Question: work problem without looking at other sokutions on here. they are wrong. thanks! QUESTION 1 A new machine is to be purchased for $200,000. The

work problem without looking at other sokutions on here. they are wrong. thanks!

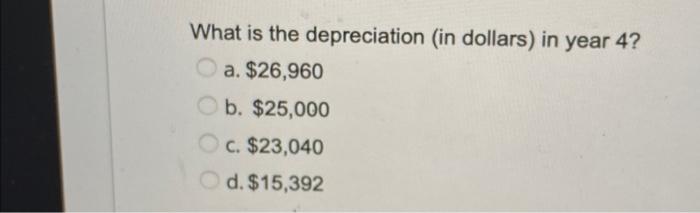

QUESTION 1 A new machine is to be purchased for $200,000. The company believes it will generate $75,000 annually in revenue due to the purchase of this machine. The company will have to train an operator to run this machine and this will result in additional labor expenses of $25,000 annually. The new machine will be depreciated using 5 years MACRS, even though the life of the project is 7 years, and the salvage value is estimated to be $0 at the end of year 7. The tax rate is 40% and the company's MARR is 15%. What is the depreciation (in dollars) in year 4? a. $26,960 b. $25,000 c. $23,040 d. $15,392

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock