Question: Work must be shown in excel using formulas. Chapter 10- Investment Planning 463 uantitative/Analytical Mini-Case Problems Tad and Tyler Mendoza Use the information provided in

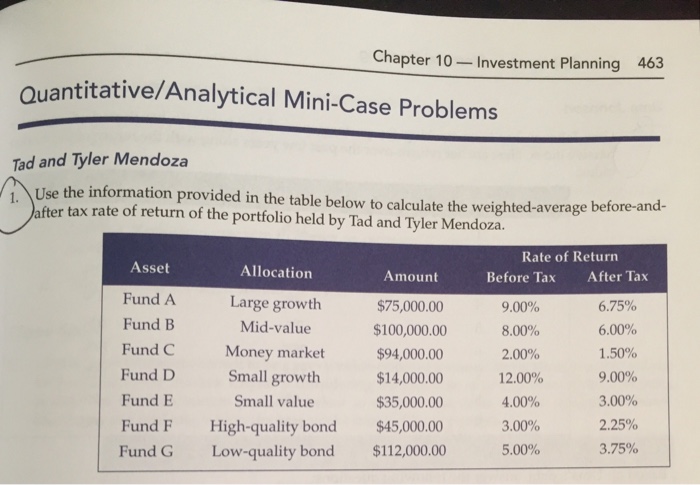

Chapter 10- Investment Planning 463 uantitative/Analytical Mini-Case Problems Tad and Tyler Mendoza Use the information provided in the table below to calculate the weighted-average before-a after tax rate of return of the portfolio held by Tad and Tyler Mendoza. Rate of Return Before Tax After Tax Asset Fund A Fund B Allocation Amount $75,000.00 $100,000.00 $94,000.00 $14,000.00 $35,000.0 $45,000.00 $112,000.00 Large growth Mid-value Fund C Fund DSmall growth Fund E Fund F High-quality bond Fund G 9.00% 8.00% 2.00% 12.00% 4.00% 3.00% 5.00% 675% 6.00% 1.50% 9.00% 3.00% 2.25% 375% Money market Small value Low-quality bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts