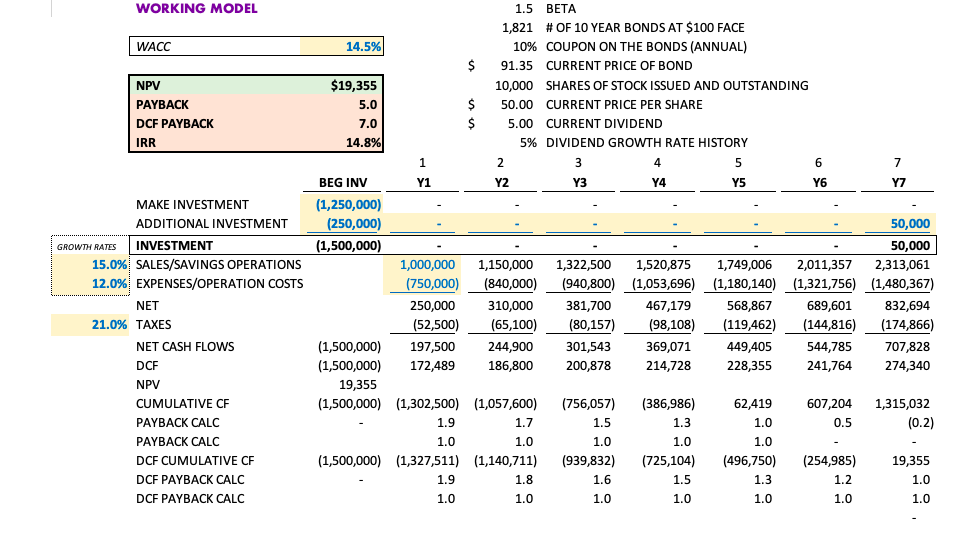

Question: WORKING MODEL GROWTH RATES WACC NPV PAYBACK DCF PAYBACK IRR MAKE INVESTMENT ADDITIONAL INVESTMENT INVESTMENT 15.0% SALES/SAVINGS OPERATIONS 12.0% EXPENSES/OPERATION COSTS NET 21.0% TAXES

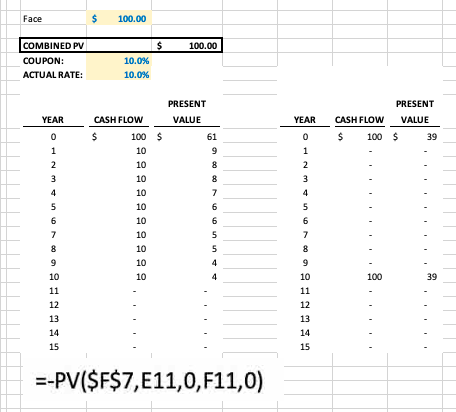

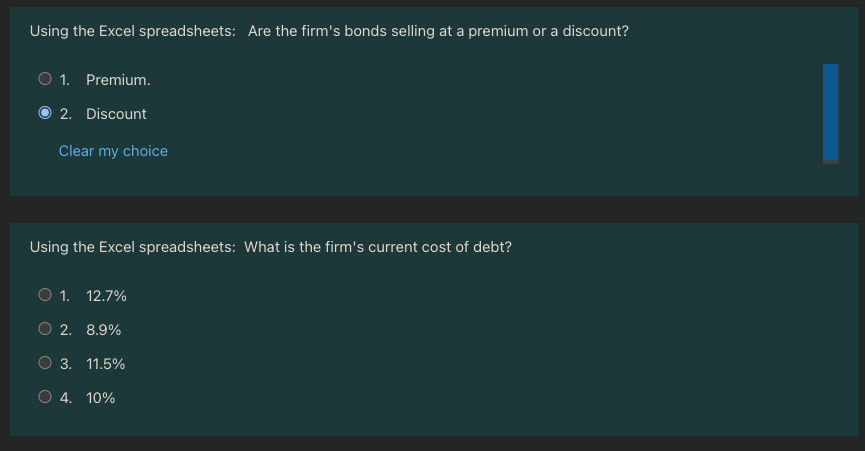

WORKING MODEL GROWTH RATES WACC NPV PAYBACK DCF PAYBACK IRR MAKE INVESTMENT ADDITIONAL INVESTMENT INVESTMENT 15.0% SALES/SAVINGS OPERATIONS 12.0% EXPENSES/OPERATION COSTS NET 21.0% TAXES NET CASH FLOWS DCF NPV CUMULATIVE CF PAYBACK CALC PAYBACK CALC DCF CUMULATIVE CF DCF PAYBACK CALC DCF PAYBACK CALC 14.5% $19,355 5.0 7.0 14.8% BEG INV (1,250,000) (250,000) (1,500,000) 1 Y1 $ $ $ 1.5 BETA 1,821 # OF 10 YEAR BONDS AT $100 FACE 10% COUPON ON THE BONDS (ANNUAL) 91.35 CURRENT PRICE OF BOND 1.9 1.0 10,000 SHARES OF STOCK ISSUED AND OUTSTANDING 50.00 CURRENT PRICE PER SHARE 5.00 CURRENT DIVIDEND 5% DIVIDEND GROWTH RATE HISTORY 3 Y3 2 Y2 250,000 310,000 381,700 (52,500) (65,100) (80,157) 197,500 244,900 (1,500,000) (1,500,000) 172,489 186,800 19,355 (1,500,000) (1,302,500) (1,057,600) 50,000 50,000 2,011,357 2,313,061 1,000,000 1,150,000 1,322,500 1,520,875 1,749,006 (750,000) (840,000) (940,800) (1,053,696) (1,180,140) (1,321,756) (1,480,367) 467,179 (98,108) 1.7 1.0 (1,500,000) (1,327,511) (1,140,711) 1.9 1.8 1.0 1.0 301,543 200,878 (756,057) 1.5 1.0 4 Y4 (939,832) 1.6 1.0 369,071 214,728 (386,986) 1.3 1.0 5 Y5 (725,104) 1.5 1.0 6 Y6 568,867 689,601 (119,462) (144,816) 449,405 544,785 228,355 241,764 62,419 1.0 1.0 (496,750) 1.3 1.0 607,204 0.5 7 Y7 (254,985) 1.2 1.0 832,694 (174,866) 707,828 274,340 1,315,032 (0.2) 19,355 1.0 1.0 Face COMBINED PV COUPON: ACTUAL RATE: YEAR 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 $ 100.00 10.0% 10.0% CASH FLOW $ 100 $ 10 10 10 10 10 10 9999 10 10 10 10 $ I 100.00 PRESENT VALUE 61 9 8 8 7 6 6 in in 5 5 4 =-PV($F$7,E11,0, F11,0) YEAR CASH FLOW 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 PRESENT VALUE $ 100 $ 100 39 39 Using the Excel spreadsheets: Are the firm's bonds selling at a premium or a discount? O 1. Premium. 2. Discount Clear my choice Using the Excel spreadsheets: What is the firm's current cost of debt? 1. 12.7% O 2. 8.9% 3. 11.5% 4. 10%

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

1 To determine if the bonds are trading at a premium or discount we compare the curren... View full answer

Get step-by-step solutions from verified subject matter experts