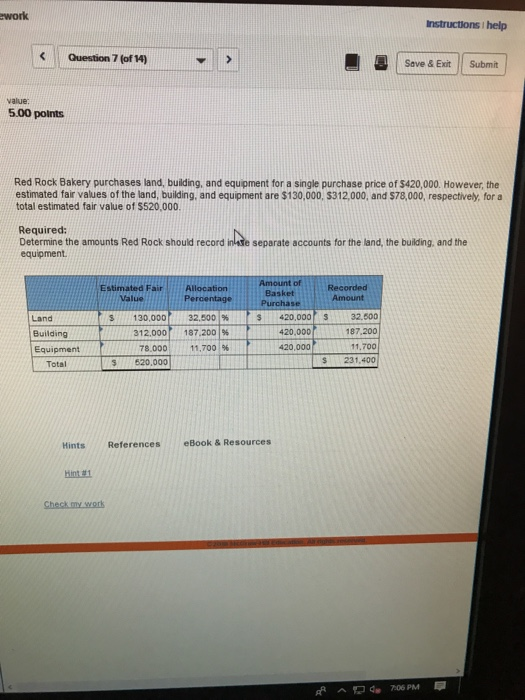

Question: work Instructions help Question 7 (of 14) Serve & Exit Submit value: 5.00 points Red Rock Bakery purchases land, building, and equipment for a single

work Instructions help Question 7 (of 14) Serve & Exit Submit value: 5.00 points Red Rock Bakery purchases land, building, and equipment for a single purchase price of $420,000. However,the estimated fair values of the land, building, and equipment are $130,000, $312,000, and $78,000, respectively, for a total estimated fair value of $520,000. Required: Determine the amounts Red Rock should record inade separate accounts for the land, the building, and the equipment Amount of Recorded Estimated Fair Allocation Basket Value Land Building Equipment S420,000S32,500 187.200 11,700 S 231,400 s 130,000 312,000 78.000| S 520,000 32.5001% 187,200 1% 11.700 | 96 420,000 420,000 Total Hints References eBook& Resources Hint 81 Ad 706 PM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts