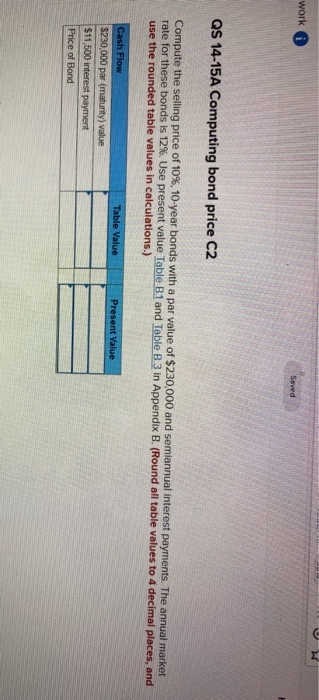

Question: work Saved QS 14-15A Computing bond price C2 Compute the selling price of 10%, 10-year bonds with a par value of $230,000 and semiannual interest

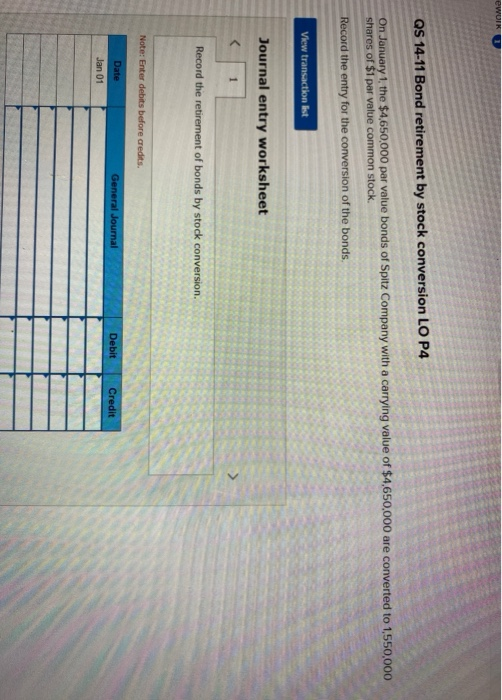

work Saved QS 14-15A Computing bond price C2 Compute the selling price of 10%, 10-year bonds with a par value of $230,000 and semiannual interest payments. The annual market rate for these bonds is 12%. Use present value Table B1 and Table B 3 in Appendix B. (Round all table values to 4 decimal places, and use the rounded table values in calculations.) Table Value Present Value Cash Flow $230,000 par (maturity) value $11,500 interest payment Price of Bond ewUIKT QS 14-11 Bond retirement by stock conversion LO P4 On January 1, the $4,650,000 par value bonds of Spitz Company with a carrying value of $4,650,000 are converted to 1,550,000 shares of $1 par value common stock. Record the entry for the conversion of the bonds View transaction ist Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts