Question: work please! 12. ROK Electronics considers acquiring Datamatic at a cash price of $5,000,000. Datamatic has short-term liabilities of $1,500,000. As a result of this

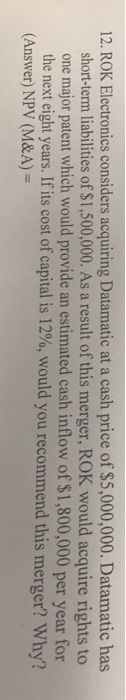

12. ROK Electronics considers acquiring Datamatic at a cash price of $5,000,000. Datamatic has short-term liabilities of $1,500,000. As a result of this merger, ROK would acquire rights to one major patent which would provide an estimated cash inflow of $1,800,000 per year for the next eight years. If its cost ofcapital is 12%, would you recommend this merger? Why? (Answer) NPV (M&A)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts