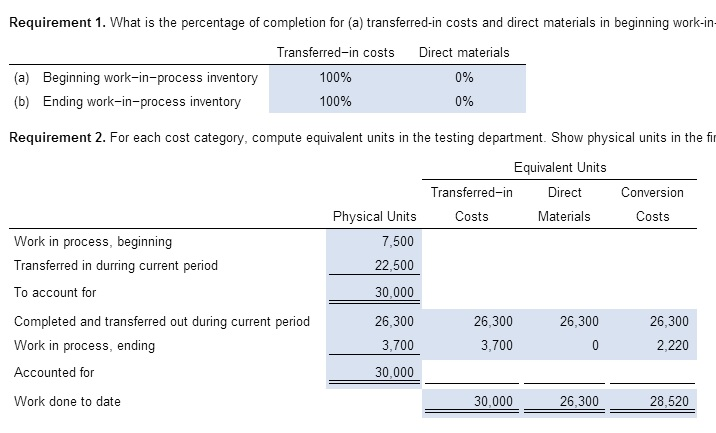

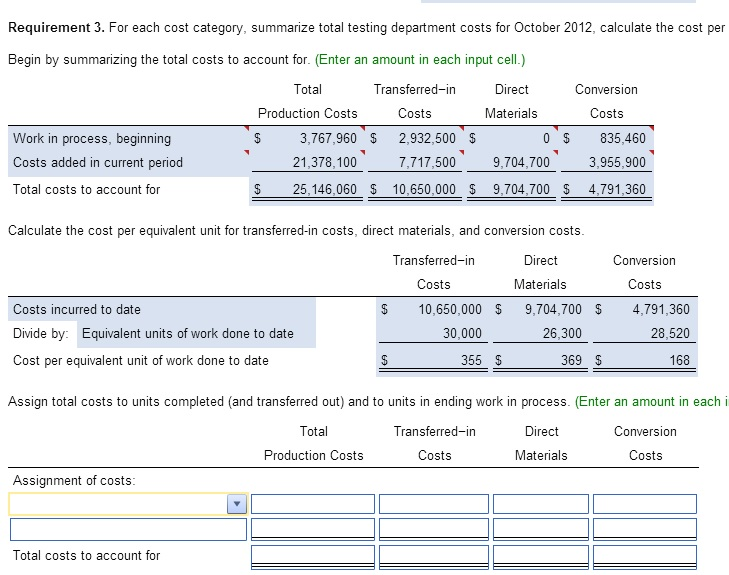

Work in process, October 1 Started during October 2012 Completed during October 2012 Work in process, October 31b Physical Units Transferred-In Direct Conversion (Car Seats) 7,500 Costs $2,932,500 Materials Costs $0 $835,460 ? 26,300 3,700 Total costs added during October 2012 $7,717,500 $9,704,700 $3,955,900 aDegree of completion: transferred-in costs, ?%; direct materials, ?%; conversion costs, 70%. "Degree of completion: transferred-in costs, ?%; direct materials, ?%; conversion costs, 60%. Requirement 1. What is the percentage of completion for (a) transferred-in costs and direct materials in beginning work-in- Transferred-in costs Direct materials (a) Beginning work-in-process inventory (b) Ending work-in-process inventory 100% 100% 0% 0% Requirement 2. For each cost category, compute equivalent units in the testing department. Show physical units in the fir Equivalent Units Transferred-in Physical Units Costs Direct Materials Conversion Costs Work in process, beginning 7,500 Transferred in durring current period 22,500 To account for 30,000 Completed and transferred out during current period 26,300 26,300 26,300 26,300 Work in process, ending 3,700 3,700 0 2,220 Accounted for 30,000 Work done to date 30,000 26,300 28,520 Requirement 3. For each cost category, summarize total testing department costs for October 2012, calculate the cost per Begin by summarizing the total costs to account for. (Enter an amount in each input cell.) Total Production Costs Transferred-in Costs Direct Materials Conversion Costs Work in process, beginning $ Costs added in current period 3,767,960 $ 21,378,100 2,932,500 $ 0 $ 835,460 7,717,500 9,704,700 3,955,900 Total costs to account for 25,146,060 $ 10,650,000 $ 9,704,700 $ 4,791,360 Calculate the cost per equivalent unit for transferred-in costs, direct materials, and conversion costs. Transferred-in Costs Direct Materials Conversion Costs incurred to date $ 10,650,000 $ 9,704,700 $ Costs 4,791,360 Divide by: Equivalent units of work done to date 30,000 26,300 28,520 Cost per equivalent unit of work done to date 355 $ 369 $ 168 Assign total costs to units completed (and transferred out) and to units in ending work in process. (Enter an amount in each it Assignment of costs: Total costs to account for Total Production Costs Transferred-in Costs Direct Conversion Materials Costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts