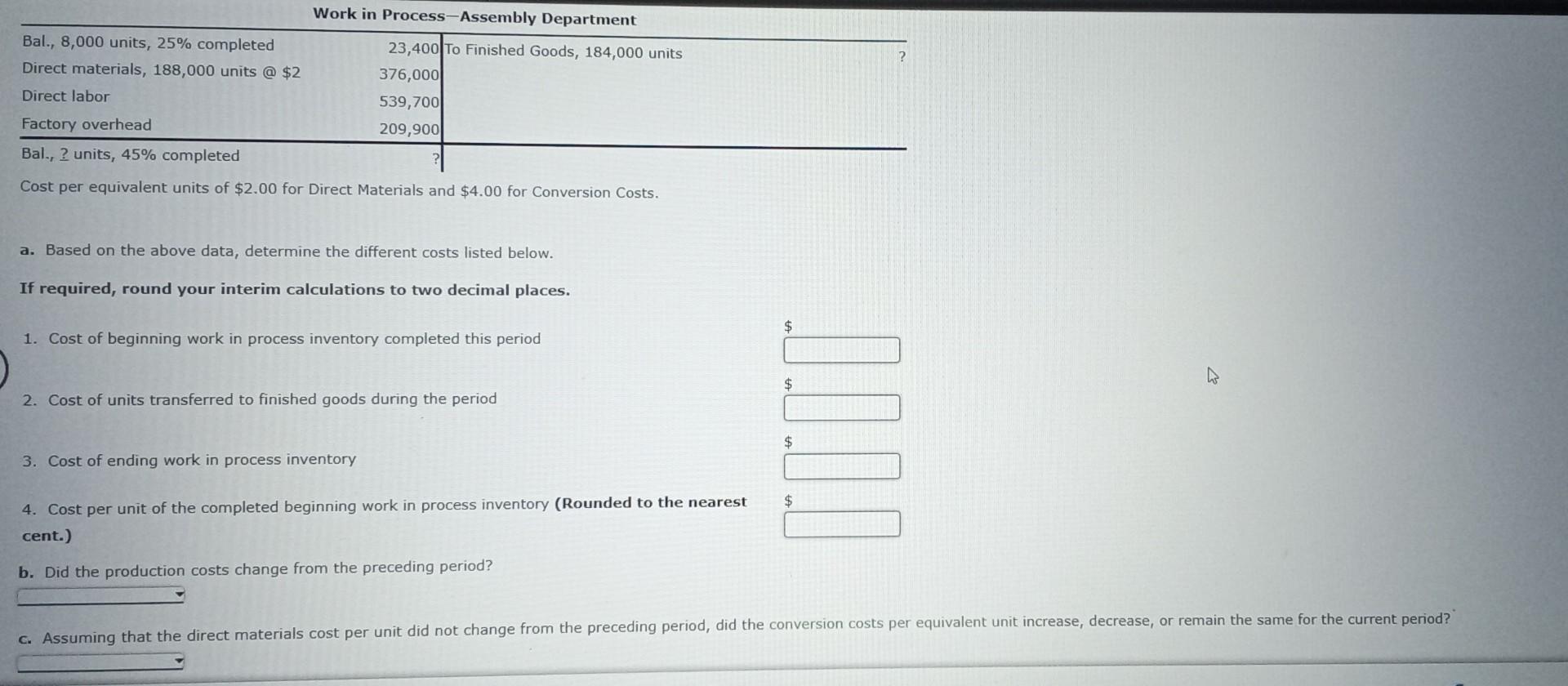

Question: Work in Process-Assembly Department Bal., 8,000 units, 25% completed Direct materials, 188,000 units @ $2 Direct labor Factory overhead Bal., 2 units, 45% completed

Work in Process-Assembly Department Bal., 8,000 units, 25% completed Direct materials, 188,000 units @ $2 Direct labor Factory overhead Bal., 2 units, 45% completed 23,400 To Finished Goods, 184,000 units 376,000 539,700 209,900 Cost per equivalent units of $2.00 for Direct Materials and $4.00 for Conversion Costs. a. Based on the above data, determine the different costs listed below. If required, round your interim calculations to two decimal places. 1. Cost of beginning work in process inventory completed this period 2. Cost of units transferred to finished goods during the period $ $ $ 3. Cost of ending work in process inventory 4. Cost per unit of the completed beginning work in process inventory (Rounded to the nearest cent.) b. Did the production costs change from the preceding period? $ c. Assuming that the direct materials cost per unit did not change from the preceding period, did the conversion costs per equivalent unit increase, decrease, or remain the same for the current period?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts