Question: Working Capital Cash Flow Cycle Strickler Technology is considering changes in its working capital policies to improve its cash flow cycle. Strickler's sales last year

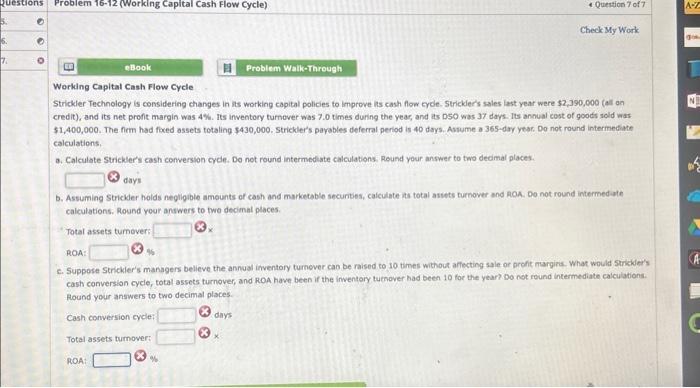

Working Capital Cash Flow Cycle Strickler Technology is considering changes in its working capital policies to improve its cash flow cycle. Strickler's sales last year were $2,390,000 (all an credit), and its net profit margin was 4%. Its inventory furnover was 7.0 times during the year, and its D50 was 37 days. Its annual cost of goods sold was $1,400,000. The firm had foced assets totaling $430,000. Strickler's parables deferral period is 40 days. Aswume a 365 -day year. Do not round intermediate calculations, a. Calculate Strickler's cash conversion cycle. Do not round intermediate calculations. Reund your answer to two dedimal places. divy b. Assuming Stricker holds negligible amounts of cash and marketable securises, cafculate its total asiets turnover and Aok. Do not round intermed ate calculations: Round your answers to two decimal places. Total arsets tumever: x ROA: 64 e. Suppote Strickler's managers believe the annual imventory tumever can be raised to 10 times without affecting sale or profit margins. What would strikiler's cash conversion cycle, total assets turnover, and RoA have been if the inventory tumover had been 10 for the year? Do not round intermediate calculations. Round your answers to two decimal places. Cash conversion cycle: dins Total assets turnover: ROA: as

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts