Question: work on the following Question one. a) Explain the term bank reconciliation and state the reasons for its preparation. (b) Ssemakula, a sole trader received

work on the following

Question one.

a) Explain the term "bank reconciliation" and state the reasons for its preparation.

(b) Ssemakula, a sole trader received his bank statement for June 2001. At that date

the bank balance was Sh. 706,500 whereas his cash book balance was Sh.2, 366,500.

His accountant investigated the matter and discovered the following discrepancies:

1. Bank charges of Sh.3, 000 had not been entered in the cashbook.

2. Cheques drawn by Ssemakula totaling Sh.22, 500 had not yet been presented

to the bank.

3. He had not entered receipts of Sh.26, 500 in his cashbook.

4. The bank had not credited. Mr. Ssemakula with receipts of Sh.98, 500 paid into

the bank on 30 June 2001.

5. Standing order payments amounting to Sh.62, 000 had not been entered into

the cashbook.

6. In the cashbook Ssemakula had entered a payment of Sh.74, 900 as Sh.79,

400.

7. A cheque for Sh.15, 000 from a debtor had been returned by the bank marked

"refer to drawer" but had not been written back into the cashbook.

8. Ssemakula had brought forward the opening cash balance of Sh.329, 250 as a

debit balance instead of a credit balance.

9. An old cheque payment amounting to Sh.44, 000 had been written back in the

cashbook but the bank had already honored it.

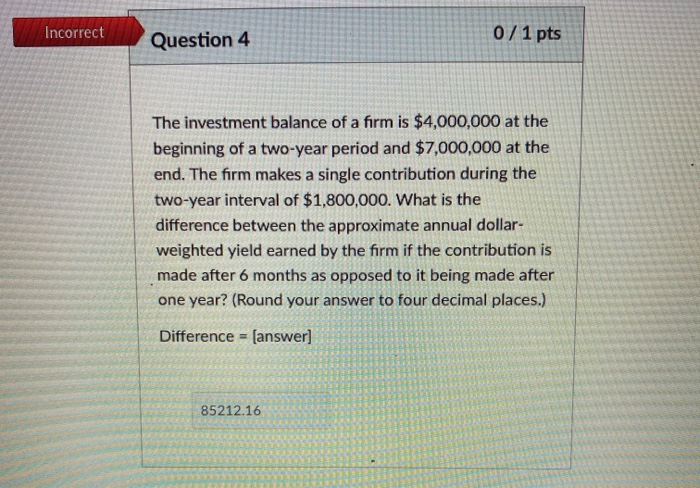

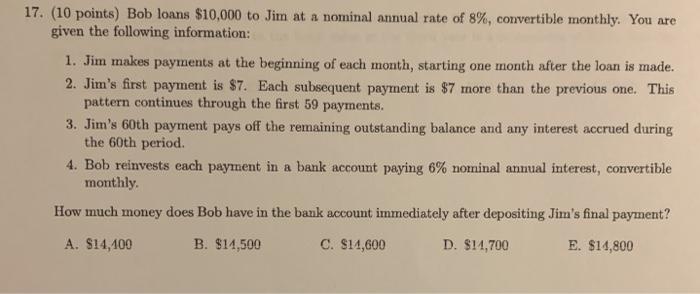

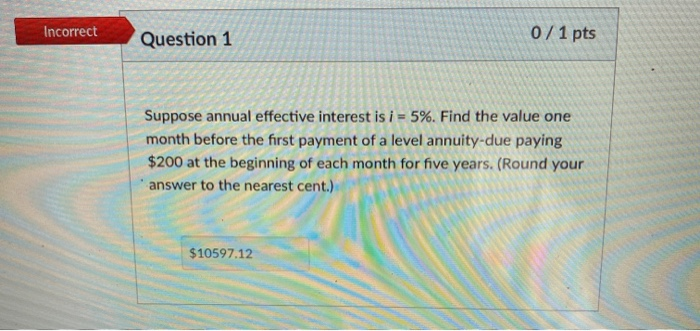

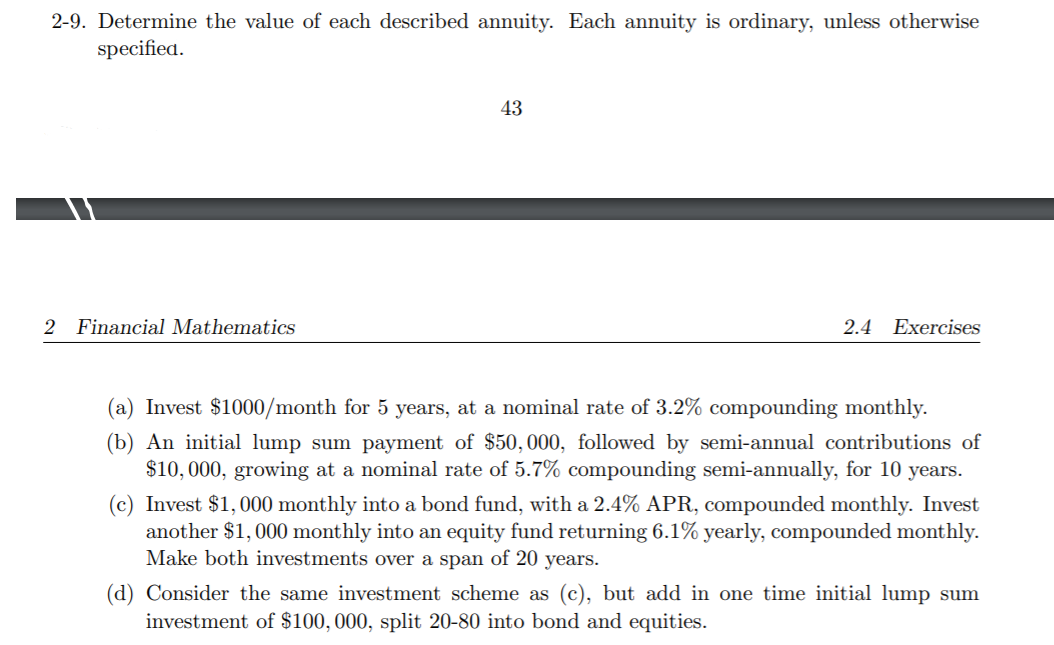

Incorrect Question 4 0 / 1 pts The investment balance of a firm is $4,000,000 at the beginning of a two-year period and $7,000,000 at the end. The firm makes a single contribution during the two-year interval of $1,800,000. What is the difference between the approximate annual dollar- weighted yield earned by the firm if the contribution is made after 6 months as opposed to it being made after one year? (Round your answer to four decimal places.) Difference = [answer] 85212.1617. (10 points) Bob loans $10,000 to Jim at a nominal annual rate of 8%, convertible monthly. You are given the following information: 1. Jim makes payments at the beginning of each month, starting one month after the loan is made. 2. Jim's first payment is $7. Each subsequent payment is $7 more than the previous one. This pattern continues through the first 59 payments. 3. Jim's 60th payment pays off the remaining outstanding balance and any interest accrued during the 60th period. 4. Bob reinvests each payment in a bank account paying 6% nominal annual interest, convertible monthly. How much money does Bob have in the bank account immediately after depositing Jim's final payment? A. $14,100 B. $14,500 C. $14,600 D. $14,700 E. $14,800Incorrect Question 1 0 / 1 pts Suppose annual effective interest is i = 5%. Find the value one month before the first payment of a level annuity-due paying $200 at the beginning of each month for five years. (Round your answer to the nearest cent.) $10597.122-9. Determine the value of each described annuity. Each annuity is ordinary, unless otherwise specied. 43 -\\ 2 Financial Mathematics 2.4 Exercises (a) Invest $1000] month for 5 years, at a nominal rate of 3.2% compounding monthly. (b) An initial lump sum payment of $50,0001 followed by semi-annual contributions of $10, 000, growing at a nominal rate of 5.7% compounding semi-annually, for 10 years. (c) Invest $1, 000 monthly into a bond fund, with a 2.4% APR, compounded monthly. Invest another $1, 000 monthly into an equity fund returning 6.1% yearly, compounded monthly. Make both investments over a span of 20 years. (d) Consider the same investment scheme as (c)1 but add in one time initial lump sum investment of $100,000, split 20-80 into bond and equities