Question: Working Notes 1: Evaluating payment made to Henry Cost price of goods = 50,000 Less: Trade discount 10% = 5,000 Purchased cost = 345,000 Cash

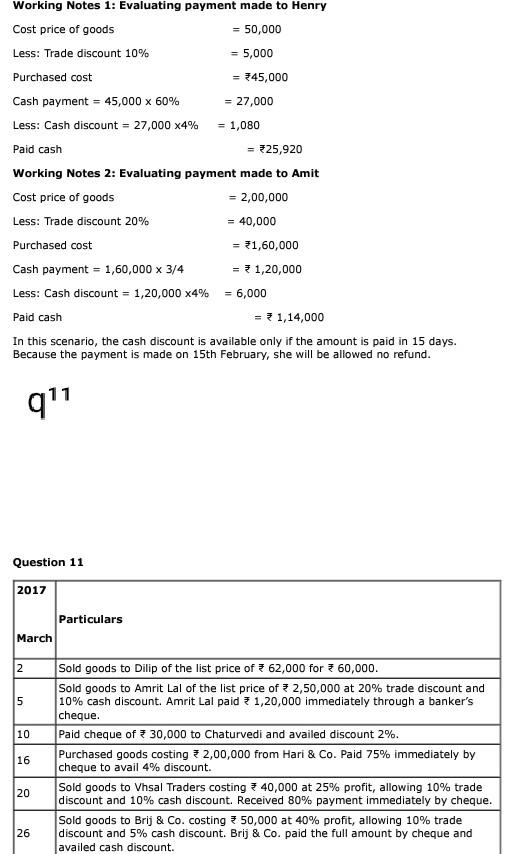

Working Notes 1: Evaluating payment made to Henry Cost price of goods = 50,000 Less: Trade discount 10% = 5,000 Purchased cost = 345,000 Cash payment = 45,000 x 60% = 27,000 Less: Cash discount = 27,000 x4% = 1,080 Paid cash = 25,920 Working Notes 2: Evaluating payment made to Amit Cost price of goods = 2,00,000 Less: Trade discount 20% = 40,000 Purchased cost 31,60,000 Cash payment = 1,60,000 x 3/4 = 71,20,000 Less: Cash discount = 1,20,000 24% = 6,000 Paid cash = 3 1,14,000 In this scenario, the cash discount is available only if the amount is paid in 15 days. Because the payment is made on 15th February, she will be allowed no refund. q"1 Question 11 2017 Particulars March 2 5 10 16 Sold goods to Dilip of the list price of 62,000 for 3 60,000. Sold goods to Amrit Lal of the list price of 2,50,000 at 20% trade discount and 10% cash discount. Amrit Lal paid 7 1,20,000 immediately through a banker's cheque. Paid cheque of 3 30,000 to Chaturvedi and availed discount 2%. Purchased goods costing : 2,00,000 from Hari & Co. Paid 75% immediately by cheque to avail 4% discount. Sold goods to Vhsal Traders costing 40,000 at 25% profit, allowing 10% trade discount and 10% cash discount. Received 80% payment immediately by cheque. Sold goods to Brij & Co. costing 50,000 at 40% profit, allowing 10% trade discount and 5% cash discount. Brij & Co. paid the full amount by cheque and availed cash discount. 20 26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts