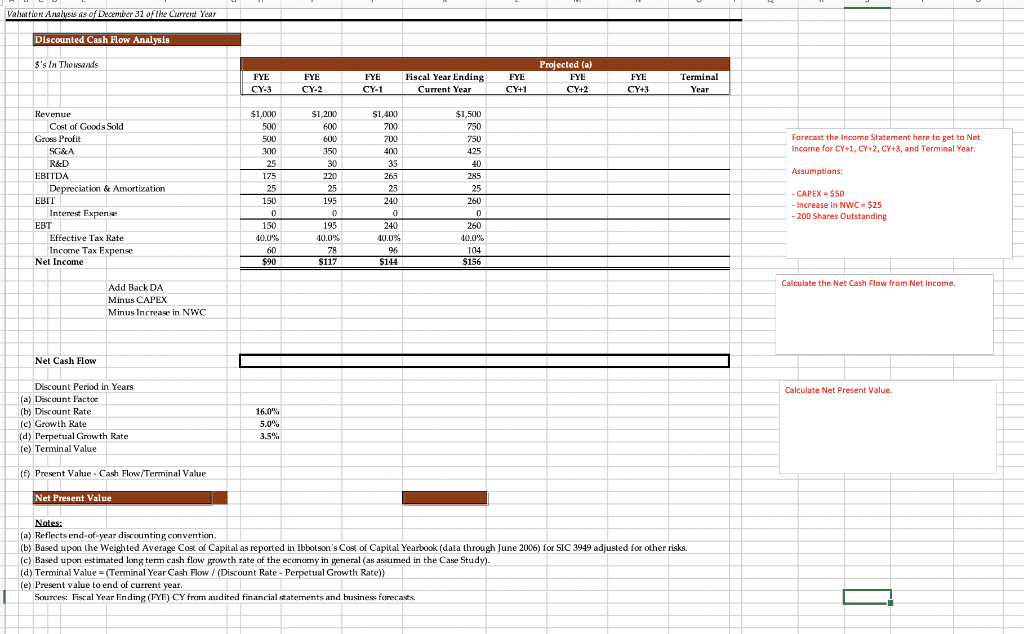

Question: Work through a valuation model to determine the value of Duke's Sporting Goods. Please use the above excel file to get started. Pay close attention

Work through a valuation model to determine the value of Duke's Sporting

Goods. Please use the above excel file to get started. Pay close attention to the assumptions

and notes. Work through the model to find the overall valuation as well as the per

share value given the shares outstanding.

Valuation Analysis as of December 31 of the Current Year Discounted Cash Flow Analysis S's In Thousands FYE CY-3 FYE CY-2 FYE CY-1 Fiscal Year Ending Current Year FYE CY+1 Projected (a) FYE CY+2 FYE + CY-3 Terminal Year Forecast the Income Statement here to get to Net Income for CY+1, CY-2, CY+3, and Terminal Year Assumptions: Revenue Cost of Goods Sold Gross Profit SC&A R&D EBITDA Depreciation & Amortization EBIT Interest Expense EBT Effective Tax Rate Income Tax Expense Net Income $1,000 500 500 300 25 175 25 150 0 150 10.0% 60 $90 $1,200 600 600 350 30 220 25 195 0 0 195 10.0% 78 $117 S1,400 700 700 400 35 265 25 240 0 240 10,0% 96 $144 $1,500 750 750 425 40 285 25 260 0 260 10.0% 104 $156 -CAPEX - $50 - Increase in NWC - $25 -200 Shares Outstanding Calculate the Net Cash Flow from Net Income. Add Back DA Minus CAPEX Minus Increase in NWC Nel Cash Flow Calculate Net Present Value. Discount Period in Years (a) Discount Factor (b) Discount Rate (c) Growth Rate (d) Perpetual Growth Rate (e) Terminal Value 16.0% 5.0% 3.5% (1) Present Value - Cash Flow/Terminal Value Net Present Value Notes: (a) Reflects end-of-year discounting convention (b) Based upon the Weighted Average Cost of Capital as reported in Ibbolson's Cost of Capital Yearbook (data through June 2006) for SIC 3949 adjusted for other risks. (c) Based upon estimated long term cash flow growth rate of the economy in general as assumed in the Case Study). (d) Terminal Value = (Terminal Year Cash Flow / (Discount Rate - Perpetual Growth Rate)) (e) Present value to end of current year. Sources: Fiscal Year Ending (FYE) CY from audited financial statements and business forecasts IC Valuation Analysis as of December 31 of the Current Year Discounted Cash Flow Analysis S's In Thousands FYE CY-3 FYE CY-2 FYE CY-1 Fiscal Year Ending Current Year FYE CY+1 Projected (a) FYE CY+2 FYE + CY-3 Terminal Year Forecast the Income Statement here to get to Net Income for CY+1, CY-2, CY+3, and Terminal Year Assumptions: Revenue Cost of Goods Sold Gross Profit SC&A R&D EBITDA Depreciation & Amortization EBIT Interest Expense EBT Effective Tax Rate Income Tax Expense Net Income $1,000 500 500 300 25 175 25 150 0 150 10.0% 60 $90 $1,200 600 600 350 30 220 25 195 0 0 195 10.0% 78 $117 S1,400 700 700 400 35 265 25 240 0 240 10,0% 96 $144 $1,500 750 750 425 40 285 25 260 0 260 10.0% 104 $156 -CAPEX - $50 - Increase in NWC - $25 -200 Shares Outstanding Calculate the Net Cash Flow from Net Income. Add Back DA Minus CAPEX Minus Increase in NWC Nel Cash Flow Calculate Net Present Value. Discount Period in Years (a) Discount Factor (b) Discount Rate (c) Growth Rate (d) Perpetual Growth Rate (e) Terminal Value 16.0% 5.0% 3.5% (1) Present Value - Cash Flow/Terminal Value Net Present Value Notes: (a) Reflects end-of-year discounting convention (b) Based upon the Weighted Average Cost of Capital as reported in Ibbolson's Cost of Capital Yearbook (data through June 2006) for SIC 3949 adjusted for other risks. (c) Based upon estimated long term cash flow growth rate of the economy in general as assumed in the Case Study). (d) Terminal Value = (Terminal Year Cash Flow / (Discount Rate - Perpetual Growth Rate)) (e) Present value to end of current year. Sources: Fiscal Year Ending (FYE) CY from audited financial statements and business forecasts IC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts