Question: Working capital & customer relationships will reflect (according to assigned reading) A. Reduced volume due to Al B. None of the other answer choices is

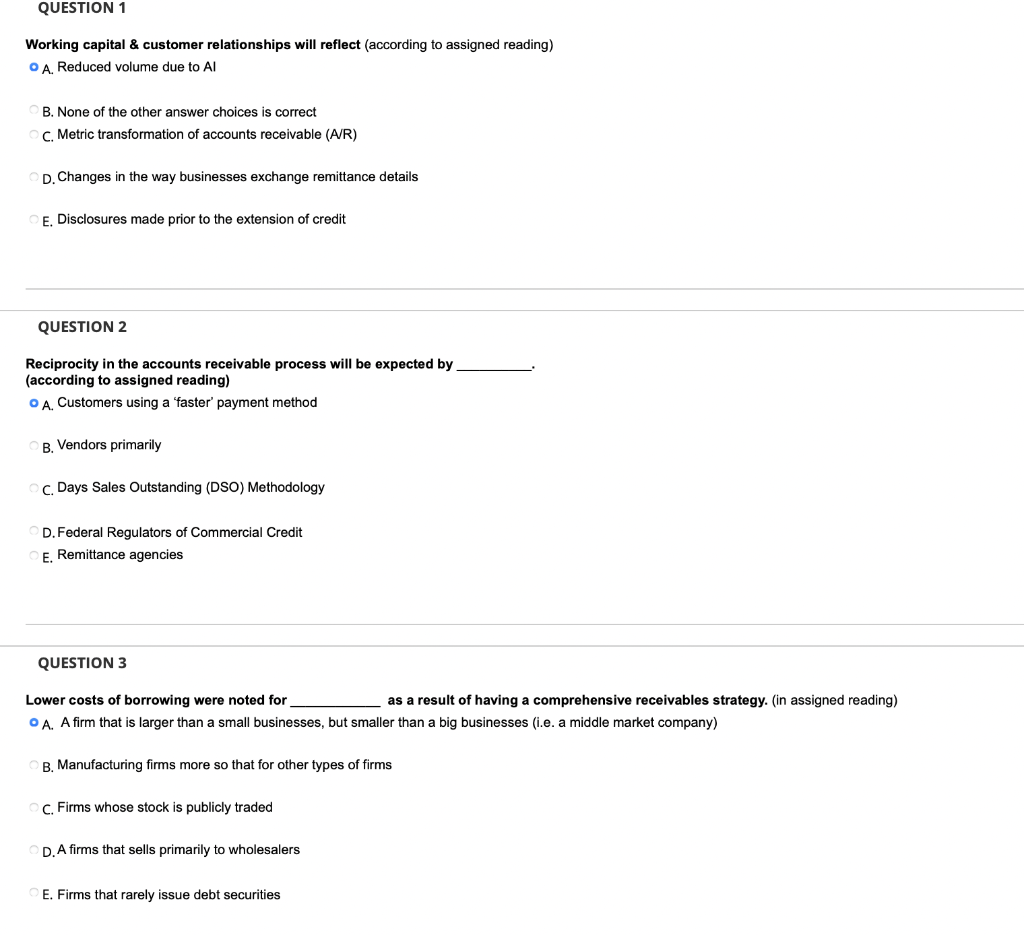

Working capital \& customer relationships will reflect (according to assigned reading) A. Reduced volume due to Al B. None of the other answer choices is correct C. Metric transformation of accounts receivable (A/R) D. Changes in the way businesses exchange remittance details E. Disclosures made prior to the extension of credit QUESTION 2 Reciprocity in the accounts receivable process will be expected by (according to assigned reading) A. Customers using a 'faster' payment method B. Vendors primarily c. Days Sales Outstanding (DSO) Methodology D. Federal Regulators of Commercial Credit E. Remittance agencies QUESTION 3 Lower costs of borrowing were noted for as a result of having a comprehensive receivables strategy. (in assigned reading) A. A firm that is larger than a small businesses, but smaller than a big businesses (i.e. a middle market company) B. Manufacturing firms more so that for other types of firms C. Firms whose stock is publicly traded D. A firms that sells primarily to wholesalers E. Firms that rarely issue debt securities Working capital \& customer relationships will reflect (according to assigned reading) A. Reduced volume due to Al B. None of the other answer choices is correct C. Metric transformation of accounts receivable (A/R) D. Changes in the way businesses exchange remittance details E. Disclosures made prior to the extension of credit QUESTION 2 Reciprocity in the accounts receivable process will be expected by (according to assigned reading) A. Customers using a 'faster' payment method B. Vendors primarily c. Days Sales Outstanding (DSO) Methodology D. Federal Regulators of Commercial Credit E. Remittance agencies QUESTION 3 Lower costs of borrowing were noted for as a result of having a comprehensive receivables strategy. (in assigned reading) A. A firm that is larger than a small businesses, but smaller than a big businesses (i.e. a middle market company) B. Manufacturing firms more so that for other types of firms C. Firms whose stock is publicly traded D. A firms that sells primarily to wholesalers E. Firms that rarely issue debt securities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts