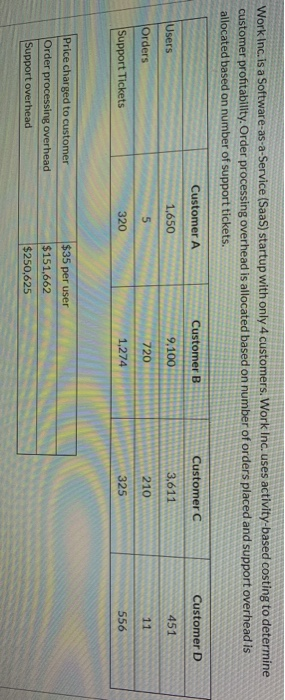

Question: Work Inc. is a Software-as-a-Service (SaaS) startup with only 4 customers. Work Inc. uses activity-based costing to determine customer profitability. Order processing overhead is allocated

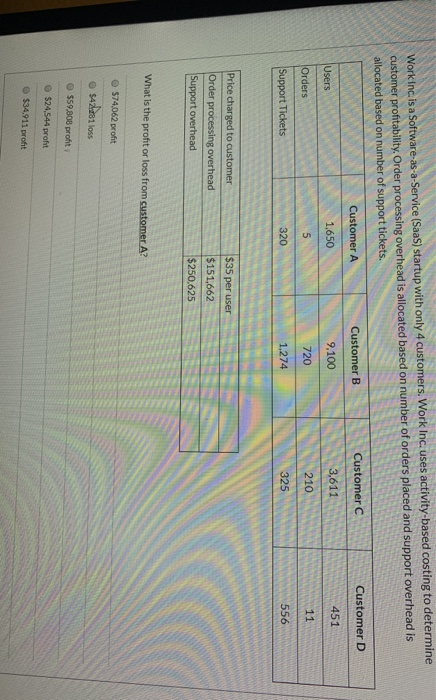

Work Inc. is a Software-as-a-Service (SaaS) startup with only 4 customers. Work Inc. uses activity-based costing to determine customer profitability. Order processing overhead is allocated based on number of orders placed and support overhead is allocated based on number of support tickets. Customer A Customer B Customer C Customer D Users 1,650 9.100 3.611 451 Orders 5 720 210 11 Support Tickets 320 1,274 325 556 Price charged to customer Order processing overhead Support overhead $35 per user $151,662 $250,625 Work Inc. is a Software-as-a-Service (SaaS) startup with only 4 customers. Work Inc. uses activity-based costing to determine customer profitability. Order processing overhead is allocated based on number of orders placed and support overhead is allocated based on number of support tickets. Customer A Customer B Customer C Customer D 1,650 Users 9.100 451 3,611 Orders 5 720 210 11 Support Tickets 320 1,274 325 556 Price charged to customer Order processing overhead Support overhead $35 per user $ 151,662 $250,625 What is the profit or loss from customer A? $74,062 profit S481 loss $59,808 profit $24.544 profit $34911 profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts