Question: work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion Return to

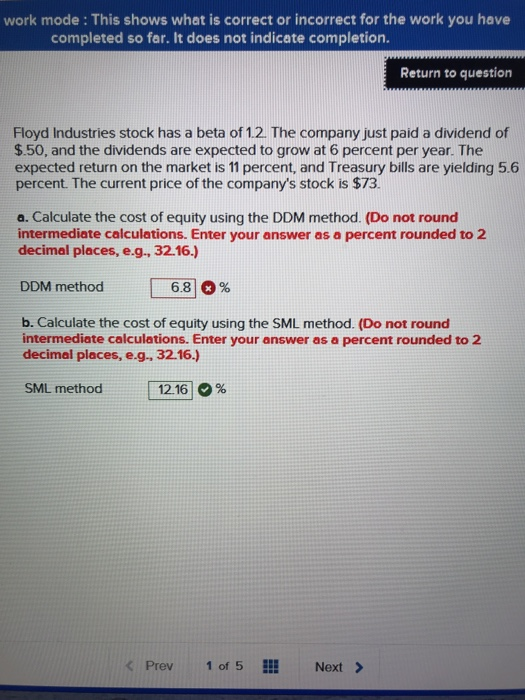

work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion Return to question Floyd Industries stock has a beta of 1.2. The company just paid a dividend of $.50, and the dividends are expected to grow at 6 percent per year. The expected return on the market is 11 percent, and Treasury bills are yielding 5.6 percent. The current price of the company's stock is $73 a. Calculate the cost of equity using the DDM method. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) DDM method b. Calculate the cost of equity using the SML method. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g. 32.16.) SML method | 12.16 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts