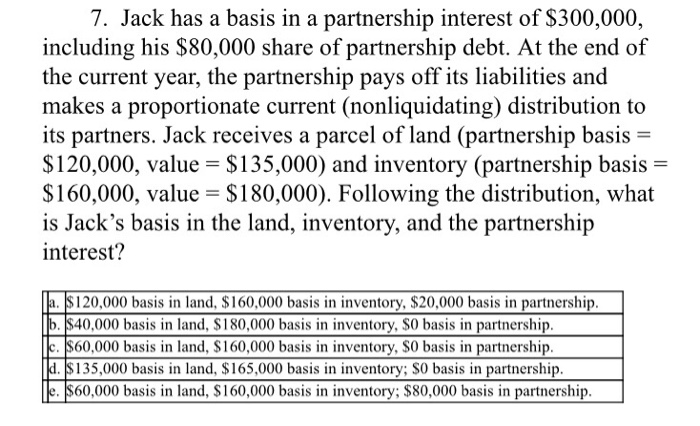

Question: Work must be shown to receive full credit please and thank you 7. Jack has a basis in a partnership interest of $300,000, including his

7. Jack has a basis in a partnership interest of $300,000, including his $80,000 share of partnership debt. At the end of the current year, the partnership pays off its liabilities and makes a proportionate current (nonliquidating) distribution to its partners. Jack receives a parcel of land (partnership basis- $120,000, value - $135,000) and inventory (partnership basis- $160,000, value S180,000). Following the distribution, what is Jack's basis in the land, inventory, and the partnership interest? a $120,000 basis in land, $160,000 basis in inventory, $20,000 basis in partnership. b. $40,000 basis in land, $180,000 basis in inventory, S0 basis in partnership 60,000 basis in land, S160,000 basis in inventory, S0 basis in partnership d. S135,000 basis in land, $165,000 basis in inventory; SO basis in partnership. e. $60,000 basis in land, $160,000 basis in inventory; $80,000 basis in partnership

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts