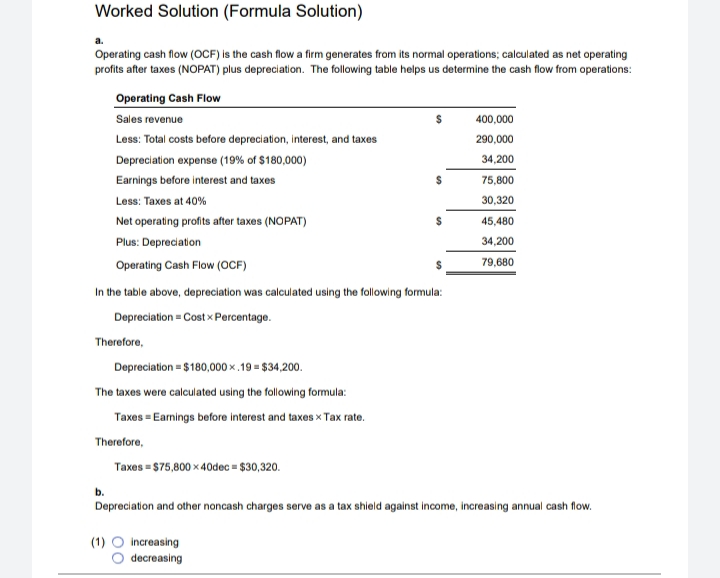

Question: Worked Solution (Formula Solution) a. Operating cash flow (OCF) is the cash flow a firm generates from its normal operations; calculated as net operating profits

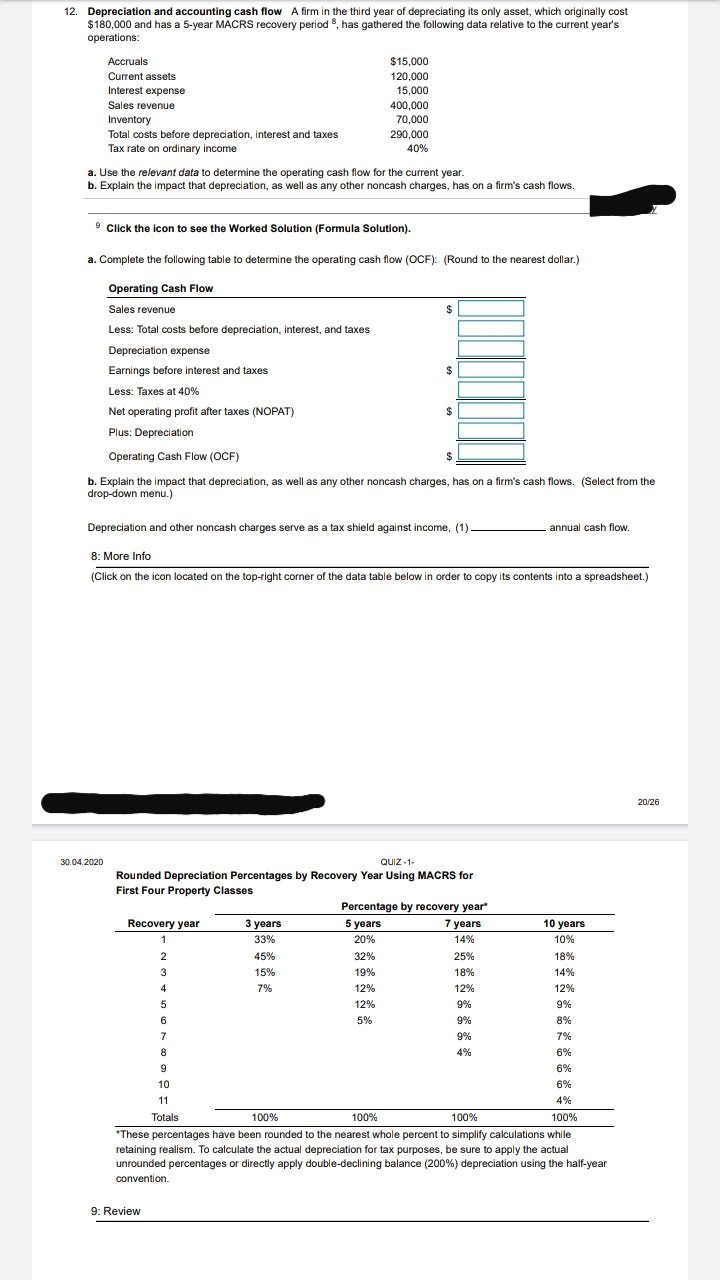

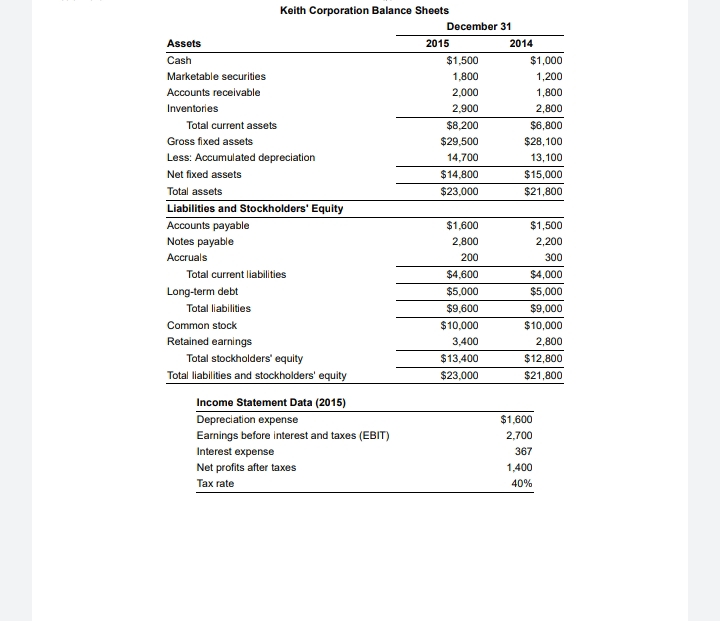

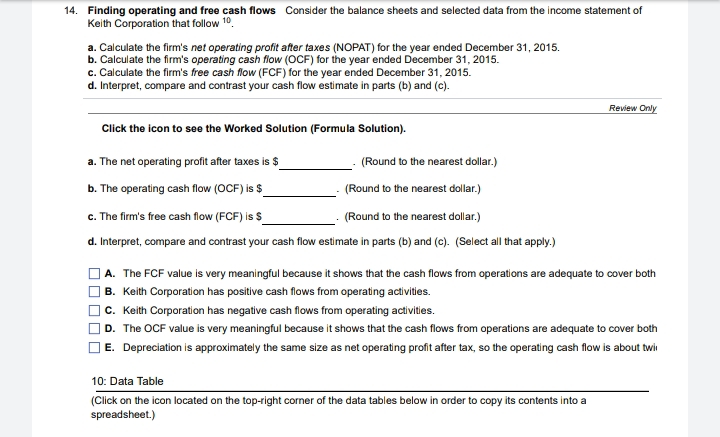

Worked Solution (Formula Solution) a. Operating cash flow (OCF) is the cash flow a firm generates from its normal operations; calculated as net operating profits after taxes (NOPAT) plus depreciation. The following table helps us determine the cash flow from operations: Operating Cash Flow Sales revenue S 400,000 Less: Total costs before depreciation, interest, and taxes 290,000 Depreciation expense (19% of $180,000) 34.200 Earnings before interest and taxes 75,800 Less: Taxes at 40% 30.320 Net operating profits after taxes (NOPAT) 45,480 Plus: Depreciation 34.200 Operating Cash Flow (OCF) 79.680 In the table above, depreciation was calculated using the following formula: Depreciation = Cost x Percentage. Therefore, Depreciation = $180,000 x. 19 = $34,200. The taxes were calculated using the following formula: Taxes = Earnings before interest and taxes x Tax rate. Therefore, Taxes = $75,800 x 40dec = $30,320. b. Depreciation and other noncash charges serve as a tax shield against income, increasing annual cash flow. (1) O increasing O decreasing12. Depreciation and accounting cash flow A firm in the third year of depreciating its only asset, which originally cost $180,000 and has a 5-year MACRS recovery period ", has gathered the following data relative to the current year's operations: Accruals $15,000 Current assets 120,000 Interest expense 15,000 Sales revenue 400,000 Inventory 70,000 Total costs before depreciation, interest and taxes 290,000 Tax rate on ordinary income 40% a. Use the relevant data to determine the operating cash flow for the current year. b. Explain the impact that depreciation, as well as any other noncash charges, has on a firm's cash flows. 9 Click the icon to see the Worked Solution (Formula Solution). a. Complete the following table to determine the operating cash flow (OCF): (Round to the nearest dollar.) Operating Cash Flow Sales revenue Less: Total costs before depreciation, interest, and taxes Depreciation expense Earnings before interest and taxes Less: Taxes at 40% Net operating profit after taxes (NOPAT) Plus: Depreciation Operating Cash Flow (OCF) b. Explain the impact that depreciation, as well as any other noncash charges, has on a firm's cash flows. (Select from the drop-down menu.) Depreciation and other noncash charges serve as a tax shield against income, (1) - annual cash flow. 8: More Info (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) 20/26 30.04.2020 QUIZ -1- Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 3 years 5 years 7 years 10 years 33% 20% 14% 10% W N 45% 32% 25% 18% 15% 19% 18% 14% 7% 12% 12% 12% 12% 9% 9% 5% 9% 8% 9% 7% 4% 6% 9 6% 10 6% 11 1% Totals 100% 100% 100% 100% *These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention. 9: ReviewKeith Corporation Balance Sheets December 31 Assets 2015 2014 Cash $1,500 $1,000 Marketable securities 1,800 1,200 Accounts receivable 2,000 1,800 Inventories 2.900 2,800 Total current assets $8.200 $6,800 Gross fixed assets $29,500 $28, 100 Less: Accumulated depreciation 14.700 13, 100 Net fixed assets $14.800 $15,000 Total assets $23.000 $21,800 Liabilities and Stockholders' Equity Accounts payable $1,600 $1,500 Notes payable 2.800 2,200 Accruals 200 300 Total current liabilities $4.600 $4,000 Long-term debt $5.000 $5,000 Total liabilities $9.600 $9,000 Common stock $10.000 $10,000 Retained earnings 3.400 2,800 Total stockholders' equity $13,400 $12,800 Total liabilities and stockholders' equity $23.000 $21,800 Income Statement Data (2015) Depreciation expense $1,600 Earnings before interest and taxes (EBIT) 2.700 Interest expense 367 Net profits after taxes 1,400 Tax rate 40%14. Finding operating and free cash flows Consider the balance sheets and selected data from the income statement of Keith Corporation that follow 10. a. Calculate the firm's net operating profit after taxes (NOPAT) for the year ended December 31, 2015. b. Calculate the firm's operating cash flow (OCF) for the year ended December 31, 2015. c. Calculate the firm's free cash flow (FCF) for the year ended December 31, 2015. d. Interpret, compare and contrast your cash flow estimate in parts (b) and (c). Review Only Click the icon to see the Worked Solution (Formula Solution). a. The net operating profit after taxes is $ (Round to the nearest dollar.) b. The operating cash flow (OCF) is $ (Round to the nearest dollar.) c. The firm's free cash flow (FCF) is $ (Round to the nearest dollar.) d. Interpret, compare and contrast your cash flow estimate in parts (b) and (c). (Select all that apply.) A. The FCF value is very meaningful because it shows that the cash flows from operations are adequate to cover both B. Keith Corporation has positive cash flows from operating activities. )C. Keith Corporation has negative cash flows from operating activities. D. The OCF value is very meaningful because it shows that the cash flows from operations are adequate to cover both E. Depreciation is approximately the same size as net operating profit after tax, so the operating cash flow is about twi 10: Data Table (Click on the icon located on the top-right corner of the data tables below in order to copy its contents into a spreadsheet.)